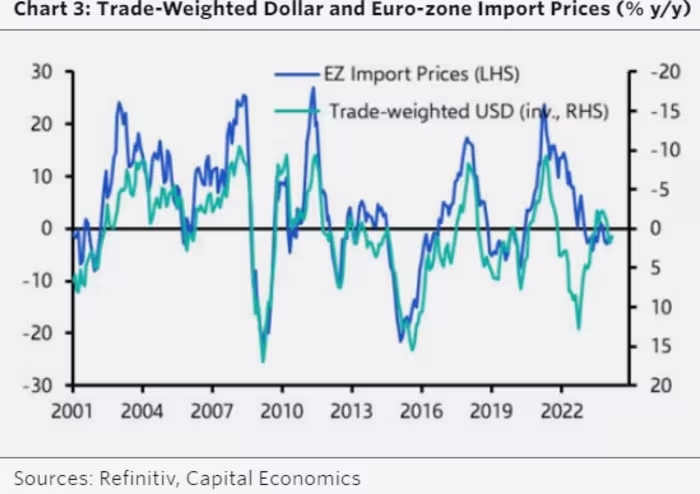

How the Strong U.S. Dollar Defies Global Economic Weights

Neil Shearing from Capital Economics suggests that despite the vigorous ascent of the U.S. dollar, the likelihood of a series of global currency crises remains slim. While the soaring dollar might unsettle global financial markets and instigate concerns about currency stability for economies worldwide, Capital Economics argues that the repercussions may not be as severe […]

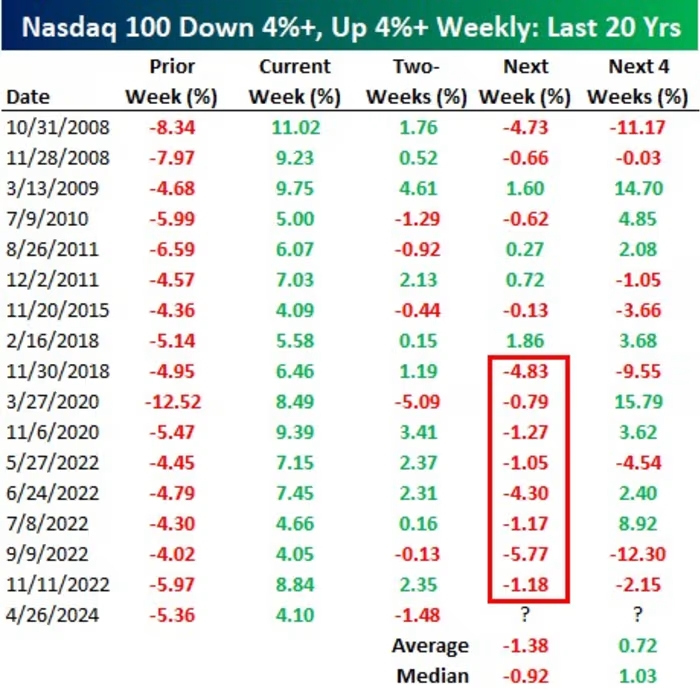

The Pulse of Tech Stocks: A Comprehensive Analysis of 20 Years

Early trading in equity futures on Monday indicates that Wall Street is poised to build upon last week’s robust rally. Despite the recent volatility driven by concerns over rising bond yields conflicting with expectations of strong corporate earnings, particularly within the tech sector, market sentiment appears resilient. Following a slight dip of over 5% in […]

Big Tech Rally Powers S&P 500 to Strongest Week Since November Amid Inflation Fears

Alphabet, Google’s parent company, saw a remarkable surge in its shares on Friday, propelling its market value past the $2 trillion mark for the first time. This boost contributed to a significant recovery in U.S. stocks for the month of April, with the S&P 500 securing its most substantial weekly increase since November, fueled largely […]

Wall Street’s Bearish Giant Takes a Break from S&P 500 Predictions

Michael Wilson of Morgan Stanley revealed to Bloomberg that he and his team are shifting their focus away from making predictions for the S&P 500 index, at least for the time being. Instead, they are now concentrating on identifying undervalued stocks. During an interview with Bloomberg Television, Wilson mentioned that discussions about the S&P 500’s […]

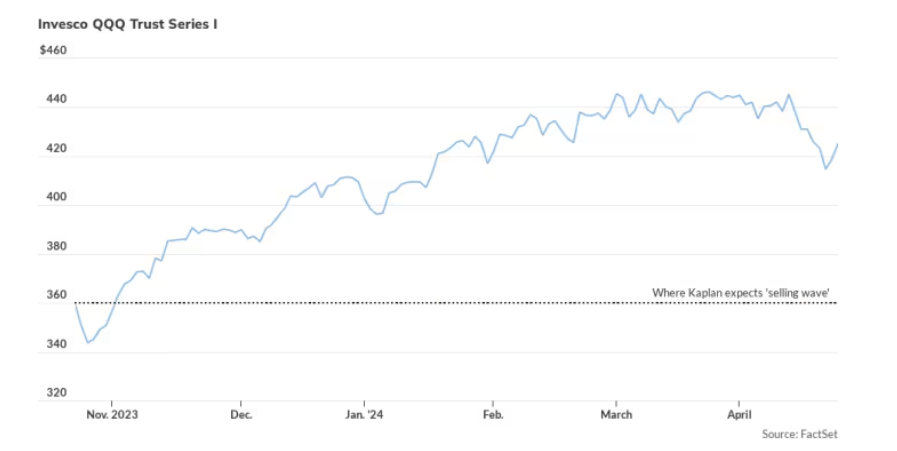

Tech Stocks on the Brink: Contrarian Investor Warns of AI-Driven Collapse

Tech stocks seem poised for a rebound, but according to Steven Jon Kaplan, the CEO of True Contrarian blog and newsletter managing $120 million, the sector may be headed for trouble reminiscent of the dot-com bubble. Kaplan predicts that the Invesco QQQ Trust Series, which tracks the Nasdaq-100, will drop from its current level of […]

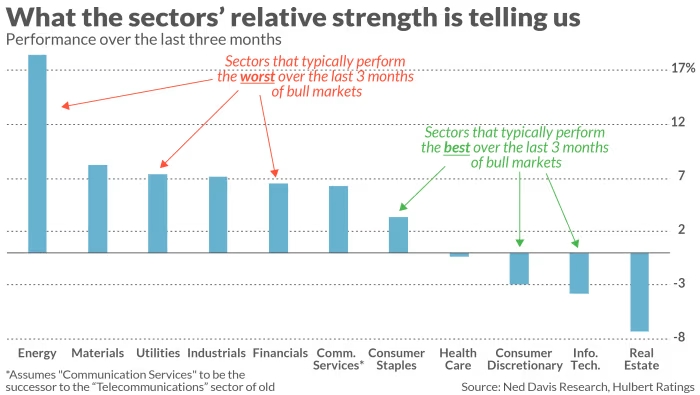

Why Rushing to Sell Stocks Might Not Be the Best Move

Sectors that typically surge toward the end of bull markets are now falling behind. Despite last week’s volatile trading sessions, the primary trend in the U.S. stock market remains upward. This conclusion is supported by the sector relative-strength rankings, despite recent market fluctuations. My optimistic outlook is based on an analysis of sector performance during […]