A team of strategists at Ned Davis Research has analyzed the latest market trends, and the data suggests that after two stellar years, U.S. stock are taking a breather in early 2025—much to investors’ frustration.

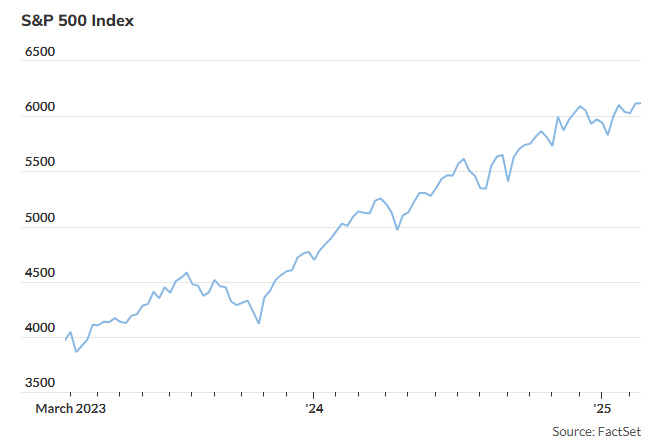

For the past two and a half months, the S&P 500 (SPX) has been stuck in a narrow trading range, a phase of “consolidation,” as described by the Ned Davis team. Despite this, the index has continued to notch record highs, most recently on Wednesday, according to FactSet. However, the rapid pace of gains that defined 2024 has slowed significantly, while European and Chinese markets have surged ahead.

With a laundry list of investor concerns—including tariffs, widespread federal layoffs, and lofty stock valuations—the market’s resilience is striking.

“I feel as though the markets have mostly shrugged off the tariff threats and [President Donald] Trump’s geopolitical drama this year,” said Burns McKinney, portfolio manager at NFJ Investments, in an email to MarketWatch on Thursday.

Despite this resilience, unease is creeping in. According to Andy Reed, head of investor-behavior research at Vanguard, several investor confidence indicators just experienced their sharpest drop since 2022. In commentary shared with MarketWatch, Reed noted that concerns over record-high egg prices are outweighing enthusiasm for stocks.

History, however, suggests that such periods of stagnation tend to resolve relatively quickly—often followed by renewed market sA team of strategists at Ned Davis Research has analyzed the latest market trends, and the data suggests that after two stellar years, U.S. stocks are taking a breather in early 2025—much to investors’ frustration.

For the past two and a half months, the S&P 500 (SPX) has been stuck in a narrow trading range, a phase of “consolidation,” as described by the Ned Davis team. Despite this, the index has continued to notch record highs, most recently on Wednesday, according to FactSet. However, the rapid pace of gains that defined 2024 has slowed significantly, while European and Chinese markets have surged ahead.

With a laundry list of investor concerns—including tariffs, widespread federal layoffs, and lofty stock valuations—the market’s resilience is striking.

“I feel as though the markets have mostly shrugged off the tariff threats and [President Donald] Trump’s geopolitical drama this year,” said Burns McKinney, portfolio manager at NFJ Investments, in an email to MarketWatch on Thursday.

Despite this resilience, unease is creeping in. According to Andy Reed, head of investor-behavior research at Vanguard, several investor confidence indicators just experienced their sharpest drop since 2022. In commentary shared with MarketWatch, Reed noted that concerns over record-high egg prices are outweighing enthusiasm for stocks.

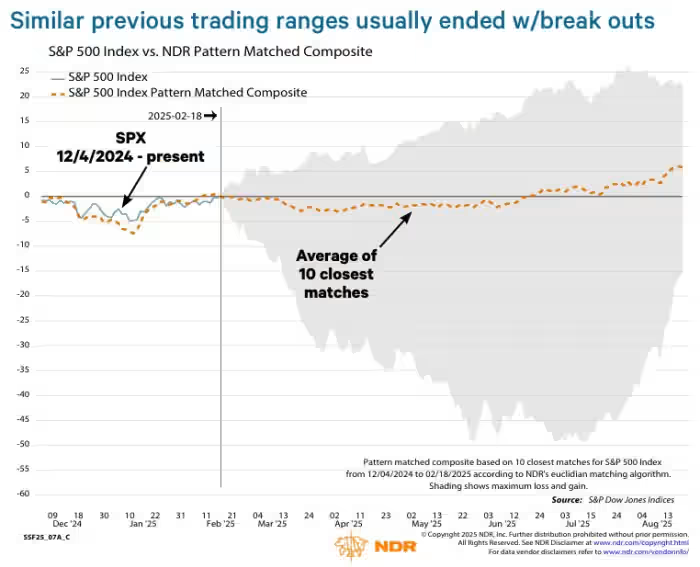

History, however, suggests that such periods of stagnation tend to resolve relatively quickly—often followed by renewed market strength. The Ned Davis team ran an analysis of the S&P 500’s performance since early December, comparing it to previous stretches of directionless trading. While results varied, the historical trend points to continued choppiness in the near term before stocks likely resume their upward trajectory.

“Whether the past 2.5 months represent a consolidation phase within an ongoing cyclical bull market or the beginning of a downturn depends on inflation, earnings, and other factors,” said Ed Clissold, chief U.S. strategist at Ned Davis, in a report shared with MarketWatch. “For now, the data supports the view that this is still a bull market—until proven otherwise.”

Thursday’s market action reflected growing uncertainty, as disappointing earnings guidance from Walmart Inc. (WMT) rattled investors’ confidence in consumer strength. The S&P 500, Nasdaq Composite (COMP), and Dow Jones Industrial Average (DJIA) all closed lower.trength. The Ned Davis team ran an analysis of the S&P 500’s performance since early December, comparing it to previous stretches of directionless trading. While results varied, the historical trend points to continued choppiness in the near term before stocks likely resume their upward trajectory.

“Whether the past 2.5 months represent a consolidation phase within an ongoing cyclical bull market or the beginning of a downturn depends on inflation, earnings, and other factors,” said Ed Clissold, chief U.S. strategist at Ned Davis, in a report shared with MarketWatch. “For now, the data supports the view that this is still a bull market—until proven otherwise.”

Thursday’s market action reflected growing uncertainty, as disappointing earnings guidance from Walmart Inc. (WMT) rattled investors’ confidence in consumer strength. The S&P 500, Nasdaq Composite (COMP), and Dow Jones Industrial Average (DJIA) all closed lower.