The U.S. stock market showed slightly more stability on Monday, but investors remained cautious due to the increase in bond yields and anticipation for the conclusion of the Federal Reserve policy meeting on Wednesday.

How are stock-index futures trading

The S&P 500 futures, also known as ES00, declined by 1.75 points or less than 0.1%, reaching a value of 4,496.25.

The futures for the Dow Jones Industrial Average, with a decrease of 0.01%, were showing a gain of 14 points or less than 0.1%, reaching a value of 34,941.

Futures for the Nasdaq 100, with a decrease of 0.1%, dropped by 22.75 points, reaching 15,369.50.

The Dow DJIA experienced a slight increase of 0.1% during the previous week, whereas the S&P 500 SPX had a decrease of 0.2% and the technology-focused Nasdaq COMP dropped by 0.4%. Both the S&P 500 and Nasdaq recorded consecutive weekly losses.

What’s driving markets

Stocks were facing difficulty recovering from a recent significant decline in value, while interest rates on benchmark bonds slowly returned to levels not seen in 16 years. Investors were cautiously observing a week filled with significant actions from central banks.

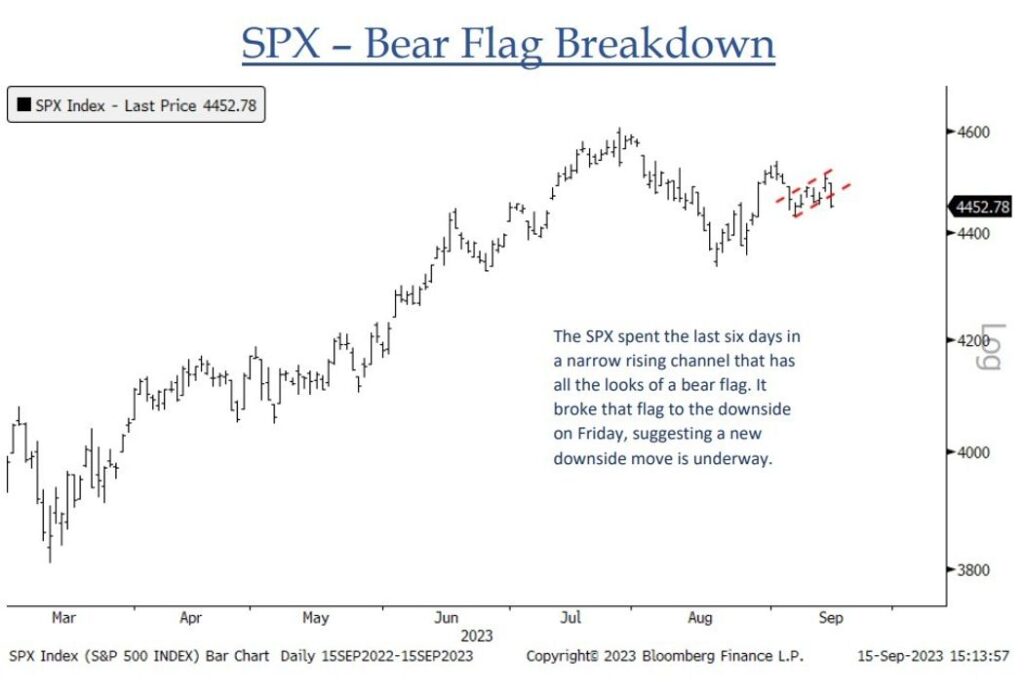

Concerns about inflation persisting above the Federal Reserve’s target of 2% were raised as the S&P 500 experienced a 1.2% decline on Friday due to the combination of stronger-than-expected economic news and increasing oil prices.

The worries were being shown in the prices of government bonds, as the implied borrowing costs for 10-year Treasury bonds increased to 4.353%, which is only slightly below the highest rate seen since 2007. Additionally, the price of U.S. crude oil futures surpassed $91 per barrel, reaching the highest price since November of the previous year.

Stephen Innes, a managing partner at SPI Asset Management, stated that investors are becoming more worried that the recent influx of data suggests an increase in inflation and the possibility of a prolonged period of higher interest rates, which could have a negative impact on the S&P 500 Index, specifically due to its heavy concentration in mega-cap technology companies.

Central banks’ perspective on these events will become clearer in the upcoming week. The Federal Reserve will announce its policy decision in the middle of the week, followed by the Bank of England on Thursday and the Bank of Japan on Friday, according to their respective local dates.

Richard Hunter, head of markets at Interactive Investor, stated that while it is widely anticipated that the Federal Reserve’s decision on Wednesday will not bring any changes, the comments accompanying the decision may provide some valuable information about their current perspective.

Hunter said that the opinions of investors are divided regarding the future outlook for the next year, and therefore, the latest views from the Federal Reserve could potentially have a significant impact on the market.

Jonathan Krinsky, a technical strategist at BTIG, states that the increasing value of the dollar (DXY) is also causing a decline in sentiment. He explains that last week, the three major challenges across different asset types (the dollar, interest rates, and crude oil) continued to rise, but it was not until Friday that this had a noticeable impact on the stock market.

Jonathan Krinsky, a technical strategist at BTIG, believes that the increasing value of the dollar is also dampening sentiment. He mentioned in a note that the three main obstacles in various financial categories (the dollar, interest rates, and crude oil) have been steadily rising, but it was only on Friday that the stock market seemed to take notice.

On Monday, there will be updates on the U.S. economy, including the release of the September home builder confidence index at 10 a.m. Eastern time.

Companies in focus

After Mizuho improved their rating for DoorDash Inc. (DASH) to a buy, the company’s shares increased by over 2% during premarket trading.