The stock market‘s nine-day winning streak came to an abrupt end on Wednesday, just before a holiday break. Speculation suggests that the bullish momentum, fueled by the Federal Reserve’s recent shift, collided with uncertainty regarding the number of interest rate cuts expected next year.

Despite a slight improvement in mood on Thursday, as indicated by stock futures, caution is advised, according to Ed Yardeni, chief investment strategist at Yardeni Research.

In an update to clients, Yardeni questions the prevailing optimism, emphasizing that the market’s overbought condition warranted a correction. Despite earlier predicting the S&P 500 could reach 6,000 in two years, Yardeni maintains a year-end target of 4,600, pointing to potential triggers for the recent selloff.

He highlights growing regional tensions in the Israel-Gaza conflict, with the U.S. leading a security operation in the Red Sea involving other nations. Yardeni sees this as a valid reason for profit-taking given the escalating risks in the Middle East.

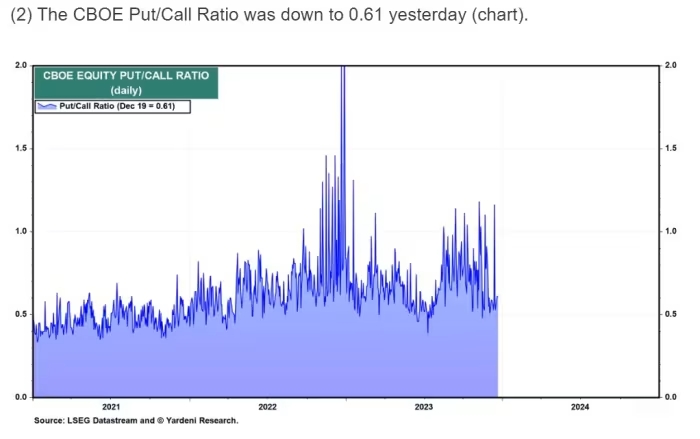

Yardeni cites bullish sentiment from recent surveys, such as the Investors Intelligence Bull/Bear Ratio and the American Association of Individual Investors, along with the CBOE equity put-call ratio falling to 0.61 on Wednesday—a potential indicator of an overheated market.

He also notes concerns about the selloff being attributed to high volumes of put options with short expirations (0DTEs), a risky derivative gaining popularity.

Additionally, Yardeni points out that crude oil prices failed to react positively to Middle East tensions due to a weak global economy and record-high U.S. crude oil production. Despite increased geopolitical risks, Yardeni keeps a close eye on Brent crude prices for potential disruptions caused by the Israel-Gaza conflict.

Yardeni warns of potential economic risks arising from Houthi attacks and rising insurance shipping costs, impacting global trade routes. He draws parallels to the Suez Canal blockage in 2021 and acknowledges analysts’ concerns about inflation linked to the current geopolitical situation.

Looking ahead, Yardeni predicts a S&P 500 target of 5,400 for 2024, the highest among Wall Street strategists.