U.S. stock-index futures saw a modest uptick on Wednesday, in tandem with a decrease in bond yields, as market participants turned their attention towards the impending earnings release from Nvidia Corp., a prominent player in the artificial intelligence software sector. The company’s results are scheduled to be unveiled after the closing bell.

Key Developments:

- S&P 500 futures (ES00, 0.14%) showed a rise.

- Dow Jones Industrial Average futures (YM00, 0.08%) climbed by 135 points, equivalent to 0.4%, reaching 34,479.

- Nasdaq 100 futures (NQ00, 0.22%) advanced by 116 points, or 0.8%, touching 15,075.

- In the previous trading session, the Dow (DJIA) and S&P 500 (SPX) experienced losses, while the Nasdaq (COMP) managed a slight gain.

Market Dynamics:

Stock market futures gained ground as bond yields experienced a decline both in Europe and the U.S., driven by news of a more significant-than-anticipated contraction in eurozone economic activity, hitting a 33-month low.

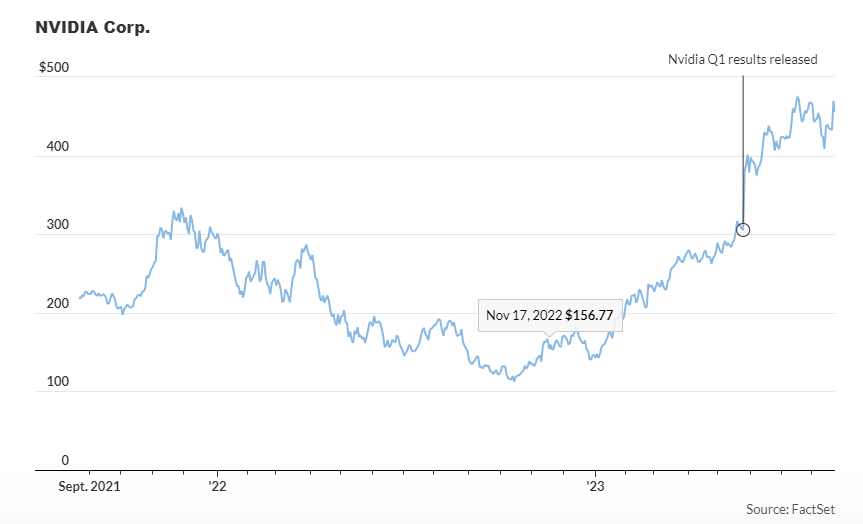

However, the major focus of the day remained on Nvidia’s (NVDA, -2.77%) earnings outcomes, set to be disclosed after the market closure. With Nvidia’s shares having surged by 212% this year compared to the S&P 500’s gain of 14.3%, the company symbolizes the enthusiasm for large technology stocks and the excitement around artificial intelligence, both of which have been pivotal in driving equity indices higher for the majority of 2023.

The reception of Nvidia’s financial results and projections is likely to shape short-term market sentiment significantly.

Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank, noted, “Investors will focus on whether Nvidia’s Q2 sales meet the $11 billion estimate. Anything less than absolutely fantastic could trigger a sharp downside correction in Nvidia’s stock price which rallied 345% since the October dip.”

Market participants are anticipating a potential 10% movement in Nvidia’s shares throughout the rest of the week, as indicated by the pricing of the company’s stock options.

Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown, commented, “A jolt [of] volatility is set to be sparked by the chip giant’s numbers and outlook.”

Economic Updates and Corporate Focus: Wednesday’s U.S. economic updates include the S&P services and manufacturing PMIs for August, slated for release at 9:45 a.m. Eastern, followed by the July new home sales report at 10 a.m.

Key Companies in Spotlight:

- Nvidia (NVDA, -2.77%) saw a 2% increase in premarket trade ahead of the highly anticipated earnings announcement after the market close. ARK Invest, led by Cathie Wood, reportedly sold Nvidia stock on Tuesday.

- United Parcel Services (UPS, -0.97%) rose by 1% following a positive vote from workers for a new contract.

- AMC Entertainment (AMC, -18.27%) experienced a 13% decline after an 18% drop on Tuesday. The company is planning a reverse stock split, accompanied by the conversion of the APE preferred shares.

- Peloton Interactive (PTON, -0.43%) dropped by 25% in premarket trading due to a disappointing revenue outlook for the latest quarter. Additionally, a bike recall had a more significant impact on the business than anticipated.

- Abercrombie & Fitch Co. (ANF, -1.41%) surged by 16% after exceeding estimates for the second quarter and raising its guidance.

- Foot Locker (FL, -4.80%) declined by 28% as the sporting goods retailer reported a loss for the second quarter, lowered its full-year guidance, and announced the suspension of its quarterly dividend to preserve cash.