80% Market Drop Coming?

Spitznagel Says the Real Crash Is Still Coming: Recent Market Dip Is Just a ‘Trap’ Mark Spitznagel, one of Wall Street’s most famously bearish — and remarkably successful — investors, isn’t convinced the recent market turmoil is the long-anticipated crash he’s been warning about. In his view, this is just a prelude — a trap. […]

S&P 500 May Fall 7-8%, Says Morgan Stanley

Strategist Mike Wilson advises investors to prepare for the S&P 500 to potentially drop another 7% to 8%, unless there’s a shift in U.S. tariff policies or a change in Federal Reserve strategy. Wilson, leading a team of strategists at Morgan Stanley, told clients in a note on Monday that the next support level for […]

S&P 500 Targets Cut, But One Bigger Risk Looms

Capital Economics Slashes 2025 S&P 500 Forecast as AI Trade Stumbles The market is reeling. The S&P 500 just suffered its worst single-day drop since the early pandemic days, plunging 4.8% after Trump’s renewed tariffs sent shockwaves through Wall Street. With sentiment already shaky, analysts are rushing to slash their stock market forecasts. UBS recently […]

Apple Stock Drops on Tariff News—Stay Calm

Apple Faces Tariff Challenges but Has a History of Exemptions Apple boasts a loyal customer base, strong profit margins, and a track record of securing tariff exemptions—factors that could help it navigate the latest trade tensions. On Wednesday, President Donald Trump sent shockwaves through the tech sector with a tariff announcement that one analyst described […]

Tariffs Are Just the Start – More Risks Ahead

Investors hoping for stability in the markets following President Trump’s April 2 tariffs deadline may need to brace for continued volatility instead. While further details on Trump’s “reciprocal” tariffs are expected by the close of business on Wednesday, it may take several days for major U.S. trade partners to assess the impact and formulate a […]

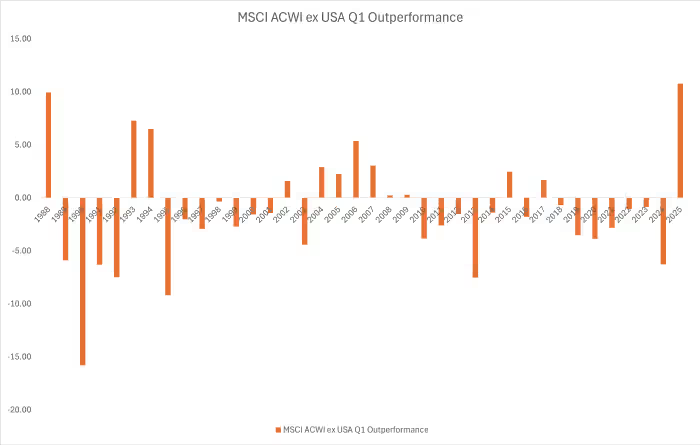

U.S. Stocks Lag Behind Global Markets – A Warning Sign?

According to Dow Jones data, international stocks achieved their strongest first-quarter outperformance against U.S. stocks on record. In late 2024, the “American exceptionalism” trade was thriving. Investors worldwide, buoyed by Donald Trump’s electoral victory in November, funneled capital into the U.S. stock market. However, three months into 2025, the landscape has shifted. U.S. stocks have […]