U.S. stock market futures exhibited a slight softening early on Wednesday as the recent rally hit a pause, accompanied by a modest rise in Treasury yields.

Here’s a glance at the current state of stock index futures:

- S&P 500 futures (ES00, 0.10%) dipped 3 points, or 0.1%, to 4503.

- Dow Jones Industrial Average futures (YM00, 0.12%) fell 8 points, or 0%, to 34880.

- Nasdaq 100 futures (NQ00, 0.18%) eased 28 points, or 0.2%, to 15388.

In the previous session, market movements looked like this:

- Dow Jones Industrial Average (DJIA) gained 293 points, or 0.85%, reaching 34853.

- S&P 500 (SPX) surged 64 points, or 1.45%, to 4498.

- Nasdaq Composite (COMP) increased 239 points, or 1.74%, closing at 13944.

Market Dynamics:

The U.S. bond market’s influence on stocks remains strong. The early rise in Treasury yields (BX:TMUBMUSD10Y) is putting pressure on equity index futures following a robust rally on Tuesday.

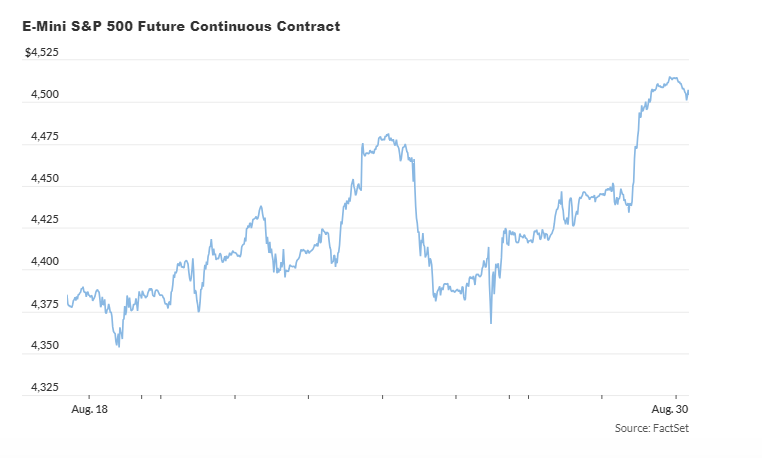

The S&P 500 index achieved a three-week peak in the previous session as Treasury yields saw a sharp decline in response to signs of labor market softness and decreasing consumer confidence.

Over the last three trading days, the benchmark equities index has climbed 2.2%, surpassing its 50-day moving average. This growth coincides with a drop of nearly 15 basis points in the 10-year Treasury yield over the same period. Recently, equities tend to rise when implied borrowing costs fall.

Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank, commented, “Yesterday was a classic ‘bad news is good news’ day,” attributing the boost in risk sentiment to unexpected decreases in U.S. job openings and consumer confidence. She noted that these developments have affected Federal Reserve expectations for future rate hikes.

Key Data Points Ahead:

Traders are keeping an eye on the upcoming ADP report on private sector employment for August, set to be released at 8:15 a.m. Eastern. This report will help confirm or challenge the prevailing market narrative. Additionally, the July PCE inflation index and the August nonfarm payrolls report are scheduled for publication on Thursday and Friday, respectively.

Other economic updates scheduled for Wednesday include revisions of second-quarter GDP, advanced readings of trade balances in goods, and data on retail and wholesale inventories for July. Pending home sales for July are also due at 10 a.m. Eastern.

Corporate Focus:

The spotlight today falls on the earnings results of Salesforce (CRM, +0.11%), expected after the closing bell. On a different note, PC manufacturer HP (HPQ, +0.13%) provided a cautious outlook on Tuesday, which led to a 9% decline in premarket trade. HP’s CEO, Enrique Lores, mentioned challenges in the PC and printer market, but also hinted at the potential of AI products to boost sales in the future.