On Thursday, Apple shares experienced slight growth during premarket trading, nearing a valuation of $3 trillion.

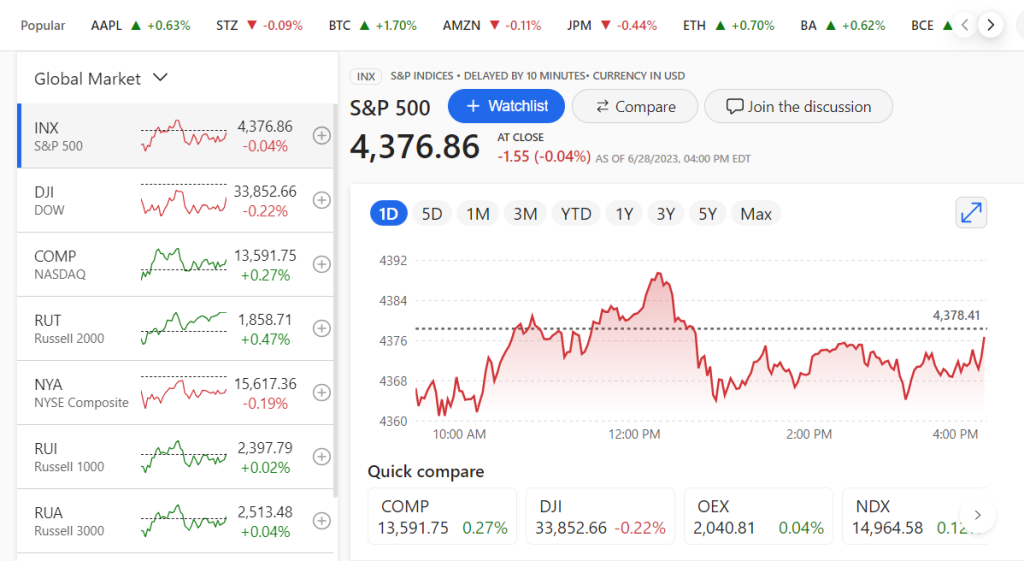

Some, such as Wedbush analyst Dan Ives, speculate about the possibility of a $4 trillion valuation by 2025. The impact of such a colossal valuation on the market’s weight is uncertain. The common saying regarding the 7.6% weighting of Apple in the S&P 500 is “as goes Apple, so goes the market.” (Of course, Microsoft, with its 6.8% share, has not been forgotten).

This momentum has contributed to the overall upward trend of the stock market, according to Irene Tunkel, the chief strategist at BCA Research. Other factors include concluding rate rises from the Federal Reserve, the absence of a recession so far, an earnings recession coming to an end, and ample idle cash.

However, Tunkel cautions victory should not yet be declared. Several warning signs exist.

One major cause for concern is the predicted decrease in consumer spending on services, which has been vital in propping up the economy until now. Also, the cushion of consumers’ excess savings is dwindling and expected to decrease further with the upcoming student loan repayments.

Simultaneously, following the debt ceiling deal, fiscal stimulus is anticipated to decline. This decline, in conjunction with a cautious banking sector limiting their lending offerings, could reveal a struggling jobs market.

Reflecting on the market, Tunkel observes that, given its high valuation and the inclusion of positive predictions in current stock prices, it is expensive. Tunkel disputes the assumption that only the best-performing stocks are overvalued.

Regarding technical factors, Tunkel notes the market is overbought. The AAII investor sentiment survey indicates its highest optimistic readings since 2021, and the CBOE VIX is less than 14. These factors, Tunkel believes, could be warnings of mean reversion.

Tunkel concludes, “The rally can run for longer, fueled by all the positives, but eventually, a black swan will land, and everything slow will suddenly accelerate – with the index being overpriced, multiples will reduce drastically, causing a significant drop.”