Futures indicate a cautious start for Wall Street, despite major stock indices holding at record levels. The Nasdaq Composite has surged 13.8% and the S&P 500 has gained 11.8% in the last three months, prompting concerns about market bubbles.

Bank of America’s team, led by Savita Subramanian, remains bullish, raising their end-of-year S&P 500 target to 5,400. However, they acknowledge the likelihood of a market pullback, citing historical patterns of 5% pullbacks three times per year and 10% corrections once per year since 1929.

Subramanian points out bearish signals from the Chief US Technician and the increasing volatility gauge (CBOE VIX), indicating rising uncertainty leading up to elections. However, post-election, removal of uncertainty often triggers a year-end rally.

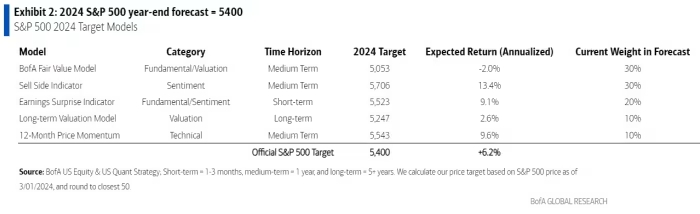

Despite potential pullbacks, Subramanian forecasts a further 5% upside for the S&P 500 this year. This forecast is derived from a comprehensive analysis of five different forecasting methods, each weighted differently based on market conditions and investor sentiment.

Currently, the most optimistic method, the sell-side indicator, suggests a target of 5,706, but its weighting has decreased due to analysts’ possibly overly optimistic outlook. Other factors, such as 12-month price momentum, earnings surprises, and long-term valuation, contribute to the overall target.

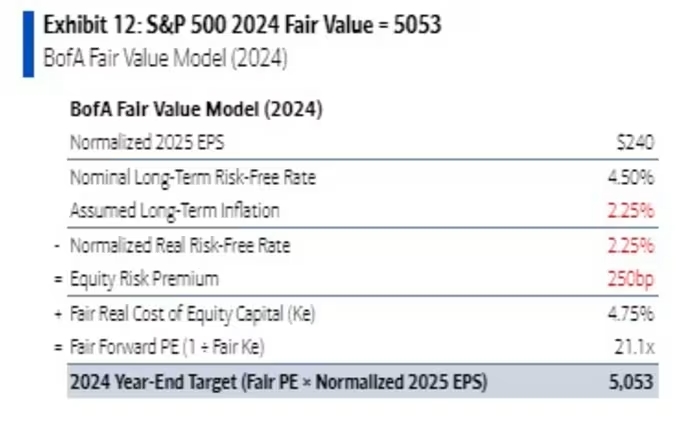

The increase in the fair value model, reflecting a shift towards higher margin, lower earnings risk industries, is the primary driver behind the revised S&P 500 target. Despite concerns of market euphoria in certain thematic sectors, Subramanian anticipates a broader market expansion beyond those themes.

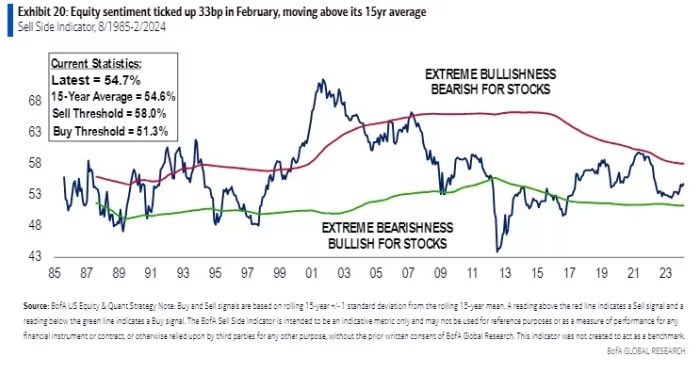

While sentiment among sell-side analysts has grown more bullish, allocations to public equity remain low, and positioning in certain sectors indicates bearish extremes. This suggests potential for further market growth beyond current trends.