In June 2024, Nvidia briefly surpassed Microsoft to become the largest company by market capitalization on the S&P 500. However, history suggests this might not be a positive sign.

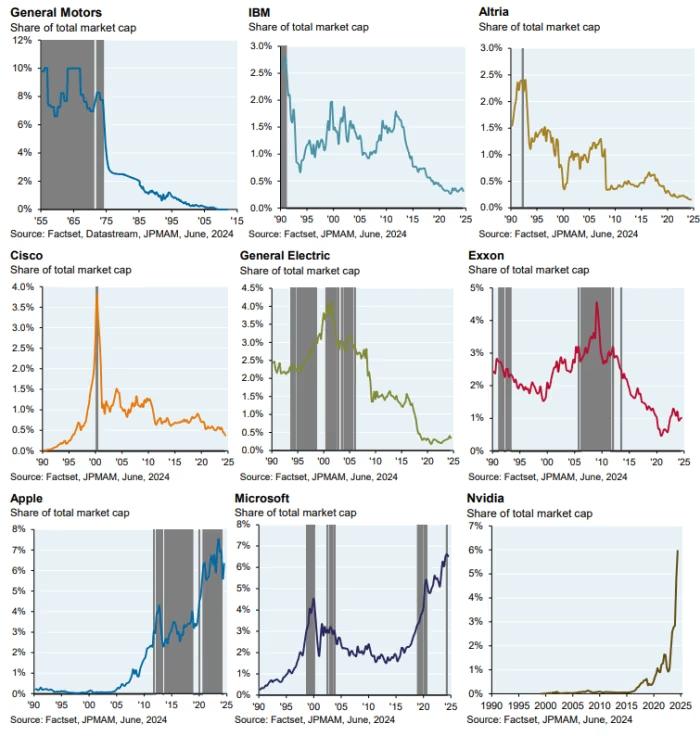

Analysts at JPMorgan Asset Management pointed out that many companies that have held this top spot, such as General Motors, IBM, Altria, Cisco, General Electric, and Exxon Mobil, eventually saw sharp declines in their market value.

So far, only Microsoft and Apple have managed to avoid significant declines after reaching the top. Nvidia’s meteoric rise, driven by excitement around AI technologies, has made it the fastest company to reach the S&P 500’s top position in the post-war era.

The big question now is whether Nvidia will follow in the footsteps of past market leaders, experiencing a downturn, or continue its upward trajectory. JPMorgan’s analysts suggest this will become clear over the next 12 to 18 months, depending on whether AI investments yield significant returns from corporate adoption.

They caution that corporate AI adoption needs to grow substantially to justify the current investments, drawing parallels to past tech booms like the mainframe era and the dot-com bubble.

Despite Nvidia’s strong earnings, the company faces risks from geopolitical tensions and competition from rivals like Intel, AMD, and ARM, which could impact its market dominance.

Taiwan Semiconductor Manufacturing Co., Nvidia’s key chip supplier, could also play a crucial role in its future, especially if U.S.-China relations worsen.