Kriss Kringle chose to bypass Wall Street for the first time since the 2015-16 period, marking an unusual absence of Santa Claus in the financial hub.

The “Santa Claus rally,” traditionally observed during the last five trading days of a calendar year and the first two sessions of the new year, typically lifts the S&P 500 by an average of 1.3% over this seven-day span, as per the Stock Trader’s Almanac.

Historical data from Dow Jones Market Data reveals that the S&P 500 has closed higher 78% of the time during this period over the past 75 years, experiencing gains for the last seven consecutive years.

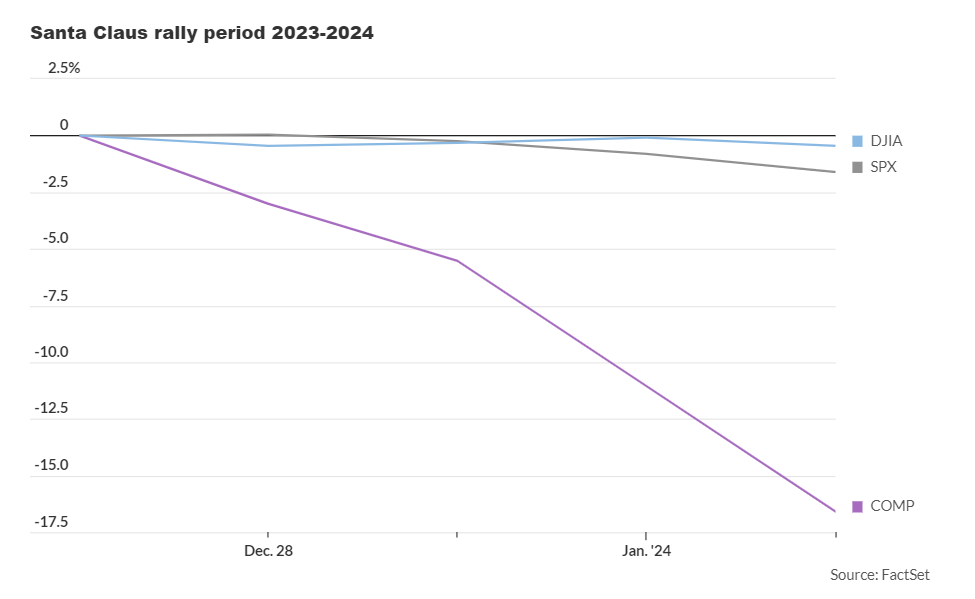

In contrast to the usual positive trend, this year’s Santa rally, spanning from December 22 to January 3, saw the S&P 500 decline by 0.9%. This performance marked the weakest Santa-rally period since 2015-2016, breaking a streak of seven consecutive positive Santa stretches, according to Dow Jones Market Data.

During the same period, the Nasdaq Composite dropped 2.5%, registering its third consecutive negative Santa rally period, while the Dow Jones Industrial Average managed a marginal gain of less than 0.1%, according to Dow Jones Market Data.

Market analysts interpret the failure to rally during this stretch as a potential signal for more challenging times ahead, with Jeff Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor Newsletter, noting that years without a “Santa Claus rally” tend to precede bear markets or periods of significantly lower stock prices later in the year.

On Wednesday, U.S. stocks closed lower, with most megacap technology stocks declining for a second consecutive session at the start of the new year. Investors appeared to reassess the year-end rally that boosted the Nasdaq Composite by 43% in 2023, while also considering the monetary-policy trajectory in 2024 following the release of the Federal Reserve’s last policy meeting minutes.

The S&P 500 ended down 0.8% at 4,704, the Dow industrials dropped 0.8% to 37,430, and the Nasdaq fell 1.2% to finish at 14,592, according to FactSet data.