Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, suggests that the increasingly ‘frothy’ atmosphere in the stock market may leave equities susceptible to a downturn.

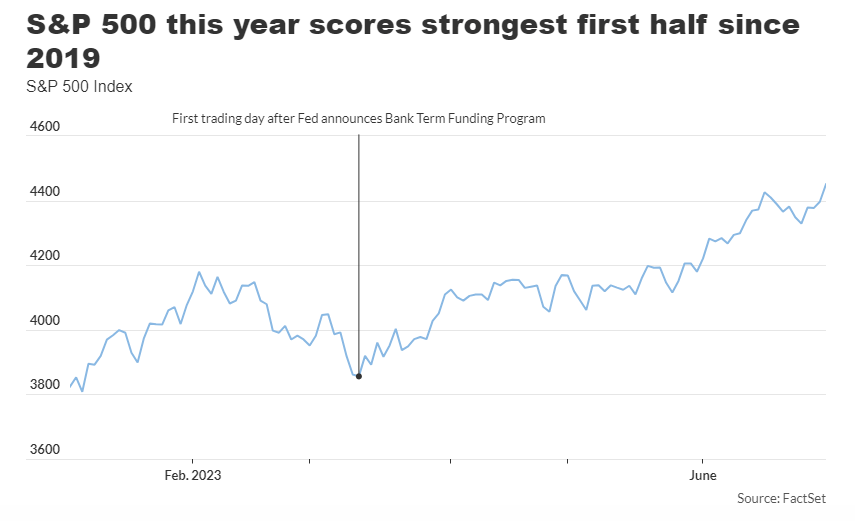

The S&P 500 index recently completed its best first half of a year since 2019. Despite worries of an upcoming U.S. recession, it seems that this concern is becoming less likely than expected. As a result, there is uncertainty about whether the stock market rally will continue throughout the rest of 2023.

José Torres, a senior economist at Interactive Brokers, stated in a recent phone interview that it is challenging to determine when the US government’s liquidity measures implemented during the pandemic will deplete. He was specifically referring to the combination of fiscal and monetary stimulus carried out between 2020 and 2021. Despite the Federal Reserve’s efforts to combat inflation by increasing interest rates since 2022, their intervention in March following regional bank failures injected additional liquidity into the financial system.

According to Torres, the conditions were set for high-risk investments to thrive, which resulted in the rise of assets. Additionally, the recent trend of artificial intelligence has further fueled the momentum in American stocks. Torres predicts that the market will experience a decline from this point onwards.

In the middle of March, the S&P 500 was trading at a similar level to the beginning of 2023. However, stocks were affected negatively by troubles in regional banks before the Federal Reserve intervened. The central bank’s announcement of a bank term funding program on March 12 provided support and boosted confidence in the banking system, relieving significant pressure on financial conditions, as stated by Torres.

According to Dow Jones Market Data, the S&P 500 had its best first-half performance since 2019, with a 15.9% increase in the first six months of 2023. In June, all 11 sectors of the index experienced growth, which had not happened since November.

Despite the Federal Reserve’s rapid increase in interest rates in 2022 with the intention to decrease inflation and demand, the U.S. economy has shown resilience. Investors seem unconcerned about the possibility of a recession due to the positive economic indicators observed in recent times.

Bernard Baumohl, the chief global economist at the Economic Outlook Group, announced via email on June 29 that the recession has been effectively ended.

The writer emphasizes that even though the economy has been performing well in the first three months, prices have still been decreasing. He suggests that all measures of inflation have been decreasing and if inflation does not start to increase, the Federal Reserve should continue its current pause.

This year, the Federal Reserve has reduced the frequency of increasing interest rates, temporarily halting the hikes during its June policy meeting. However, they have indicated that there could be more rate increases in the future. As of Friday, the Federal-funds futures indicate that traders are mostly anticipating a quarter-point increase in the Fed’s benchmark rate in July, which would bring it to a targeted range of 5.25% to 5.5%, according to the CME FedWatch Tool.

Many investors are pleased with the Federal Reserve’s decision to pause, as they believe it signals that the rate-hiking cycle is nearly over. This cycle had previously resulted in significant losses for both stocks and bonds in the previous year.

In the recent week, various economic indicators in the United States provided positive surprises. The revised estimate for economic growth in the first quarter exceeded expectations. Additionally, the orders for durable goods from manufacturers in May were stronger than anticipated. The sales of newly constructed homes during the same month surpassed the predictions made by economists. Furthermore, consumer confidence reached a 17-month peak in June, according to a survey conducted by the Conference Board. Lastly, there was a decrease in the number of initial jobless claims for the week ending June 24.

Investors were also pleased to see signs of inflation decreasing. According to a government report released on Friday, U.S. inflation, as measured by the personal-consumption-expenditures price index, declined to 3.8% in May compared to the same time last year. This represents the slowest growth rate since April 2021.

However, Torres expressed concerns that the American economy might be expanding at an excessive rate for the Federal Reserve’s battle against inflation, which could result in the central bank adopting a more aggressive stance by implementing stricter monetary policies.

‘Shocked’

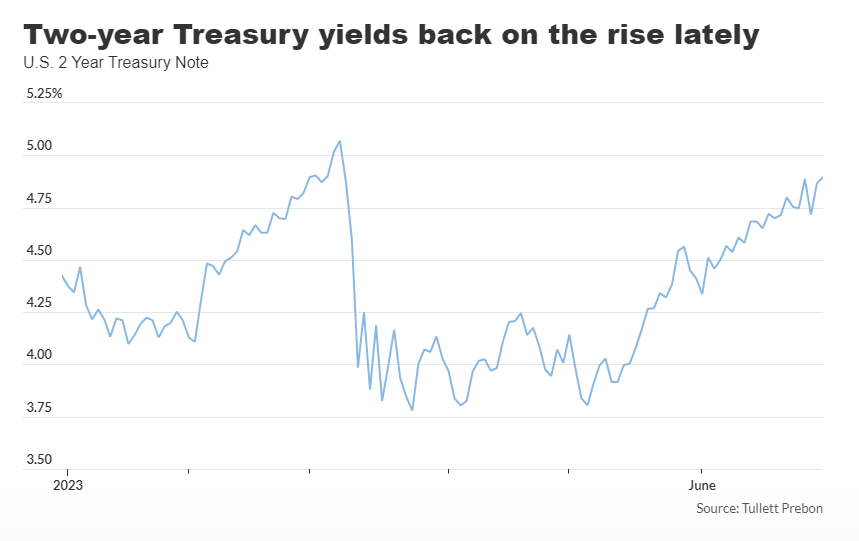

“There is a significant difference” between the current yield of two-year Treasury bonds at 4.925% and the rate the Federal Reserve has suggested as their target after completing their cycle of raising interest rates, according to the speaker. This comes after a recent increase in two-year yields following a decline during a period of stress for regional banks.

In June, the Federal Reserve released a summary of economic projections indicating that its policy rate could reach a maximum of 5.6% by the end of the year. Currently, the targeted range is 5% to 5.25%.

According to Dow Jones Market Data, the yield on the two-year Treasury note increased by 81.7 basis points during the second quarter to reach 4.877% on Friday. This is the highest level since March 9, based on 3 p.m. Eastern Time data.

Torres expressed surprise at how quickly the market has adjusted to the increase in yields. He also believes that there is still potential for yields to increase further. Torres mentioned that the two-year Treasury rates are often seen as an indicator of the Federal Reserve’s stance on interest rates.

On Friday, the stock market in the United States experienced an increase, concluding the month of June with gains for the week, month, and quarter.

Based on data from Dow Jones Market Data, the S&P 500 and Nasdaq Composite recently reached their highest closing levels since April 2022. Additionally, both indexes achieved their longest monthly winning streaks since 2021. The Nasdaq, which is largely composed of technology stocks, experienced a notable surge of 31.7% in the first half of 2023, making it the best performance for this timeframe since 1983.

Liz Ann Sonders, the chief investment strategist at Charles Schwab, expressed concerns about the sentiment in the stock market being overly optimistic, which exposes equities to the possibility of a decrease. Despite the market displaying impressive resilience, Sonders pointed out that there has been a notable concentration in certain areas.

She identified a “small group” of large-cap stocks, such as Apple Inc. (AAPL), Microsoft Corp. (MSFT), and Nvidia Corp. (NVDA), that are driving the success of the S&P 500 and Nasdaq.

According to her, during the beginning of the banking crisis in March, these stocks experienced a significant increase in performance as investors sought out companies that had a strong financial position and were able to generate cash.

According to Sonders, stocks in the megacap group, which includes various sectors like communication services, consumer discretionary, and information technology, have also seen positive effects from being involved with AI. Despite being referred to as Big Tech, these stocks have benefited from their association with artificial intelligence.

Weakness, strength on the roll

Sonders believes that the United States has encountered multiple recessions in specific sectors, like housing and manufacturing, rather than the entire economy being affected by a complete downturn. She thinks that the ongoing discussion about whether there is a recession or not fails to acknowledge the current intricacies of this economic cycle.

She stated that the economy has experienced periods of both weakness and strength instead of everything thriving or declining simultaneously. Therefore, although there may be issues in the services sector, the United States could still see advantages in other areas like the recent improvement in the housing market, which has already endured a recession.

According to her, megacap companies in the stock market have gained significant attention for their strong performance this year. However, she also noted that other sectors, such as homebuilders and the industrials sector of the S&P 500, have been performing well. Sonders specifically mentioned that industrial stocks have stood out due to their satisfactory range of options.

According to her perspective, “this is not the appropriate setting to make big decisions about an entire sector,” instead Sonders prefers to analyze stocks based on traits like “high quality” when searching for investment prospects.

According to Torres, the unpredictable economic circumstances have made it more difficult to determine when the United States could enter a recession. However, he warns that further increases in interest rates could potentially result in a similar challenging situation for regional banks. Additionally, with worries about the potential risks associated with commercial real estate, he finds it challenging to envision the stock market continuing to rise from its already high levels seen in the S&P 500.

“The banks’ balance sheets will face increasing pressure as the Federal Reserve raises interest rates,” explained Charlie Ripley, senior investment strategist at Allianz Investment Management, during a phone interview. He added that the concern revolves around the possibility of a bank experiencing a sudden rush of customers withdrawing their funds.

The minutes from the Fed’s June policy meeting will be made available to investors on Wednesday, following the U.S. Independence Day holiday on July 4.

According to FactSet data, the S&P 500 has seen a strong increase in 2023. However, the SPDR S&P Regional Banking ETF (KRE) has experienced a significant decrease of 30.5% in the first half of the year, while the Invesco KBW Bank ETF (KBWB) has also seen a decline of 20.5% over the same period.

Ripley noted that there is a significant variation within the market, with certain areas performing better than others.