Monday saw the S&P 500 finishing below its 50-day average amid robust retail sales figures and a temporary easing of tensions between Iran and Israel, nudging Treasury yields upwards.

With the benchmark index now 2% lower than its late March peaks, trading has been volatile following unexpected inflation spikes, geopolitical tensions, and a lackluster start to first-quarter earnings reports.

Keith Lerner, Truist Advisory Services’ chief market strategist, noted that market retractions are typical, with only a few years in the past four decades escaping pullbacks exceeding 5%.

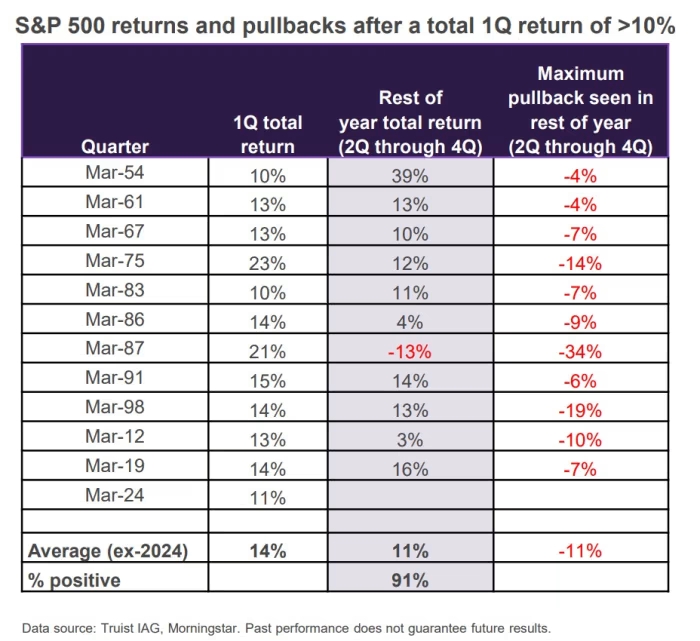

Analyzing S&P 500 returns and pullbacks post a first-quarter surge of at least 10%, Lerner found average drawdowns of 11% for the remainder of the year. Nonetheless, the total return for quarters two through four averaged 11%, with 91% being positive—barring the exceptional case of 1987.

Lerner remains optimistic about stocks, citing the economy’s resilience. He emphasized the historical lesson that a robust economy with minimal rate cuts fares better than a weakening one requiring significant cuts, which should buoy earnings.

Furthermore, Lerner highlighted stocks’ role as a partial hedge against inflation, given its correlation with increased sales and earnings.

Despite rising oil prices, recessions typically follow year-over-year gains of over 80%, which current figures fall short of, with just a 5% increase in the front-month contract over the last year.

Lastly, Lerner pointed to strong price support for the S&P 500 in the 4,800 to 5,000 range, with structural support at 4,600.

In conclusion, Lerner maintains that the evidence suggests a bull market, although the ongoing correction may have further to run in terms of price and/or duration. He advises sidelined investors and those below target equity allocations to consider dollar-cost averaging and potentially increasing investments during a deeper, more typical correction.