Stock investors have experienced a shaky start to the new year, facing uncertainties linked to shifting expectations regarding the timing and extent of Federal Reserve interest-rate cuts in 2024.

The nine-week winning streak for all three major U.S. stock indexes came to an end on Friday. This reversal followed unexpectedly robust December job gains, causing traders to briefly reassess the likelihood of a March rate cut by the Federal Reserve.

The S&P 500 (SPX) and Nasdaq Composite (COMP) also failed to initiate a Santa Claus Rally during the final five trading days of 2023 through the initial two sessions of 2024, as doubts emerged about the market’s anticipation of multiple rate cuts.

This scenario offers a preview of potential challenges for investors in the coming year. The “January effect,” a theory suggesting that stocks typically experience significant gains this month, may face headwinds, including stalled progress on inflation.

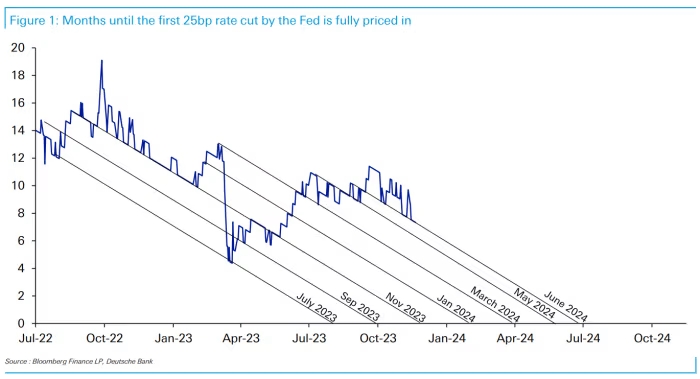

Despite recent hopes for six or seven quarter-percentage-point rate cuts by the Federal Reserve in 2024, starting in March, the reality has started to set in during the early days of the new year.

Concerns have arisen about the feasibility of multiple rate cuts, as such a move is often associated with recessions rather than soft landings for the economy. Mike Sanders, head of fixed income at Madison Investments, warns that excessive rate cuts could undermine the fight against inflation, leading to a potential cycle of rate hikes.

Uncertainty lingers over the path of U.S. interest rates, posing a challenge for investors and potentially dampening the optimism that fueled the impressive performance of major stock indexes in 2023. Financial markets, operating with high expectations for 2024 rate cuts, may need to reconcile these expectations with the possibility of a less aggressive approach by the Federal Reserve.

The week ahead includes key economic updates, with December’s consumer price index report set to be released on Thursday. The market is closely watching inflation trends, with the Federal Reserve navigating uncertainties around the most likely trajectory of inflation and the labor market.

Rate-cut expectations are expected to be a central theme in 2024, with a cautious approach recommended to avoid premature actions unless the economic landscape significantly deteriorates.