The S&P 500 flirted with a significant milestone as it briefly crossed the 5,000 mark just before Thursday’s market close, marking its ninth record finish of 2024 at 4,997.91. While these round numbers don’t hold technical significance, they do carry psychological weight, influencing market sentiment.

Mark Arbeter, president of Arbeter Investments, pointed out historical instances where such milestones acted as market ceilings. For instance, the Dow Jones Industrial Average struggled to surpass 1,000 until 1983, while the S&P 500 faced similar challenges until 1980.

While surpassing 1,000 points is relatively easier for the Dow, requiring just a 2.6% increase, the S&P 500’s move from 4,000 to 5,000 represents a substantial 25% gain, underscoring its significance.

Despite the attention lavished on the Dow, the S&P 500 holds more weight in the investment world, being the preferred benchmark for professionals due to its broader representation of the market.

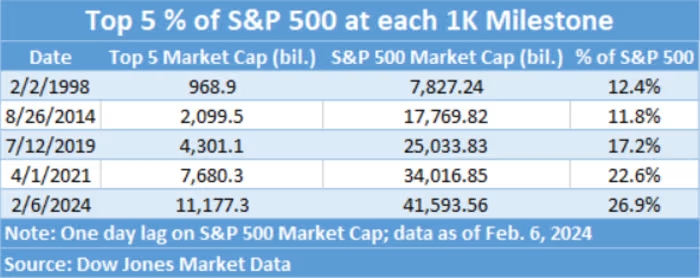

The current rally’s longevity since crossing the 4,000 mark in 2021 underscores the index’s resilience. However, concerns loom over the market’s increasing concentration, with the top five companies now dominating a larger share of the index than at any previous 1,000-point milestone.