Today’s Live Webinar Recording – E-Mini +1.75 Points

Today’s webinar was filled to capacity. This video is for all of you who were unable to get in and those who want to see how our systems performed. John starts the live presentation by showing two charts: the E-Mini and Euro. The Atlas Line produced a Long signal on each market. The Long signal […]

Group Mentorship Begins Tomorrow, May 9, 2012

Sign up for the Private Mentorship Program – begins May 9, 2012 Eight weeks of live training with all Day Trade to Win courses and software included Purchase the Atlas Line® Automated entry software for NinjaTrader, TradeStation and eSignal How many profit opportunities did you see today? The Atlas Line® tells you exactly how and […]

Trading How-To Webinar Recorded May 4, 2012

Atlas Line – Change the Way You Trade Today Here is last Friday’s live webinar event in which John Paul discussed price action trading and demonstrated the Atlas Line. Early in the video, John shows the trade you could have taken based on the news event. Fast forward to the 15 minute mark, and you’ll […]

One Point Made Easy on ES

Trading systems are a dime a dozen. It’s always better to be able to see the trades plot on your charts, so ultimately, you’re in control. The Atlas Line puts you in control by letting you know the expected direction of price. You then place an order in the given direction using the profit taking […]

Today’s Webinar Recording – Four Markets Traded

Trading isn’t getting any easier as 2012 rolls along. Opportunities exist every day to get ahead, you just have to know where to find them! Today, did you trade the E-Mini, Australian Dollar, Light Sweet Crude, or the Mini Russell? This morning, John Paul conducted a live webinar where he showed the Atlas Line on […]

Obama Oil Futures Announcement

Yesterday, President Obama announced a plan to clamp down on oil speculation. The plan introduces increased margin requirements, thereby forcing oil futures traders to put up more money per trade. By reducing speculation through this $52 million margin requirement plan, Obama hopes to stabilize and possibly reduce gasoline prices. Obama has stated this plan is […]

Trading with a Direction in Mind

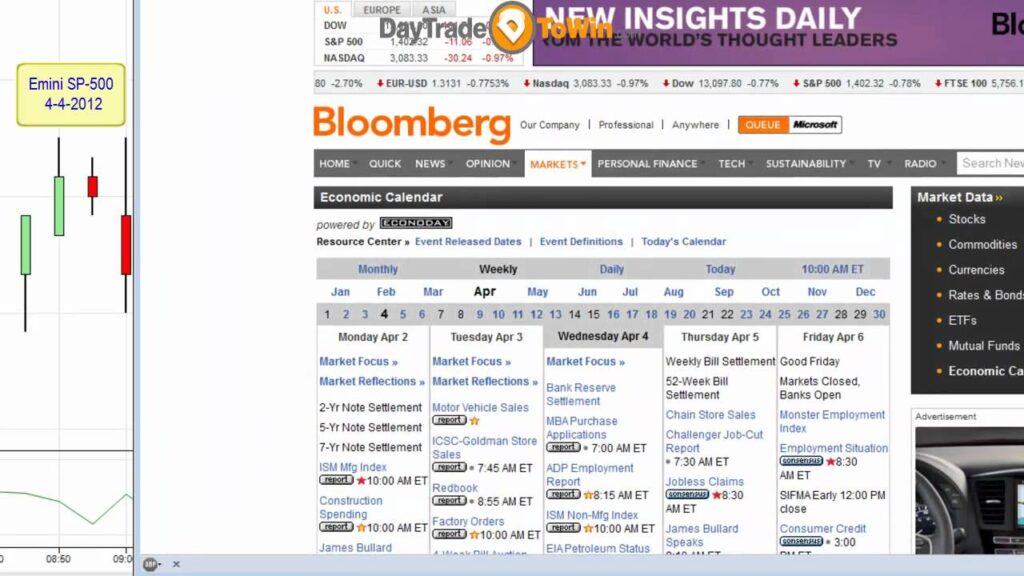

On April 4, 2012, John took a Short E-Mini (ES) trade as advised by the Atlas Line software. The entry signal (Dbl Bar Short) was produced automatically when price was at 1398. The ATR (Average True Range) was at a value of 1.8. The ATR (available in most trading platforms) provided us with a value […]

DTI Webinar – Trading Price Action with John Paul

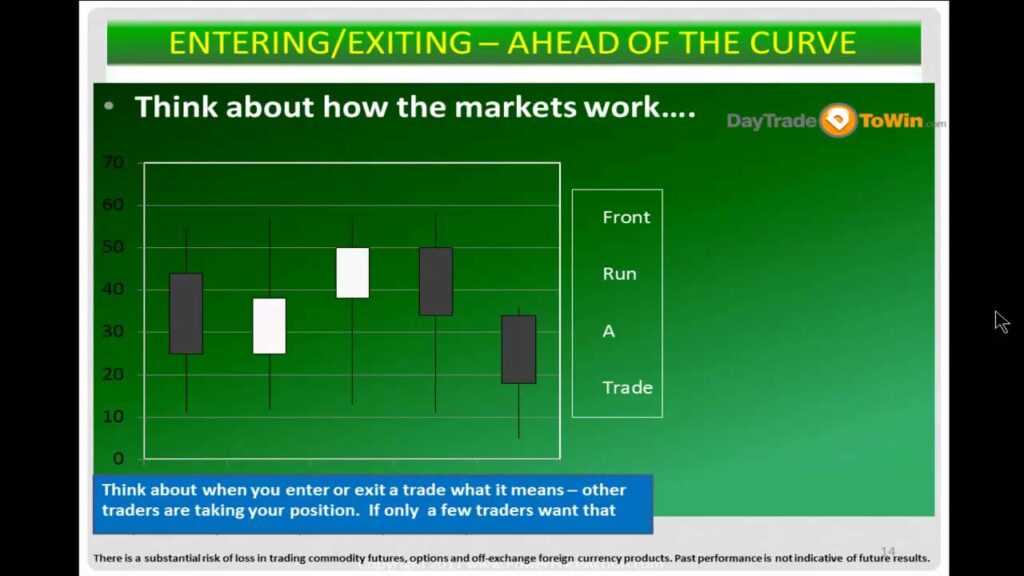

Yesterday, John took part in an educational webinar event hosted by DTI. The video above shows John’s presentation, where he covered the benefits of price action trading. He also discussed how most traders think, front running trades, essential tools and chart configurations, stop and entry placement, problems with using indicators, exact trading setups, and how […]

Are You a Setup Trader?

What type of trader are you? I was asked this question recently and the first answer that came to mind was “I’m a setup trader.” Now this phrase may be confusing, but it really explains how I look at trading the markets. I teach traders how to identify specific setups in order to validate trades. […]

The Gold Fix – An Example of Market Manipulation

Most of you who follow my blog know that I consider to price action as the best way to trade. I also bring to light how the markets are artificially manipulated in one way or another. In the Private Mentorship Program, I demonstrate a way to capitalize on this manipulation – the “RoadMap Trade.” It’s […]