The ascending U.S. dollar has become a cause for concern overseas and has captured the attention of both domestic and international investors. However, it remains uncertain whether authorities have the means to curtail this surge or if it poses an imminent threat to U.S. equities.

Edward Moya, a senior market analyst at Oanda, noted, “The dollar’s rise is starting to unnerve everyone. Last night, both Japanese and Chinese officials attempted to thwart the greenback’s rally, but weren’t effective.”

Despite warnings from Japanese authorities regarding potential currency-buying interventions, the Japanese yen continued its decline against the dollar, trading near 148 to the U.S. unit, marking its weakest point in ten months. Masato Kanda, vice finance minister for international affairs, expressed concerns about the negative impact of excessive currency fluctuations on the economy and stated, “We won’t rule out any option and will take appropriate action if this trend continues.”

Meanwhile, China’s central bank took measures such as setting a daily reference rate for the yuan higher than expected and other actions to support the currency, as it traded near its weakest point against the dollar since November.

European Central Bank officials also emphasized the potential for a further interest rate increase, despite discouraging German economic data. The euro traded near a three-month low against the dollar.

Moya commented on the situation, saying, “FX talk is cheap if it doesn’t come with convincing data/market conditions that support decisive and meaningful action.” He also mentioned concerns about the property crisis and contagion risks in China, stating, “A gradual declining yuan is not China’s biggest problem.”

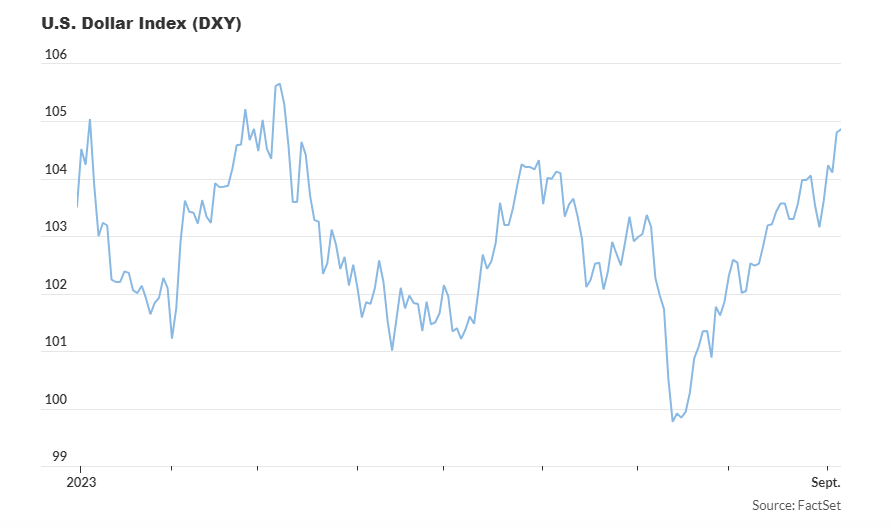

The ICE U.S. Dollar Index, which measures the greenback against six major currencies, briefly crossed the 105 threshold for the first time since March, standing at 104.87, up 0.1%.

The dollar’s strength has been attributed to resilient U.S. economic data, which has positioned the U.S. more favorably compared to its developed market counterparts. Even if the Federal Reserve has completed or nearly completed its interest rate hikes to combat inflation, the strong data suggests that rates are expected to remain elevated. This view was reinforced after Saudi Arabia and Russia extended crude oil production cuts, pushing Brent crude back above $90 per barrel.

Higher oil prices contributed to an increase in Treasury yields, making the dollar more attractive.

However, concerns about rising yields and the Fed’s rate trajectory weighed on U.S. stocks during the week, with the S&P 500 and Dow Jones Industrial Average both experiencing declines.

For stock-market investors, a strong dollar can present challenges, particularly for companies heavily reliant on overseas sales, as it makes their exports more expensive for foreign buyers. Nevertheless, it appears that the dollar’s movements are not yet causing significant issues.

Ross Mayfield, an investment strategy analyst at Baird Private Wealth Management, believes that the current dollar rally resembles a temporary uptick within a broader downtrend, rather than a sustained rally. While the dollar had surged in 2022, causing disruptions in financial markets, the ICE U.S. Dollar Index, while near a six-month high, remains down by almost 5% from its level a year ago and has declined by 8.6% from its more than two-decade high reached in the fall of the previous year, just below 115.

Mayfield speculates that the dollar is likely to stabilize and eventually weaken, rather than continue its recent rally. He suggests that any significant concerns would arise if the dollar index were to break through and reach new 2023 highs, potentially revisiting the highs from late 2022.