Key Insights for the U.S. Economy

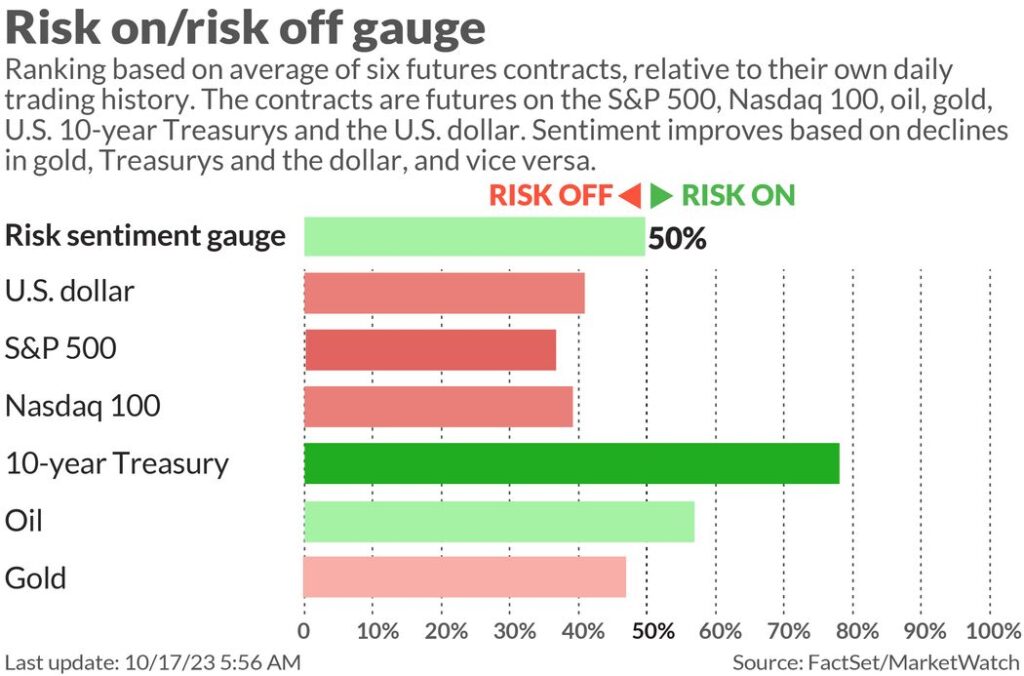

After an explosive start to the week, the stock market appears to be cooling down on Tuesday, amidst more big bank earnings reports and retail sales data. Unfortunately, the global geopolitical landscape remains turbulent.

If you’re an investor concerned about a potential stock market downturn, our featured perspective offers some budget-friendly ideas, especially given the current valuations of certain stocks for this year.

These insights are courtesy of Smead Capital Management, based in Phoenix, which recently shared its analysis in an investor letter. It has been a challenging year for value managers like Smead, with their value fund SVFAX showing a 2% gain year-to-date as of September 30 but an annualized return of 16.7% over three years.

Bill Smead, the lead portfolio manager, and his son, co-portfolio manager Cole Smead, foresee this year being marked in history as a period of mania and a bubble around seven prominent tech stocks and AI. While they anticipate this ending on a sour note, they believe that some of the capital invested in these areas will flow “into whatever investors gravitate toward in the future.”

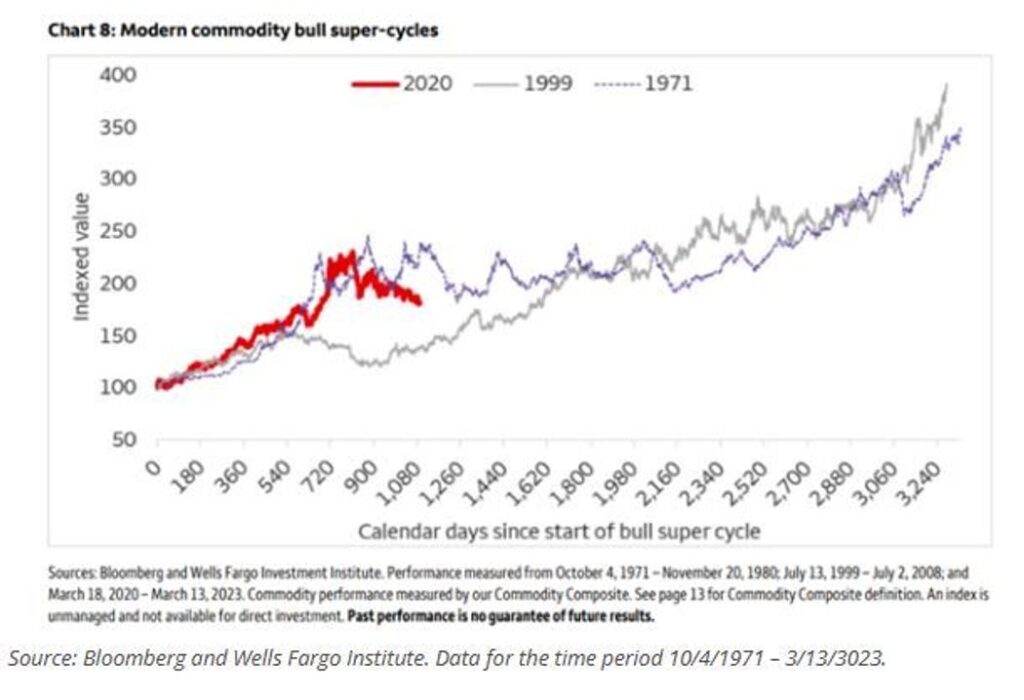

The Smead team sees the market in the “early stages of a commodity supercycle” and identifies a “once-in-a-lifetime opportunity in oil and gas stocks.” These stocks have significantly underperformed the price of oil this year, presenting what they consider an attractive short-term buying opportunity for the industry.

Among the stocks they highlight are Occidental Petroleum (OXY) and ConocoPhillips (COP), both of which have seen positive performance and are part of their value fund.

The Smead managers also point to the potential for the “upcoming dominance” of the millennial generation, representing a substantial portion of the population in 2022. They emphasize that the inverted yield curve and Federal Reserve tightening have led investors away from economically sensitive businesses, which they believe should benefit from the fact that there are 40% more millennials in the 27-42 year-old age group than the preceding Gen Xers.

Despite the challenges in the housing market due to high interest rates, the Smead team places their bets on home builders, financial institutions, and retail-oriented companies to benefit from the millennial shift to suburban living.

Their selected companies include D.R. Horton (DHI), American Express (AXP), and U-Haul (UHAL). If their prediction holds true, this could be an opportune moment to invest in millennial-related assets.

In this era, the Smead managers see the potential to own companies with high return-on-equity trading at prices considerably lower than the average stock and at a substantial discount compared to the dominant shares in the S&P 500 index.

As of now, stock futures are showing a soft trend, with modestly higher Treasury yields and a slight increase in oil prices. Bitcoin is hovering around $28,000, with one analyst suggesting a likely rise to $45,000 once the SEC approves an ETF.