Market Alert: A Grim Forecast for Stock Market Returns by Fed Economist ??

US stock investors may need to brace for potential letdowns, as indicated by recent warnings from a Federal Reserve researcher. Corporate tax reductions and interest-rate cuts have facilitated stock returns for an extended period, as pointed out by Federal Reserve economist Michael Smolyansky. Smolyansky anticipates a rather grim future for stocks, with slowing earnings growth […]

The Ongoing Stock Market Rally: Treading Carefully Before Pronouncing the Bear’s Fall

On Thursday, Apple shares experienced slight growth during premarket trading, nearing a valuation of $3 trillion. Some, such as Wedbush analyst Dan Ives, speculate about the possibility of a $4 trillion valuation by 2025. The impact of such a colossal valuation on the market’s weight is uncertain. The common saying regarding the 7.6% weighting of […]

Stock Market Update: Chip Restrictions and Powell’s Speech Impact Futures

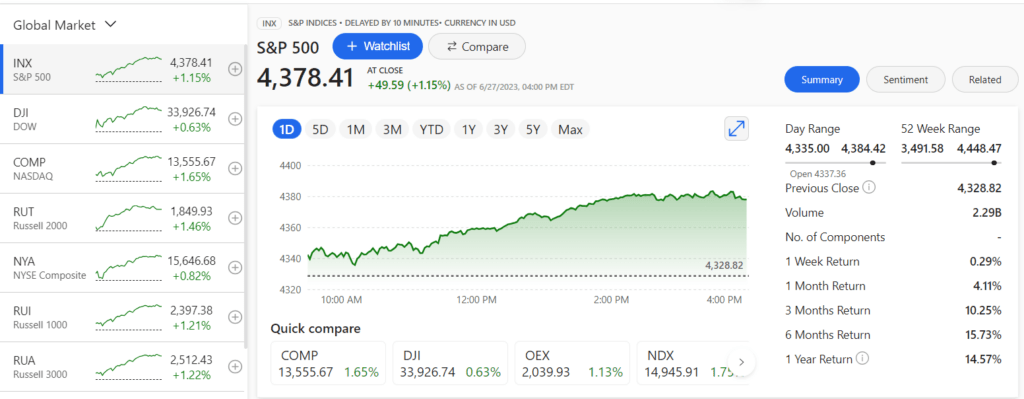

On Wednesday, stocks displayed potential instability, specifically within the tech sector. This instability stemmed from fears of additional trade restrictions on AI chips. The stock market also focused on the anticipated remarks by Federal Reserve Chair Jerome Powell. Futures associated with the Nasdaq Composite (^IXIC) decreased considerably, plummeting 0.45%. S&P 500 (^GSPC) Futures also experienced […]

Investor’s Guide to Rocky Stock Markets ?️: Unlocking the Power of Options in Uncertain Times ⏳

As the quarter draws to a close, the stock market seems to be losing some momentum, with speculations that investors are finally acknowledging the possibility of a delayed Fed rate hike in 2023. The S&P 500 and Nasdaq Composite have each recorded five losing sessions out of the last six. Over the past three months, […]

The Crucial First Hour: A Guide to Effective Opening Bell Trading Techniques

Economic conditions may be challenging, with stocks experiencing significant volatility and persistent inflation, but some economists believe that these turbulent times can present new opportunities (as well as risks) for investors. What’s happening: The global economy is constantly changing. The labor market remains remarkably resilient, but other economic indicators, such as spending and manufacturing, are […]

20-Year S&P 500 Journey: The Value of Your $10,000 Investment Today

Beating the market is a challenging task, with only a small group of individuals able to achieve it. It is noteworthy that it is comparatively simpler to outperform the stock market during a downturn. In the year 2021, the stock market saw a growth of 29%, yet 85% of money managers performed worse than the […]

Fed’s Interest Rate Plans Shake the Stock Market: What to Expect Next

The S&P 500 experienced a drop during the week after the Federal Reserve Chair, Jerome Powell, addressed Congress and stated that the members of the Federal Open Market Committee unanimously agreed on raising interest rates by the end of the year. June experienced the biggest decline in the index, ending the weeks of high performance […]

Climbing the Wall of Worry: How Stock Investors’ Concerns Are Fueling a New Bull Market

The latest information on money flow in mutual funds is positive for stocks but negative for bonds. If you just looked at the data, you would come to a different conclusion. According to EPFR-TrimTabs, U.S. equity funds (including both open-end and exchange-traded funds) have had a net outflow of $86.5 billion so far this year. […]

Discovering Wealth in the Shadows: The Forgotten Part of the Stock Market

As previously mentioned, the rise in stock prices has become more widespread, with small-cap stocks performing better after a mixed jobs report on June 2 allowed the Federal Reserve to avoid increasing short-term interest rates last week. Midcap stocks, which have been largely neglected in the past, are also experiencing a resurgence. Until the end […]

The Summer Stock Rally: Why Experienced Market Technicians Are Voicing Concerns

As temperatures increase during the summer, so does the stock market. The S&P 500 index has officially entered bull market territory after 164 days due to a 23% increase from its lowest point in October. The only recovery that took longer to transition from a bear market to a bull market was in 1947, which […]