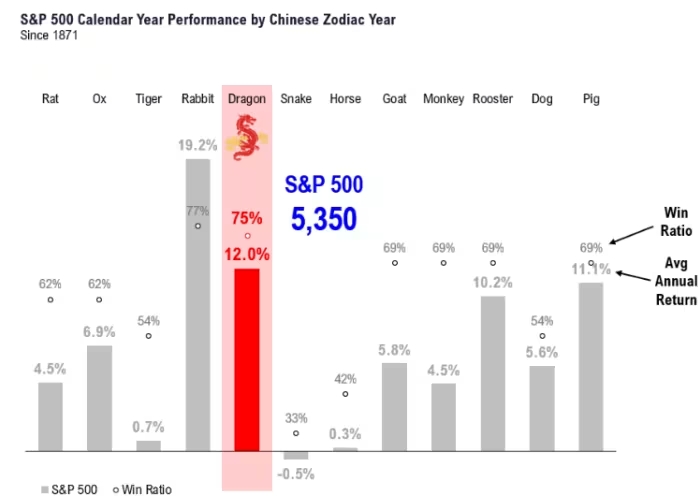

According to Fundstrat’s Tom Lee, the U.S. stock market has historically thrived during the Years of the Dragon, with an average gain of 12.7% since 1871. This trend suggests that the recent surge in the S&P 500, propelling it to the 5,000-point milestone, may still have momentum.

Lee forecasts that the S&P 500 could reach as high as 5,350 points by the end of 2024, indicating a potential 6.4% increase from its current level.

In the upcoming Year of the Dragon, which starts on February 10, 2024, small-cap stocks are also expected to perform well, historically outperforming the S&P 500 88% of the time since 1979.

Lee notes that the current price-to-book ratio of the Russell 2000 index compared to the S&P 500 resembles the situation seen in 1999 when small-cap stocks began to outpace large-cap stocks for the following 12 years.

Lee anticipates positive investor inflows into equities in 2024, reversing two consecutive years of outflows, which could further bolster small-cap stocks and broaden the stock-market rally.

This broader rally could potentially push the S&P 500 to levels between 5,400 and 5,500 by the year’s end.

Beyond equities, the Year of the Dragon typically sees increased demand for gold, particularly from China during the Lunar New Year vacation season. This tradition, coupled with ongoing geopolitical tensions and strong central bank demand, suggests a supportive environment for gold prices in 2024.