As if the challenges facing the U.S. stock market weren’t enough, there’s another one to add to the list: systematic trend-following funds are reducing their exposure, potentially exerting additional downward pressure on the markets in the coming weeks.

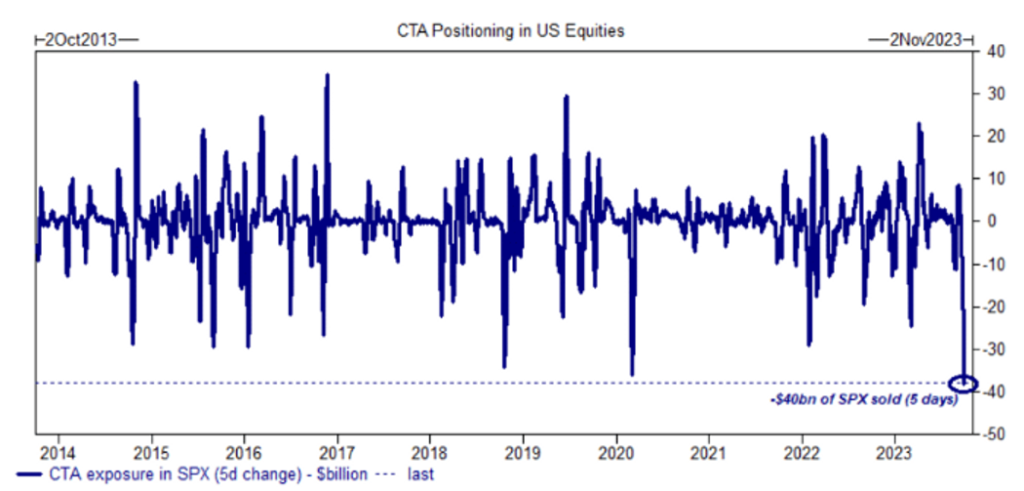

Goldman analysts estimate that commodity trading advisors (CTAs), a type of trend-following hedge fund active in futures markets, offloaded approximately $40 billion in exposure to U.S. stocks last week. According to Goldman’s data, this represents the most rapid pace of CTA selling on record.

Fortunately, the Goldman team anticipates that the selling pressure from systematic funds will ease in the coming days, but not everyone shares this view. A team at UBS, in a recent note obtained by MarketWatch, predicts another $20 billion to $30 billion in CTA selling over the next two weeks. According to their data, this would result in systematic funds being net short on stocks for the first time since November of the previous year.

The S&P 500 experienced a 3.6% decline in the quarter ending in September, marking its first quarterly drop in a year. Since then, stocks have continued to slide, with the index decreasing by another 0.5% since the beginning of October. Overall, the S&P 500 has fallen by nearly 7.5% since its peak on July 31. In comparison, the index closed at 4,263.75 on Wednesday after a 0.8% increase, its largest daily gain in three weeks, according to FactSet data.

On the other hand, the Nasdaq Composite rose by 1.4% on Wednesday to reach 13,236.01, while the Dow Jones Industrial Average climbed 127.17 points, or 0.4%, to 33,129.55, possibly due to easing Treasury yields providing some relief to stocks.

The rise in Treasury bond yields, especially for longer-dated maturities, has created pressure on stocks, with the yields on the 10-year and 30-year Treasury bonds reaching their highest levels in 16 years earlier this week. Higher bond yields can increase borrowing costs for corporations, potentially impacting economic growth, and can also make U.S. equity valuations less attractive compared to bonds.

For instance, these higher yields have recently pushed the U.S. equity risk premium, a measure of expected risk-adjusted returns for stocks relative to bonds, to its lowest level in over two decades, at just under 0.90 earlier this week, according to Dow Jones Market Data. This indicates that the compensation investors can anticipate for holding stocks over bonds is currently less favorable in theory.

Investors have also attributed the selloff to the inflated valuations of mega-cap technology stocks and concerns about the Federal Reserve’s plans for higher interest rates in the foreseeable future.