Rising Interest Rates Alone Won’t Suppress Stock Prices for Much Longer”

The recent decline in the U.S. stock market can’t be solely attributed to higher interest rates, and investors will soon recognize this.

The common belief that stocks tumble when interest rates climb is widely accepted, but unquestioned convictions can lead us astray. As Humphrey Neill, the pioneer of contrarian analysis, often advised his clients, “When everyone thinks alike, everyone is likely to be wrong.”

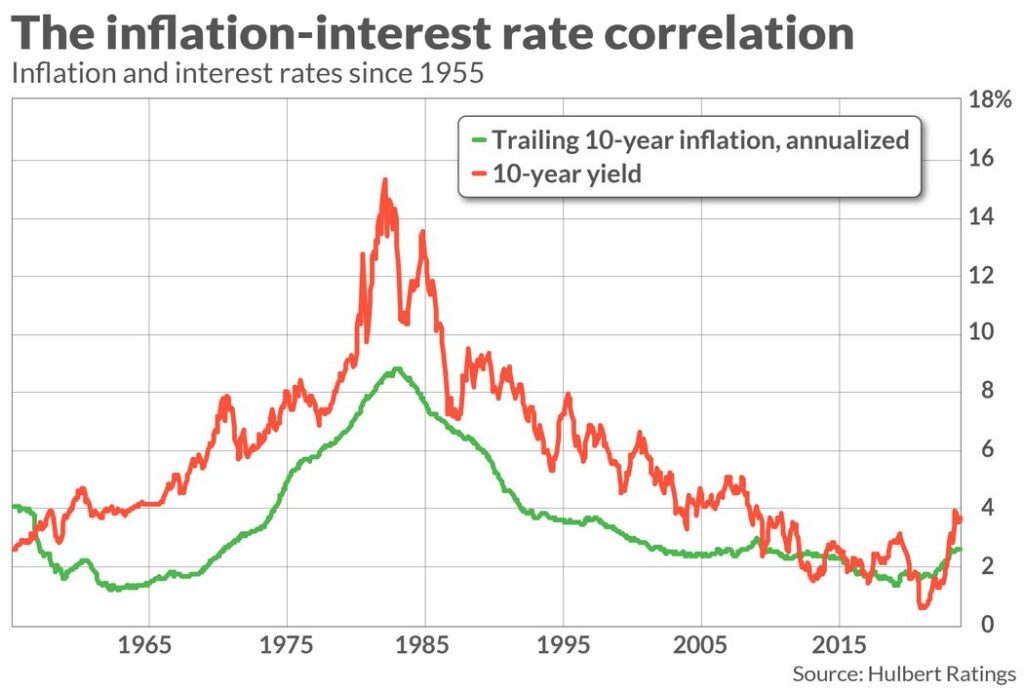

To reassess this notion, let’s first remember that interest rates and inflation have a strong historical correlation, as evident from the accompanying chart.

This year is no exception: The 10-year Treasury yield (BX:TMUBMUSD10Y), often blamed for the slowdown in the bull market, has surged from 3.79% to 4.81% since the start of 2023 through October 3. Over the same period, the 10-year breakeven inflation rate, a collective measure of expected inflation among bond investors, has only slightly increased from 2.26% to 2.33%.

The interest-rate/inflation correlation is vital because nominal corporate earnings tend to grow faster during periods of higher inflation. While this doesn’t mean investors should welcome inflation, it does mean that future earnings in years to come will be discounted at a higher rate.

However, due to various psychological factors, investors often emphasize the negative impact of the increased discount rate over the higher nominal earnings growth associated with higher inflation.

Economists call this investor bias the “inflation illusion.” A significant study on how this error affects the stock market was conducted by Jay Ritter of the University of Florida and Richard Warr of North Carolina State University. They found that investors consistently undervalue stocks in high inflation environments.

Conversely, when inflation and interest rates begin to decline, investors will make the same error in reverse. This sets the stage for a significant buying opportunity in the market.