The positive momentum in the U.S. stock market, which started in the first half of 2023, is still ongoing in the second half. This has kept optimistic investors hopeful, especially as the technology-focused Nasdaq 100 index has already increased by 42% this year. Conversely, pessimistic investors monitor the situation closely, anticipating when the current momentum will fade, and the market will start declining.

The gap between those who believe in the potential growth of the stock market, known as the bulls, and those who foresee its decline, known as the bears, has significantly expanded.

Liz Young, head of investment strategy at SoFi, compared the current situation to a political landscape where both sides are filled with anger and resentment towards each other, making it difficult to reach a consensus. This is due to conflicting data, including a stock-market rally that seems out of touch with economic indicators and bond market signals that are warning of potential issues. Despite these concerns, U.S. stocks continued to rise this week thanks to positive inflation readings that increase the possibility of the Federal Reserve ending its interest rate hikes. There is also growing optimism for a soft landing, where inflation returns to the central bank’s target without a recession. The S&P 500 reached a new high since April 2022, with a 2.4% increase for the week, while the Nasdaq Composite rose 3.2% and the Dow Jones Industrial Average gained 2.3%.

Market analysts informed MarketWatch that the ongoing disagreement between those who are optimistic about the market (bulls) and those who are pessimistic (bears) will continue. They suggested that the overall positive sentiment will not fully take hold until uncertainties surrounding factors such as monetary policy, economic indicators, and the inversion of Treasury yield curves have been addressed and resolved.

“We may still be in the process of tightening monetary policy. Various indicators, such as yield-curve inversions, suggest that the economy is contracting and we are not yet out of the difficult situation,” Young expressed in a subsequent interview on Friday. “The discussion will persist, and I personally hold a more cautious stance, especially considering the current valuations.”

Melissa Brown, managing director of applied research at Qontigo, explained that markets are currently expected to progress, but with occasional setbacks, unless something happens to make investors pessimistic, similar to what occurred for the majority of last year.

The rise in the value of large technology stocks, such as Nvidia Corp., Meta Platforms, and Alphabet Inc., has caused the S&P 500 to increase by over 17% this year. This value growth can be attributed to the growing optimism surrounding artificial intelligence (AI). However, there is a potential risk that investors are paying too much for stocks based on AI excitement. If they do not see positive results within the next year, the value of these stocks may no longer be seen as appealing, according to Young.

“The speaker mentioned that when purchasing stocks, they are usually bought based on the anticipation of earnings for the next 12 months. While AI could significantly impact various industries, it is unlikely to completely revolutionize the technology landscape before the end of this year. Therefore, the potential issue lies in having unrealistic timeframe expectations.”

Brown from Qontigo also mentioned the current instability in the stock market, which has significantly decreased since late March when worries about the banking industry subsided following the unexpected failure of Silicon Valley Bank. As of Friday, the CBOE Volatility Index VIX was at 13.31, having recently reached its lowest point in over three years. Generally, a VIX score below 20 indicates a perceived low-risk situation, while a score above 20 suggests a period of increased volatility.

Nonetheless, Brown stated that her models indicate a growing disparity between a basic model, which examines market volatility by considering macroeconomic factors, and a statistical model that relies on data to determine the volatility’s location.

“In at least the past six years, and likely even longer, this is the first instance where the statistical model predicts a substantially greater risk level than the fundamental model. This indicates that volatility is hidden or developing, posing a potential threat,” Brown said in a phone conversation with MarketWatch on Friday.

Raheel Siddiqui, a senior research analyst at Neuberger Berman, expressed concern about the imminent liquidity shortage. He noted that investors, particularly in high-growth mega-cap stocks, are currently “significantly overbought” about available liquidity.

In his third-quarter equity-market outlook, Siddiqui mentioned that investor excitement usually fades away when there is less liquidity, and this is likely to occur soon due to several factors. These factors include the Federal Reserve’s intention to reduce its balance sheet every month, which is known as quantitative tightening, the Treasury’s issuance of new debt to refill the Treasury General Account following an increase in the debt-ceiling by Congress, and the European Central Bank’s plan to withdraw €477 billion in TLTRO financing from the banking system.

Siddiqui expressed his belief that equities may face unfavorable consequences shortly.

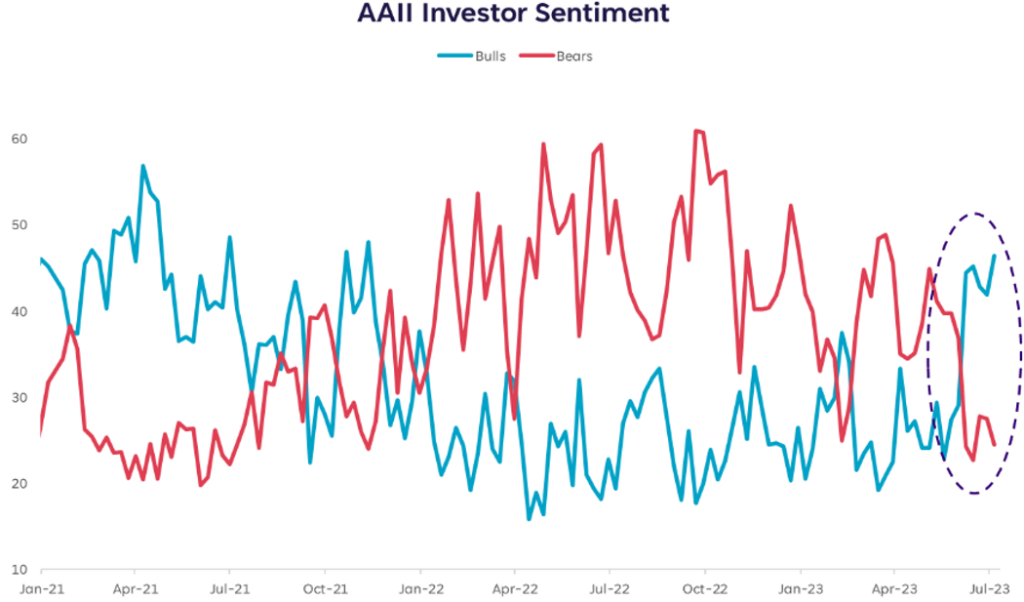

In the most recent American Association of Individual Investors (AAII) Sentiment Survey, there was a decrease in stock-market optimism. However, it remains higher than average for the sixth consecutive week. Furthermore, both neutral and bearish sentiments increased during the week until Wednesday.

Nonetheless, Young from SoFi stated that a noteworthy shift has occurred among investors from a negative sentiment to a positive one. She highlighted that while the exact number of optimists compared to pessimists may not be at extreme levels according to the chart, the abrupt and drastic change in their positions is notable.

According to Young, significant and rapid changes are often followed by equally significant and rapid changes in the opposite direction, as markets and investors strive to find a balance.