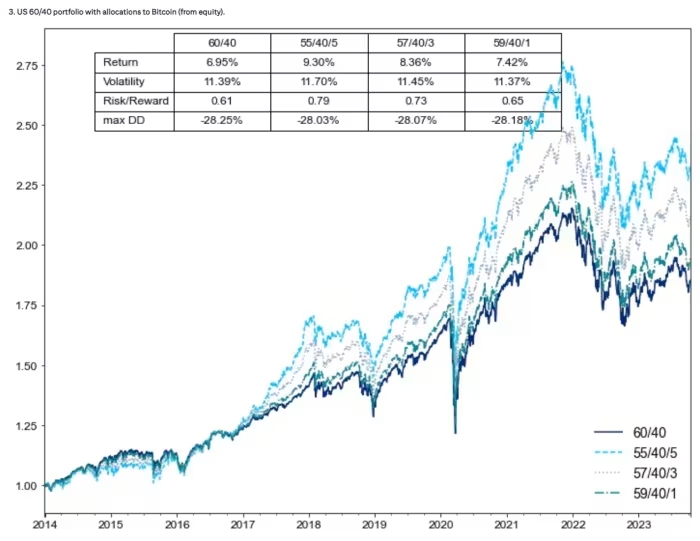

Exploring alternatives to the traditional 60/40 portfolio, there’s a proposal by Alex Saunders and David Glass from Citi suggesting a 55% stocks, 40% bonds, and 5% bitcoin allocation.

This proposition gains traction with the advent of spot bitcoin ETFs, simplifying investment without the custody or liquidity issues associated with physical or futures-based bitcoin investments.

While not endorsing cryptocurrencies’ fundamental value, Citi’s analysts present a compelling case for adding bitcoin. Their analysis shows improved returns with a 5% bitcoin allocation, notably boosting average annual returns without significantly altering maximum drawdowns.

Historical data supports this, with a significant Sharpe ratio improvement in the early years. Even post-bitcoin futures launch to SEC approval, an allocation of up to 12% may be optimal, suggesting potential benefits for investors with varying risk appetites.

However, future expectations are crucial. For a 5% allocation to be justifiable, bitcoin would need to generate returns of 12% to 16%, exceeding traditional asset classes’ expected returns.

With bitcoin’s recent surge and Citi’s model target, the prospects for meeting or surpassing these expectations seem promising.