U.S. stock index futures showed strength in the early hours of Thursday, as bond yields stabilized and traders monitored the release of August retail sales data alongside the commencement of ARM Holdings’ IPO.

Here’s how stock-index futures were performing:

- S&P 500 futures (ES00, 0.34%) climbed 10 points, equivalent to a 0.2% increase, reaching 4527.

- Dow Jones Industrial Average futures (YM00, 0.23%) advanced by 45 points, or 0.1%, reaching 34963.

- Nasdaq 100 futures (NQ00, 0.41%) added 44 points, equivalent to a 0.3% gain, reaching 15596.

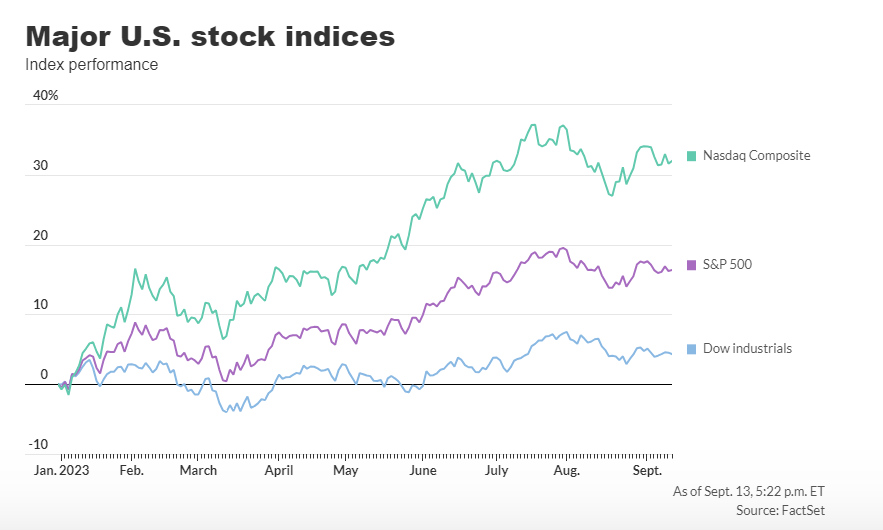

In the previous trading session, the market saw the Dow Jones Industrial Average (DJIA) decline by 70 points, or 0.2%, closing at 34576. The S&P 500 (SPX) gained 6 points, a 0.12% increase, closing at 4467, while the Nasdaq Composite (COMP) rose by 40 points, equivalent to a 0.29% gain, closing at 13814.

Market sentiment appeared to be mildly positive early on Thursday, as a decline in government bond yields suggested reduced concerns about the Federal Reserve’s potential interest rate hikes following the latest inflation data. A report released on Wednesday indicated that annual core consumer prices, excluding volatile items like food and energy, had risen by 4.3% in August, down from the previous month’s 4.7% and marking the lowest level in nearly two years.

Henry Allen, a strategist at Deutsche Bank, noted, “After much anticipation, markets mostly took the U.S. CPI release in their stride yesterday, with bonds and equities fairly steady after the release, before a bond rally eventually took hold.”

Markets were currently pricing in a minimal likelihood of the Federal Reserve raising borrowing costs after its meeting next week and remained uncertain about the possibility of a 25 basis point hike in November. Expectations could shift based on the upcoming releases of August producer prices and retail sales data, scheduled for 8:30 a.m. Eastern Time. Other U.S. economic updates slated for Thursday included the weekly initial jobless benefit claims at 8:30 a.m. and July business inventories at 10 a.m.

Investors were also closely watching the opening trading of ARM Holdings (ARM) following the pricing of its IPO at $51 per share, near the upper end of the expected range, giving the U.K.-based company a valuation of $52 billion. A well-received ARM listing was seen as potentially revitalizing the IPO market and bolstering overall bullish sentiment.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, commented, “Given the eagerness from investors, it seems ARM could have pushed for an even higher price, but is playing it safe to try to ensure a surge in the share price once trading gets underway.”

Another potential market-moving event on Thursday was the European Central Bank’s (ECB) policy decision, scheduled for 2:15 p.m. Frankfurt time and 8:15 a.m. Eastern Time. While ECB decisions typically do not have a significant impact on U.S. trading, it was unusual for the market to enter a major central bank meeting without a firm consensus on the outcome. The ECB faced a two-in-three chance of implementing a 25 basis point interest rate hike as it grappled with persistent inflation and slowing economic activity, particularly in Germany.