Investors are bracing for a chilly return from an extended holiday weekend, as stock futures dip alongside a rise in bond yields following hawkish comments from regional policymakers in Europe on Monday.

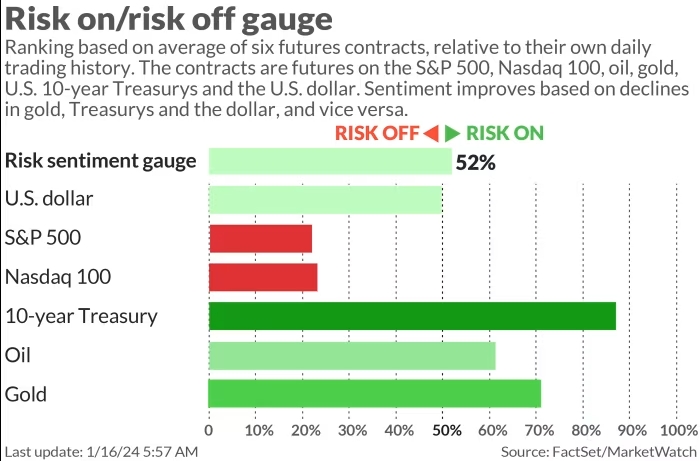

The anticipated Iowa triumph of former President Donald Trump, though expected, has triggered speculation about a potentially volatile election year ahead (refer to chart below).

Despite the prevailing concerns, Tuesday brings optimism from a Wall Street bank that has revised its year-end stock outlook upward. A team of strategists at UBS, led by Jonathan Golub, now projects the S&P 500 to reach 5,150 by year-end, up from the previous estimate of 4,850. Last year’s outlook from UBS had already signaled favorable conditions for stocks, citing strong earnings, easing inflation, accommodative monetary policy, and an improved economic landscape.

Golub and his team attribute their revised outlook to the Federal Reserve’s recent shift, a subsequent decline in rate expectations, and above-trend 2024 earnings per share revisions. This optimistic scenario is now considered their base case, surpassing even UBS’s wealth management arm, which recently raised its index target to 5,000.

The bullish stance from UBS comes amid a rocky start for stocks, as concerns mount that investors, fueled by overly optimistic Fed rate-hike expectations, rushed into the market. Nevertheless, the S&P 500 remains just 0.27% shy of its January 2022 record close as of Friday.

The bank’s new S&P 500 target reflects a 7.7% upside from the current levels. Additionally, they have increased their 2024-25 earnings per share estimates to $225 (from $235) and $246 (from $250), respectively. Golub and his team highlight that their growth estimates of 6.3% and 6.4% over the next two years are more conservative than the consensus of 11.4% and 12.8%. They emphasize that while earnings are expected to drive 2024 returns, declining interest rates should support higher multiples.

UBS’s new S&P 500 target places it among the top forecasts on Wall Street for 2024. Yardeni Research leads with a target of 5,400, while JPMorgan is more conservative at 4,200. Goldman Sachs, in late December, raised its forecast to 5,100 from 4,700, shortly after setting the initial target.

The Markets