The positive surge in the U.S. stock-market that characterized the initial half of 2023 has extended into the latter half, causing confident investors to hold onto the hope that has propelled the tech-focused Nasdaq 100 index to a 42% rise for the year so far. Meanwhile, cautious investors are attempting to predict the moment when this upward stride loses steam and the trend begins to decline.

The divide between perceived stock-market bulls, who are hopeful and purchase stocks with the expectation of an increase in value, and bears, who predict a downward trend in the market and may aim to make money from falling stock prices, has significantly expanded.

Liz Young, the head of investment strategy at SoFi, likened the current financial atmosphere to a hostile political climate, with both sides harbouring anger and unable to reach a consensus. She stated this was unsurprising, considering the abundance of contradictory information, including the surprising surge in the stock market despite ominous economic indicators and bond market signals. The positive inflation figures this week boosted the likelihood of a halt in the Federal Reserve’s interest-rate hikes. There are increasing chances of a soft landing, where inflation reverts to about 2% as per the central bank’s goal, without causing a recession. For the first time since April 2022, S&P 500 hit over 4,500 points on Thursday, reaching a new 15-month peak. This week, it increased by 2.4%, the Nasdaq Composite rose by 3.2%, and the Dow Jones Industrial Average climbed by 2.3%, as per FactSet data.

MarketWatch received information from market analysts, stating that the ongoing dispute between optimistic and pessimistic investors will continue. They suggested that optimism won’t fully take over until uncertainties regarding monetary policy, economic indicators, and fluctuations in Treasury yield curve have been clarified.

“We continue to encounter a monetary contraction phase whose end is uncertain. Numerous economic indicators are predicting a shrinkage. Various signs including inverted yield curves suggest that we’re still not in a stable financial situation,” Young stated in an interview on Friday. “Debates on this matter are ongoing and I lean more towards a cautious approach, especially given the current market evaluations.”

Melissa Brown, the managing director of applied research at Qontigo, suggests that currently, markets are predicted to progress steadily but cautiously, taking two steps forward and one backward. This pattern could be disrupted by an occurrence that triggers negative investor sentiment, similar to much of the previous year.

The remarkable increase in the worth of leading tech stocks, including Nvidia Corp., Meta Platforms, and Alphabet Inc., has driven the S&P 500’s upward trend of over 17% this year, fueled by the rising optimism towards artificial intelligence (AI). Yet, Young expressed a concern that investors might be overvaluing these stocks fueled by their AI enthusiasm. If these stocks don’t deliver desired results within the next 12 months, their valuation may no longer look appealing.

“When purchasing stocks, you usually base your decision on the projected earnings for the next 12 months. While AI might indeed bring about significant changes across various sectors, it’s unlikely to completely overhaul the technology landscape within this year,” she explained. The expected timeline could be the element that goes awry.

Qontigo’s Brown also highlighted the recent instability in the stock market, which has seen considerable drops since the end of March. This period marked the easing of fears over the banking sector, following the abrupt fall of Silicon Valley Bank. The CBOE Volatility Index VIX was marked at 13.31 on Friday, after recently reaching its lowest point in over three years. Generally, a VIX value below 20 implies a perceived low-risk climate, while a score over 20 represents a time of amplified market volatility.

Brown stated that her models illustrate a growing discrepancy between a fundamental model–that evaluates market instability according to economic conditions–and a statistical model–that determines volatility based on the data provided.

The predictive statistical model presents a significantly greater risk compared to the core model, marking potentially the first such instance in over six years. This indicates the possibility of some concealed volatility, suggesting that it’s emerging beneath the surface,” Brown explained to MarketWatch over the phone on Friday.

Another major worry is the impending shortage of liquidity, as investors are now considerably overinvested compared to liquidity, particularly regarding mega-cap growth stocks, according to Raheel Siddiqui, Senior Research Analyst of Global Equity Research at Neuberger Berman.

In his Q3 forecast for the equity market, Siddiqui pointed out that investor enthusiasm often wanes as liquidity decreases, a scenario he anticipates will occur soon due to possible large scale withdrawals in the coming weeks. He was alluding to several developments – the Federal Reserve’s projected reduction of its balance sheet each month, aptly named quantitative tightening, the Treasury’s plan to issue fresh debt to refill the Treasury General Account following Congress’s decision to elevate the debt-ceiling, and the European Central Bank’s strategy to withdraw €477 billion in TLTRO funding from the banking structure.

According to Siddiqui, our perspective suggests a potential negative impact on stocks in the upcoming period.

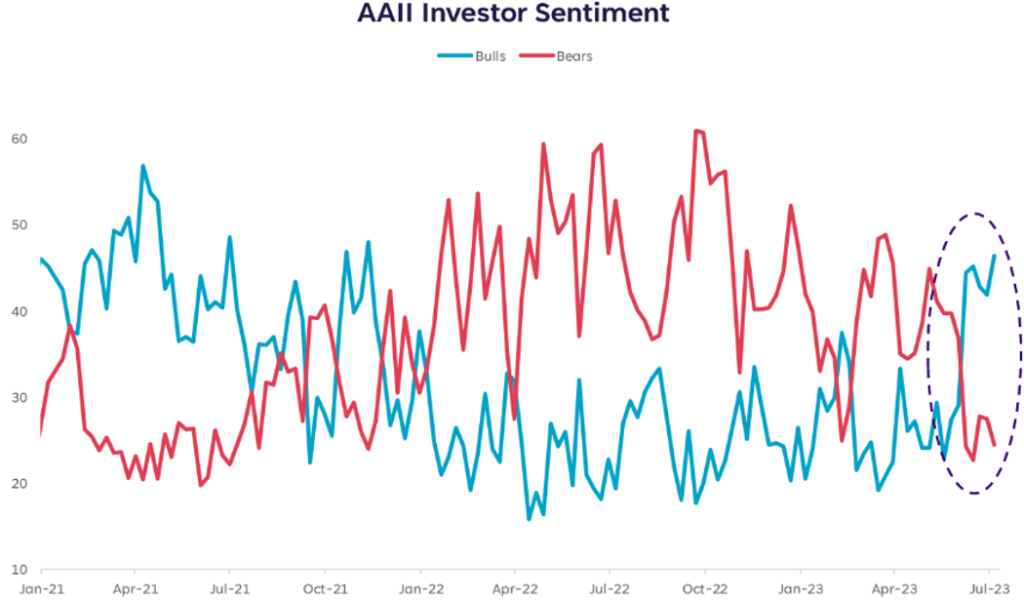

Optimism in the stock market has declined, yet for the sixth week straight, it continues to stay above the norm, according to the recent Sentiment Survey by the American Association of Individual Investors (AAII). Both neutral and bearish feelings witnessed a rise in the week leading up to Wednesday.

Young from SoFi noted a considerable shift in investors’ sentiment from continually bearish to bullish. Despite the chart not showing a dramatic difference in the count of bulls versus bears, she pointed out that the abrupt change in positions is considerably notable.

“Young stated that typically, rapid and significant changes can often prompt an equally fast and substantial reversal as markets and investors try to find a balance,”