UBS Cites Investor Sentiment, Goldman Highlights Central Bank Demand in New Gold Forecasts

Strategists at UBS and Goldman Sachs are adjusting their gold price targets, driven by differing but complementary market forces.

UBS strategist Joni Teves acknowledged the challenges of chasing an already strong market but argued that it would be premature to call an end to gold’s rally simply because prices have repeatedly hit new highs. She raised her year-end target from $2,800 to $2,900 and increased her 2026 projection from $2,850 to $2,900.

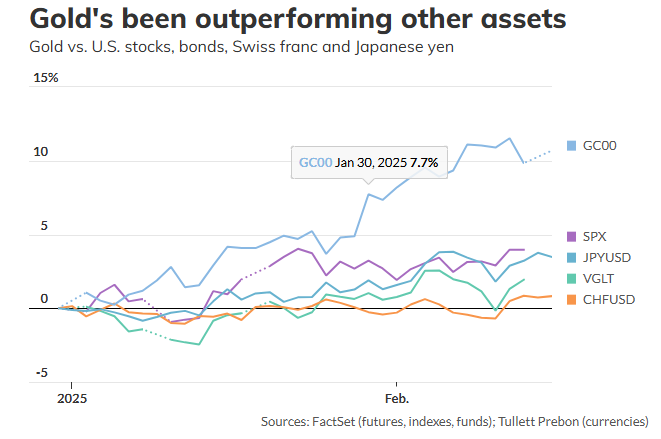

Meanwhile, Goldman Sachs analysts, led by Lina Thomas, lifted their year-end gold target to $3,100 from $2,890. Gold futures GC00 +0.82% rose 1% on Tuesday to $2,923.80 an ounce, continuing a year in which the precious metal has outperformed U.S. stocks, bonds, the Swiss franc, and the Japanese yen.

Drivers Behind the Forecasts

Teves sees gold potentially reaching $3,200 later this year, citing strong investor sentiment fueled by macroeconomic uncertainty and under-positioned markets. She noted that official purchases would provide further support, while liquidity constraints—especially in London—could amplify price swings.

In the long run, UBS projects gold to stabilize around $2,500, factoring in elevated production costs and capital expenditures. Teves also pointed to key themes like fiat currency debasement, rising U.S. fiscal deficits, and geopolitical risks as reasons why gold remains an attractive alternative asset.

On silver, Teves left her forecast unchanged at $35.40 per ounce by year-end but noted that the white metal could outperform gold if weaker economic growth prompts a more dovish stance from the Federal Reserve.

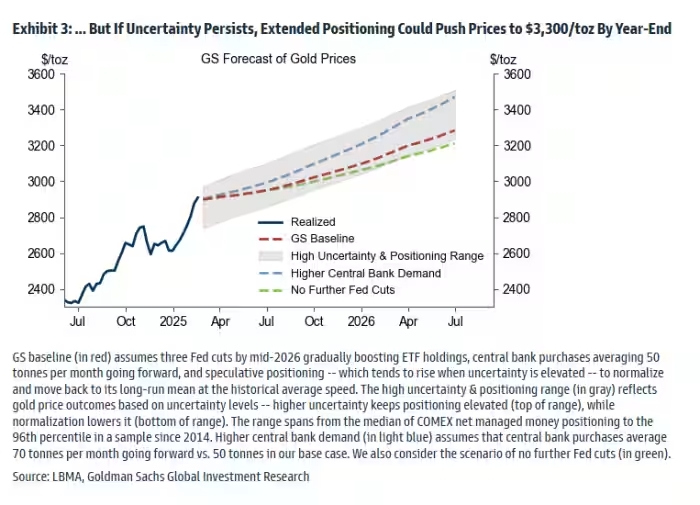

Goldman Sachs echoed UBS’s bullish stance but placed greater emphasis on structurally higher central bank demand, which they estimate could add 9% to gold prices by year-end. If policy uncertainty remains elevated, Goldman sees the potential for gold to climb as high as $3,300.