Major U.S. stock indices marked their seventh consecutive week of gains as they closed mostly higher on Friday, following the Federal Reserve’s policy meeting. The S&P 500 achieved its lengthiest weekly winning streak since November 2017, according to Dow Jones Market Data.

Here’s a breakdown of how the stock indices performed:

- The Dow Jones Industrial Average (DJIA) rose 56.81 points, or 0.2%, closing at a record 37,305.16.

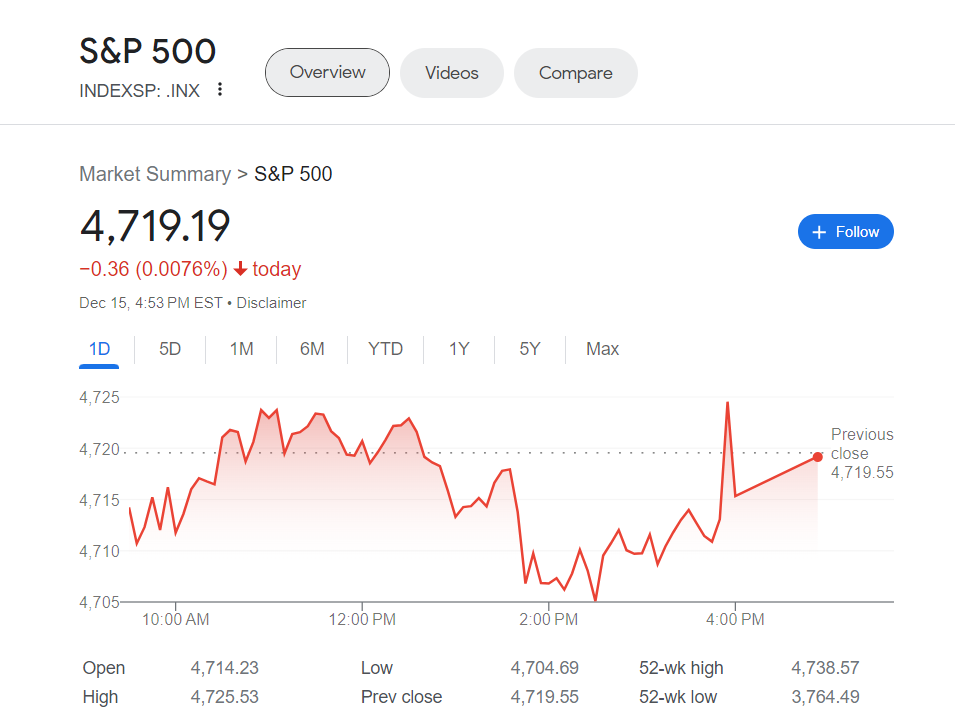

- The S&P 500 (SPX) was nearly flat, slipping less than 0.1%, finishing at 4,719.19.

- The Nasdaq Composite (COMP) gained 52.36 points, or 0.4%, ending at 14,813.92.

The week saw a general market rally fueled by positive reactions to key U.S. inflation data, the Federal Reserve’s policy statement, and interest rate projections. The Dow, S&P 500, and Nasdaq Composite each achieved a seventh straight week of gains.

Russell Price, Chief Economist at Ameriprise Financial, expressed confidence in the market’s optimistic tone, justifying recent weeks’ positive trends. He suggested that the stock market may be anticipating rate cuts by the Federal Reserve in 2024, supported by the decline in 10-year Treasury yields.

Price predicted the Fed might begin cutting rates in June, leading to a sustainable pace of economic growth in 2024, with a projected real GDP increase of 1.8% to 1.9% next year. Most sectors in the S&P 500 saw gains, and small-cap stocks, represented by the Russell 2000 index, outperformed large-cap equities with a weekly gain of around 5.6%.

While Fed Chair Jerome Powell hinted at a favorable trajectory for inflation and potential lower rates in the coming year, some caution emerged as traders appeared to be overly optimistic about rate cuts. Federal-funds futures suggested a potential rate reduction starting as early as March, according to the CME FedWatch Tool.

Friday’s trading session encountered a brief setback after New York Federal Reserve Bank President John Williams downplayed expectations of imminent rate cuts, stating, “We aren’t really talking about cutting interest rates right now.”

In terms of economic indicators, the consumer-price index showed a year-over-year inflation rate of 3.1% in November, a notable decrease from the peak of 9.1% in June. Powell emphasized the Fed’s commitment to its 2% inflation target.

Mark Hackett, Chief of Investment Research at Nationwide, interpreted Powell’s statements as signaling a soft landing without the need for a recession. Economic data from Friday highlighted challenges in U.S. manufacturing, while the 10-year Treasury yield experienced its largest weekly drop since November 2022.

Despite Friday’s flat close, the S&P 500 remained just 1.6% below its record close on January 3, 2022, reflecting the market’s robust momentum. Companies in focus included Palantir Technologies Inc., Steel Dynamics Inc., Costco Wholesale Corp., JD.com, and Alibaba Group Holding Ltd., each experiencing notable stock movements based on various news and earnings reports.