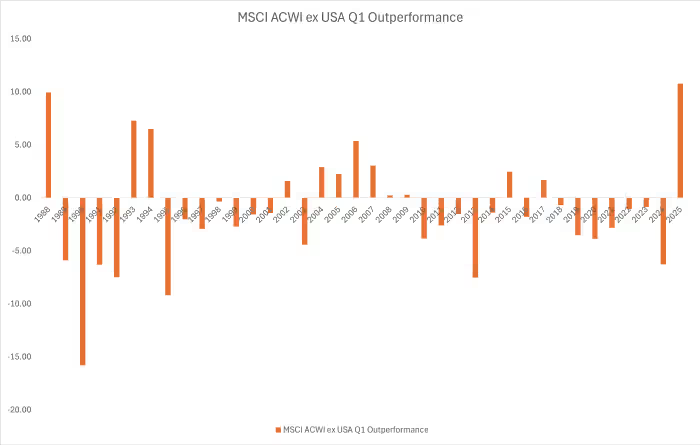

According to Dow Jones data, international stocks achieved their strongest first-quarter outperformance against U.S. stocks on record.

In late 2024, the “American exceptionalism” trade was thriving. Investors worldwide, buoyed by Donald Trump’s electoral victory in November, funneled capital into the U.S. stock market. However, three months into 2025, the landscape has shifted. U.S. stocks have struggled in the first quarter, weighed down by the unwinding of popular artificial intelligence trades and tariff-related uncertainty, while international stocks have surged ahead.

As of Monday, the S&P 500 (SPX) was on track to lag behind global stocks—measured by the MSCI All Country World Index ex-U.S. ETF (ACWX)—by nearly 11 percentage points during the first quarter. This marks the largest first-quarter outperformance by international stocks on record, based on Dow Jones Market Data going back to 1987.

Despite this recent trend, U.S. stocks have dramatically outperformed international markets over the past two decades. Since March 2005, the S&P 500 has climbed 370%, compared to less than 65% for the MSCI All Country World Index ex-U.S. ETF, excluding dividends, according to Dow Jones data. This suggests that a “catch-up” trade is now taking place.

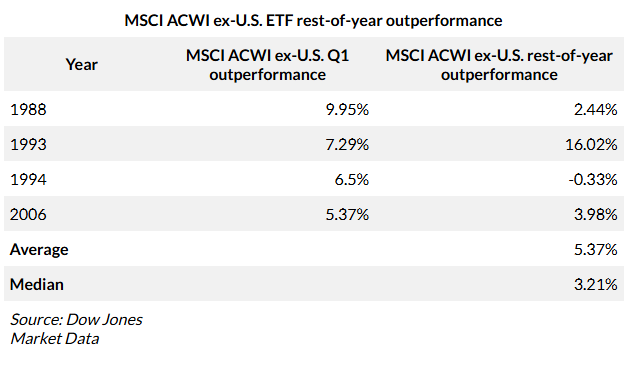

“We’re finally starting to see some reversion to the mean,” said Ryan Dykmans, chief investment officer at Dunham & Assoc. Investment Counsel, in an interview with MarketWatch on Monday. Historical data indicates that when international stocks outperform U.S. equities significantly in the first quarter, they tend to maintain this lead for the remainder of the year.

Globally, stock performance in the first quarter has varied. The STOXX Europe 600 (SXXP), which includes stocks from the eurozone, the U.K., and Switzerland, is on track for its best first-quarter outperformance against the U.S. since 2015, according to Dow Jones data. Meanwhile, Japan’s Nikkei 225 (NIK) has struggled, dropping over 10% in local-currency terms, based on FactSet data.

Currency Weakness and Foreign Investment Risks

For foreign investors holding U.S. stocks, the market’s downturn in 2025 has been especially painful. The U.S. dollar has also weakened alongside equities. As of midday Monday, the ICE U.S. Dollar Index (DXY) had declined about 4% for the quarter, while the S&P 500 had fallen more than 5.5%, according to FactSet data. This simultaneous drop in both stocks and the dollar hasn’t occurred in a calendar quarter since early 2018.

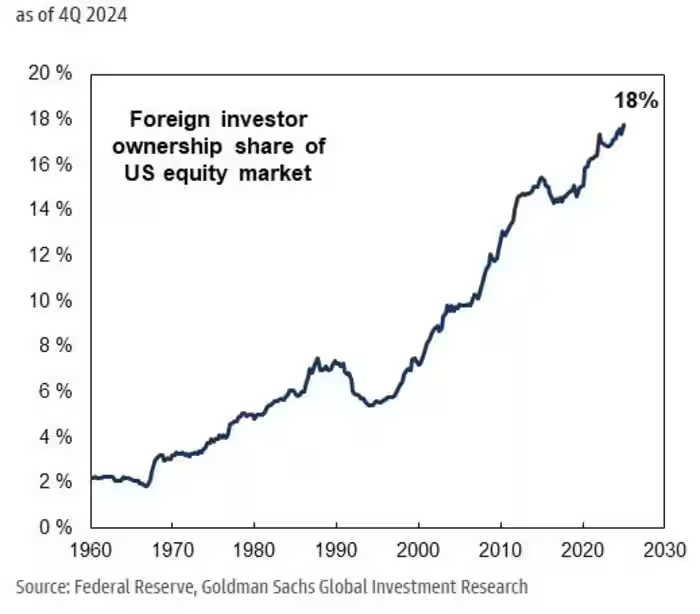

The weakening dollar compounds losses for foreign investors. Many had refrained from hedging their currency exposure due to the dollar’s historical strength. If U.S. stocks continue to struggle, international investors may reallocate funds to Europe or other markets, potentially exacerbating U.S. stock losses in a negative feedback loop.

“There was a time when U.S. stocks were primarily owned by domestic investors,” said Hardika Singh, an economic strategist at Fundstrat Global Advisors. However, since the early 2000s, foreign ownership of U.S. stocks has surged. According to Federal Reserve data cited by Goldman Sachs, foreign investors held 18% of U.S. equities in late 2024, up from just 7% in 2000 and 2% in 1960.

As of late 2024, U.S. stocks represented 57% of the total global equity market value, surpassing the dot-com bubble peak in 2000. Their share has since declined to 54%.

Singh attributes international stocks’ recent gains to a “catch-up” trade rather than a lasting shift. While Trump’s tariff policies introduce uncertainty, their economic impact would likely extend beyond the U.S., as trading partners retaliate. Moreover, U.S. companies are still expected to experience stronger earnings growth than their global peers in 2025, reinforcing Fundstrat’s expectation that U.S. stocks will regain leadership before year-end.

“It really is to the rest of the world’s advantage that the U.S. continues to do well,” Singh added.

On Monday, the S&P 500 rose 0.6%, trimming earlier losses. The Dow Jones Industrial Average (DJIA) gained 417 points, or 1%, reaching 42,001, while the Nasdaq Composite (COMP) declined 0.1% as Big Tech stocks continued to struggle.