Five percent is a pretty normal interest rate,” says Michael Rosen, CIO at Angeles Investments. Consumer spending has defied Wall Street expectations all year, both by keeping stocks afloat near record levels and by preventing the U.S. economy from running aground into a recession.

That’s why sentiment around stocks in the week ahead could hinge on two related economic data points: the consumer-price index (CPI) for August due on Wednesday and monthly U.S. retail sales slated for a day later.

“They are hanging in a lot longer than we all gave them credit for last year,” said Jason Blackwell, chief investment strategist at The Colony Group, of the willingness of consumers to spend, despite credit-card interest rates eclipsing 20% and inflation still above the Fed’s 2% annual target rate.

“Our view is that the consumer does remain fairly healthy and is able to keep up with prices increase,” he said.

The yearly CPI bumped up to 3.2% last month, but has declined from a peak of 9.1% last year. Blackwell will be watching Wednesday’s economic update for signs of easing in shelter, a “sticky” kind of inflation, which in July was pegged at 7.7% yearly, even though home prices in the past year have fallen. “There’s a disconnect that needs to narrow, at some point,” he said.

The sharp rise in mortgage rates has been less damaging to the housing market than it might have been in an earlier era. That’s because most homeowners already refinanced at historically low pandemic rates, providing a buffer as the Fed raised its policy rate to a 22-year high. A decade of underbuilding also has kept prices from tumbling, even as sales dropped, leaving many people with a big equity cushion in their homes. At the same time, wages have been rising and the economy has refused to capitulate.

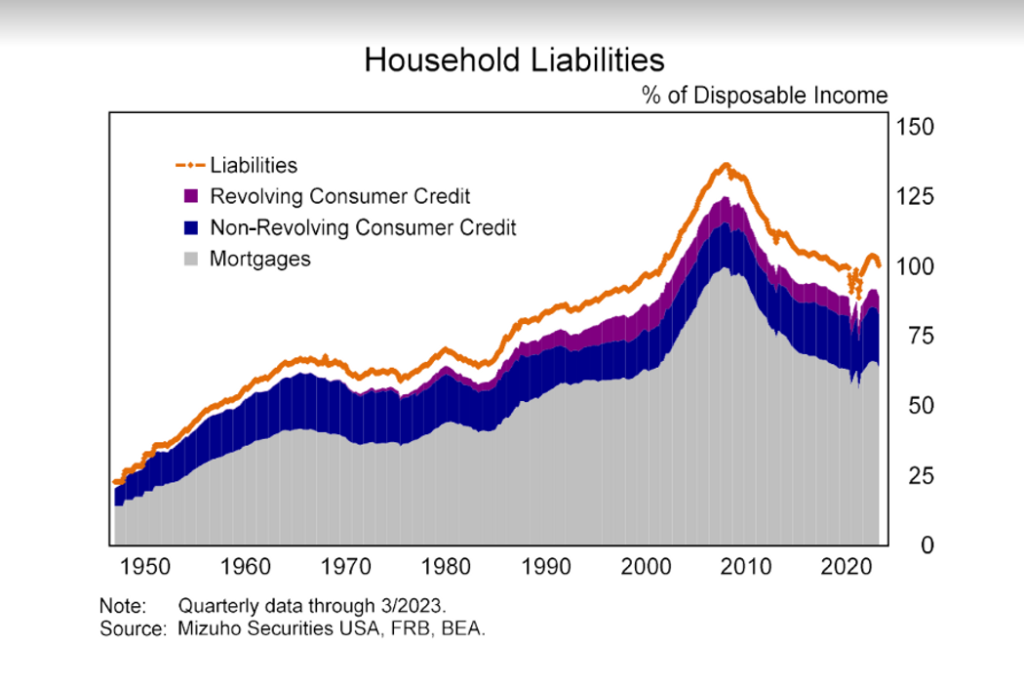

Putting it all together suggests a recipe for continued spending, particularly with household debt-to-incomes still near a 20-year low of about 100%, according to Mizuho Securities.

“The market has been expecting a recession for the past year or so, and has been wrong,” said Michael Rosen, chief investment officer at Angeles Investments. “In some sense, they probably are still looking for a recession. I think that’s also wrong.”

That’s because Rosen views today’s higher interest rates as less ominous than others might think, especially with wage gains and strong households balance sheets able to keep the economy humming, even if spending largely has exhausted pandemic savings.

“There has been some weakness in the manufacturing sector, but it’s the consumer that dominates our economy,” Rosen said. That has been reflected in recent economic data but also in jammed airports, restaurants or at one of Beyoncé or Taylor Swift’s sold out summer concerts, he said.

In July, sales at U.S. retailers reflected the biggest increase in six months. Higher energy prices could play a role in looming economic data for August. But Rosen still views the backdrop for stocks and short-term Treasury securities as favorable.

“The market climbs a wall of worry and that’s exactly what’s been happening here,” he said, adding that he expects stocks to move higher. “What drives markets is profits and corporate profits are strong.”

John Butters, FactSet’s senior earnings analyst on Friday said he’s forecasting a net profit margin for the S&P 500 index of 11.7% for the third quarter, which would be above the 11.6% figure for the previous quarter and above the 11.4% five-year average.

“Investors tend to have short memories,” Rosen said, pointing to a Fed funds rates that hit double-digits in the 1980s. but staying high as the economy expanded for most of the decade. “Five percent is a pretty normal interest rate,” he said. “I’d even go further and say zero interest rates are harmful for the economy.”

U.S. stocks closed the week lower, with the S&P 500 index SPX down 1.3% for the week, the Dow Jones Industrial Average DJIA 0.8% lower and the Nasdaq Composite Index COMP shedding 1.9% for the week, according to Dow Jones Market Data.

Bigger picture, the Dow ended Friday only 6% away its record high set in January 2022, while the S&P 500 was 7% below its prior peak. Yields on 3-month BX:TMUBMUSD03M and 6-month BX:TMUBMUSD06M Treasurys have been above 5% since this spring.