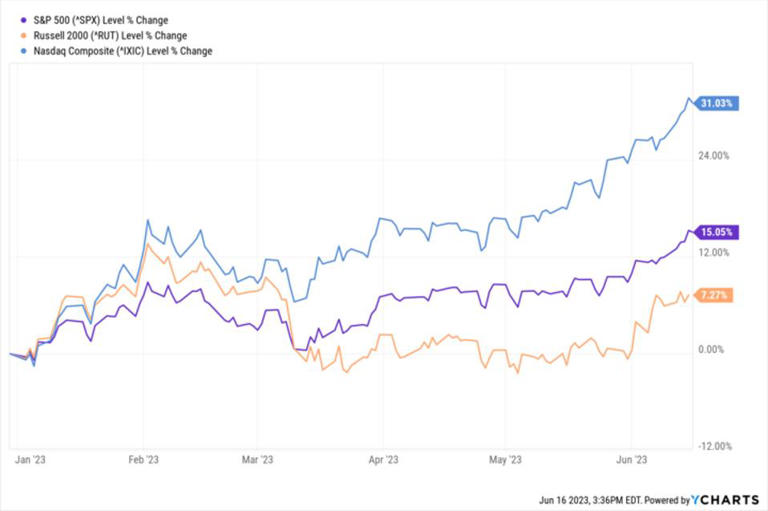

As temperatures increase during the summer, so does the stock market. The S&P 500 index has officially entered bull market territory after 164 days due to a 23% increase from its lowest point in October. The only recovery that took longer to transition from a bear market to a bull market was in 1947, which took 281 days. Recently, the Bureau of Labor Statistics reported a 4% inflation rate, the lowest in two years, and Chairman of the Federal Reserve, Jerome Powell, announced on June 14th that there would be no increase in interest rates, stopping the rise that had been happening aggressively for the past 15 months.

Several experienced market experts caution that, although a promising combination of factors may indicate a positive outcome for the markets during summer, the ongoing upward trend in the stock market could be a false impression or a temporary phenomenon.

According to Jim Stack, an experienced market expert and author of InvesTech Research newsletter, the current bull market, if it is proven to be valid, could be considered as one of the most uncommon occurrences in the history of Wall Street.

In Stack’s evaluation, the Russell 2000 comprises of stocks with the smallest market capitalization, usually exhibit the highest profits at the start of a bullish market. During the previous 40 years, the index gained a mean of 30% after eight months into a bullish market. However, currently, the index only reflects an increment of approximately 13% from its lows in October.

Furthermore, InvesTech discovered that the S&P 500’s year-to-date gain of 81% is largely attributed to the top 10 stocks, namely AppleAAPL, TeslaTSLA, and AmazonAMZN. This indicates a heavy bias towards large-cap stocks and an unhealthy bullish market trend, as per CEO Jim Stack. Consequently, small cap stocks are being left out.

According to Stack, we are currently in unknown territory.

Stack is not forecasting another financial crisis but is indicating that this year’s macroeconomic and technical indicators suggest a more perilous situation for investors. This situation is comparable to the events that occurred in the markets just before the crisis of 2007.

InvesTech is worried even though the Fed has taken a more cautious approach to interest rates. Although inflation is decreasing, the Fed still uses the Core Personal Consumption Expenditure Price Index (which excludes energy and food) to gauge inflation. This index is more than twice the Fed’s desired inflation rate of 2%, indicating that the Fed will likely continue to adjust interest rates.

Throughout history, the Federal Reserve’s Yield Spread Model has been a reliable indicator of economic downturns. This model calculates the difference between short and long-term treasury yields. According to InvesTech’s analysis, the model currently indicates a 71% chance of a recession.

The Leading Economic Index (LEI) from the Conference Board, a sign of an impending or current economic downturn, has declined for 13 consecutive months, providing more evidence of a recession.

Stack commented that the decline of the LEI has only occurred during times of economic recession in the United States.

Stack explained that when bear markets last for a longer period, the subsequent bull markets tend to be relatively shorter. For instance, between 1929 to 1932, which characterized the peak of the Great Depression, there were five bull markets. Similarly, during the tech bubble in 2000, Wall Street standards recorded only two bull markets.

Jeff Hirsh, the editor-in-chief of the established Stock Trader’s Almanac, which has been in circulation for 55 years, a market technician, has expressed that the current bull market is not conforming to a strong seasonal behavior as expected, which contradicts the commonly observed “summer rally” phenomenon. Hirsh provides an explanation that a summer rally is defined by the lowest value reached by the Dow Jones Industrials during May or June, followed by the highest point reached within 60 to 90 days of that low. However, Hirsh argues that this idea of a summer rally is an unfounded and impractical trend.

According to the information given by InvesTech Research, historically, the Dow Jones Industrial Average experiences small increases from May to June before recovering in September. Additionally, their research has found that investing $10,000 from November to April can lead to significantly higher returns compared to investing the same amount from May to October. The difference in returns could result in an individual seeing over $970,000 more in profits.

According to David Keller, who is the Chief Market Strategist at StockCharts.com, the good beginning of June is unusual because historically, June is not a profitable month. Despite this, Keller noted that the S&P 500 has become overbought due to the positive news, and traditionally this is a sign that the bull market is coming to an end.

Keller stated to Forbes that several well-known leaders in the industry, such as AAPL and MSFT, are currently experiencing the highest performance rates they have ever seen. Due to this, it is highly likely that they will experience a significant decline.

Hirsh assumes that there will be a comparable surge to 2022’s mid-July peak in the upcoming year. Nonetheless, in the course of August and September, the market is anticipated to retract as the Federal Reserve reappraises interest rates.

According to Hirsh, it is a common trend that during the summer months, the market experiences a decline as people tend to take a break from investing and work. However, as the fall approaches, investors tend to re-evaluate their investment strategies, and companies get ready to release their third-quarter results.

Investors are advised by InvesTech to be cautious during the summer and to keep in mind that “a good defense is always the best offense.”

According to Hirsh, it would be beneficial to find pleasure in the summer season while investing in successful areas such as healthcare and biotechnology. In addition, if investments are not performing well, it is recommended to follow the example of the Federal Reserve and take a break to reevaluate strategies for the upcoming fall season. It is suggested to make the most of the warm summer weather and increase savings.

Hirsh believes that individuals who have a comprehension of past events in the market will inevitably reap financial benefits.