According to Goldman Sachs, the rate of consumption is expected to decrease, but it will still continue to grow at a satisfactory rate.

American stocks have experienced a significant surge and are now approaching the record levels seen during the summer. This noteworthy recovery comes at a time when investors are getting ready for the holiday season, with the highly anticipated Black Friday just a few days away.

The anticipated rush of shopping on Friday, the day following Thanksgiving, initiates a period of increased spending for the holidays, which has the potential to support the rise of stocks following their recent increase.

According to analysts at Yardeni Research, the start of the holiday selling season looks promising as consumers are employed and have a positive financial outlook. Despite the possibility of high-interest rates affecting spending on costly items that require financing, the sales levels in October indicate a strong beginning to the holiday shopping season.

However, there are concerns among investors that the increase in U.S. stocks during November may have been excessive. The S&P 500 index is on track to achieve its biggest monthly gain after the successful performance of both bonds and equities. Despite this, the S&P 500 remains 1.6% below its highest closing point in July 2023. This month alone, it has surged by 7.6% after a third consecutive week of positive results, as Dow Jones Market Data reported.

Bob Elliott, the co-founder and CEO of Unlimited Funds, expressed his opinion in a phone interview, stating that the situation is exaggerated and that there has been a significant improvement in financial conditions.

According to Elliott, the improvement in financial conditions resulted from the U.S. Treasury Department’s recent announcement to issue fewer long-term Treasury bonds than the market had predicted. This has alleviated worries among investors about the demand for long-duration U.S. government debt, considering the large number of Treasurys being introduced into the market.

The prices of long-term Treasury bonds increased, causing yields to decrease. This decrease in yields has subsequently contributed to the rise in stock prices.

Elliott mentioned that the Treasury’s action of implementing a policy that reduces restrictions is beneficial for the overall economy and essentially delays the process of implementing stricter measures.

To reduce inflation that is currently higher than its intended target of 2%, the Federal Reserve has implemented interest rate increases to slow down the economy. According to the consumer-price index, inflation remained steady at 3.2% in October compared to the previous year. This is a decrease from 3.7% in September and a significant drop from the peak of 9.1% in June 2022.

Investors felt optimistic as the consumer price index report released on Nov. 14 caused treasury yields to plummet. This led to a more significant decline in yields throughout the month, while stocks experienced an increase.

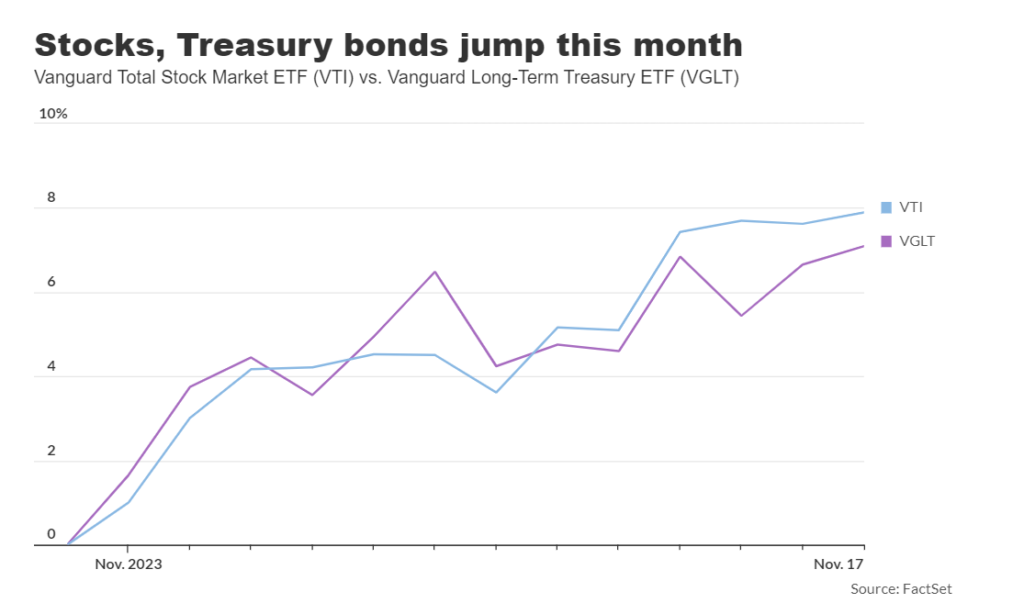

During November, both stocks and long-term Treasury bond prices have been increasing simultaneously.

According to data from FactSet, both the Vanguard Total Stock Market ETF VTI and the Vanguard Long-Term Treasury ETF VGLT have experienced a significant increase of over 7% this month until Friday.

According to Dow Jones Market Data, the yield on the 10 year-Treasury note BX:TMUBMUSD10Y remained relatively stable at 4.441% on Friday. However, it has decreased by approximately 43 basis points this month based on 3 p.m. Eastern Time levels.

Don McCree, the vice chairman of Citizens Financial Group, suggested in an interview with MarketWatch that due to the decrease in Treasury yields, the bank’s corporate clients should consider utilizing the opportunity to access the debt markets if they anticipate a need for refinancing within the next three years, as borrowing costs have decreased.

McCree, the head of commercial banking at Citizens, additionally mentioned that his corporate clients are closely monitoring consumer spending, particularly during the holiday shopping season.

According to a note from Yardeni Research, Home Depot and Target recently reported a decrease in revenue. However, their results exceeded what analysts had predicted. On the other hand, TJX, which is the strongest of the three retailers, reported a significant increase in quarterly results and expressed positivity about the upcoming holiday selling season.

Consumer savings

According to Jan Hatzius, the chief economist at Goldman Sachs Group, the excess savings of consumers played a crucial role in 2022 due to a significant decrease in real disposable personal income, which can be attributed partially to the rise in inflation. Hatzius made this statement in a virtual media briefing about the outlook for the bank’s global investment research group in 2024, held on November 16th.

Hatzius stated that although excess savings have decreased, real disposable income is increasing at a strong rate of approximately 4% in 2023. He also mentioned that they anticipate a similar growth rate of around 3% in 2024, which should be enough to sustain consumption at a decent pace of about 2%.

According to analysts at Yardeni, retail sales in the United States dropped by 0.1% in October, which marked the first decline in seven months. However, they noted that not all sectors experienced a decrease, and highlighted that the latest data revealed consumers are still spending more in restaurants compared to the previous year.

At present, the unemployment rate in the United States remains at a low level of 3.9% in October.

Hatzius mentioned during the media briefing that our objective is to avoid a significant rise in the unemployment rate next year. Additionally, there is only a 15% chance of a recession occurring within the next 12 months.

Elliott believes that the most important aspect for consumers is employment. He states that income growth is greater than price growth, which ultimately enhances households’ spending power.

Restrictive?

The central bank has raised its benchmark rate to the highest level in 22 years, reaching 5.5%, as part of its efforts to combat inflation. Recently, Jerome Powell, the Chair of the Federal Reserve, referred to the central bank’s monetary policy as “restrictive”.

However, Elliott stated that if the economy is stable at these rate levels, it implies that the rates are not restrictive, and as a result, rates might stay elevated for a longer period.

“He claimed that the overall economy is progressing at a sluggish pace and suggested that the Federal Reserve may have to reduce asset prices in order to accelerate their tightening efforts.”

On Friday, the stock market in the United States experienced gains as the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all increased for the third consecutive week. During the past three weeks, the S&P 500 saw a significant surge of 9.6%, which marks its largest three-week percentage gain since June 2020, according to Dow Jones Market Data.

Time to buy quality stocks?

According to a research note from UBS on Friday, it may be a good idea to consider investing in high-quality stocks as there are indications of a slowdown in U.S. economic growth.

“In the past, stocks that are considered to be of high quality have consistently performed well during the later stages of the business cycle and even during periods of economic decline. This can offer a safeguard for portfolios in the event that the economy slows down more than anticipated,” stated Solita Marcelli, the chief investment officer for the Americas at UBS Global Wealth Management. Marcelli also indicated a preference for U.S. technology companies, which aligns with the emphasis on quality.”

According to Tom Hancock, head of GMO’s focused equity team, companies that have strong financial stability and consistent cash flow, and are considered to be of high quality, might also experience advantages in terms of their ability to control prices. This perspective aligns with the views of Jeremy Grantham, a renowned investor.

In an interview with MarketWatch, Hancock, who is a portfolio manager for GMO U.S. Quality ETF QLTY, stated that he seeks out stocks of high quality that are priced reasonably. These stocks can be found in a range of sectors including technology, healthcare, and consumer staples.

During the media briefing, David Kostin, the chief U.S. equity strategist at Goldman, mentioned that quality stocks are expected to thrive in this current situation. These stocks are typically larger in terms of market capitalization and exhibit more stable revenue and sales growth. This stability is advantageous if economic growth predictions turn out to be incorrect.