Trump’s Tariff Strategy May Offer Temporary Market Relief, but Recession Risks Loom

President Donald Trump’s latest tweaks to U.S. tariffs appear to have temporarily steadied financial markets. But that relief could be short-lived, warns Daniel von Ahlen, senior macro strategist at GlobalData TS Lombard.

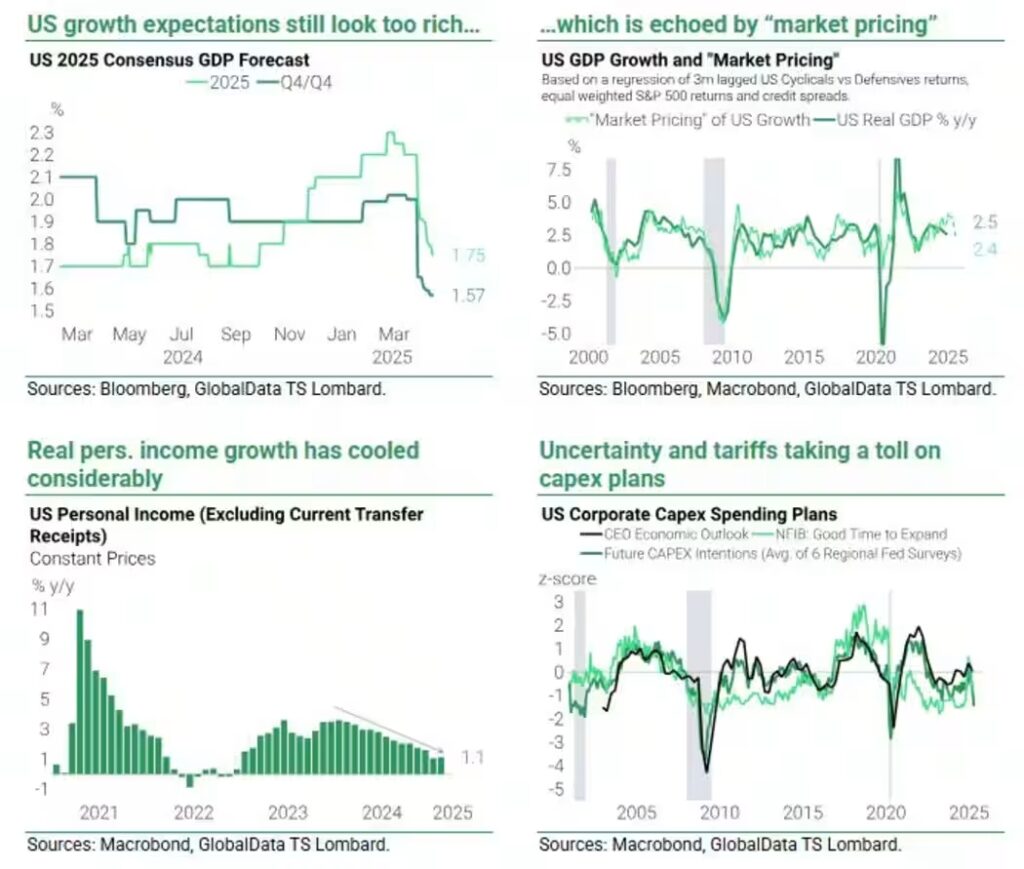

In a report shared with MarketWatch, von Ahlen expressed concern that investors may be underestimating the risk of a U.S. recession—a miscalculation that could lead to more severe market pain later in the year, particularly for equities.

He pointed to a series of worrying economic indicators. Government layoffs could strain an already weakening labor market, just as hiring rates have begun to slow. At the same time, tariffs are expected to drive up the cost of many goods, further eroding consumer purchasing power amid sluggish income growth.

Von Ahlen also noted that retaliatory tariffs from China may hit U.S. exporters, while tighter immigration policies could reduce the size of the workforce. Meanwhile, any fiscal belt-tightening required to extend Trump’s previous tax cuts could pull critical stimulus from the economy at a time it can least afford it.

“Collectively, these factors could be powerful enough to push the U.S. economy into recession,” von Ahlen wrote, “especially as rapidly cooling real personal income growth leaves little room for error.”

To support his view, von Ahlen analyzed how much economic growth is currently being priced into markets. Despite falling consensus forecasts from Wall Street economists, investor expectations for robust growth have remained surprisingly strong.

Another potential red flag for equities: corporate earnings forecasts for 2025 still look overly optimistic. While some downward revisions have begun, the consensus still sees earnings growing 8.9% next year—an outcome that’s unlikely if a recession materializes, when earnings typically stagnate or decline.

A downturn in stock markets could also hit consumer spending, von Ahlen warned, as equities now represent a larger slice of household wealth than in years past.

He’s not the only one sounding the alarm. Michael Brown, a senior research strategist at Pepperstone, also sees significant risks. In recent comments to MarketWatch, Brown pointed out that new sector-specific tariffs—targeting industries like semiconductors and pharmaceuticals—are on the horizon. A 10% blanket tariff remains on most U.S. imports, and trade ties between the U.S. and China are still severely strained.

“China has now halted Boeing jet deliveries,” Brown noted, adding that progress toward eliminating reciprocal tariffs has been slower than many had hoped.

“There’s still a lot of uncertainty around trade,” he said. “Markets may be underpricing both the inflation risks and potential drag on global growth.”

So how can investors prepare for a potential downturn?

Von Ahlen recommends rotating into defensive sectors through ETFs like the Utilities Select Sector SPDR Fund (XLU), while reducing exposure to more economically sensitive sectors via funds like the Financial Select Sector SPDR Fund (XLF). He also suggests buying long-duration, inflation-protected bonds—such as those tracked by the Pimco 15+ Year U.S. TIPS Index ETF (LTPZ).

Another idea: use Mexican pesos to fund long positions in the Japanese yen (MXNJPY), a currency traditionally seen as a safe haven. Despite some recent gains versus the U.S. dollar, the yen still appears undervalued.

Initially, several Wall Street economists—including those at Goldman Sachs—sounded alarms following Trump’s announcement of new “liberation day” tariffs on April 2. But after Trump paused some of those tariffs for 90 days on April 9, Goldman quickly adjusted its outlook.

Nevertheless, fresh tensions have reemerged. On Tuesday, Nvidia reported that the White House had blocked additional AI chip exports to China without a license. The same day, Bloomberg reported that China had ordered its domestic airlines to stop accepting deliveries of Boeing aircraft.

Markets responded swiftly: the S&P 500 dropped 1.3% and the Nasdaq Composite slid more than 2% in Wednesday trading. Nvidia shares fell nearly 7%.