Tom Lee, a steadfast advocate for equities and the head of research at Fundstrat Global Advisors, predicts that the S&P 500 will surge to 5,200 by the conclusion of the upcoming year, marking a substantial 14% increase from its current level. In his Thursday analysis, Lee anticipates that decreasing inflation will result in lower interest rates and a swifter-than-expected improvement in financial conditions. This, in turn, is poised to enhance corporate earnings and bolster stock-market valuations.

Expressing confidence in the U.S. economy, Lee suggests that a recession is likely to be averted in 2024, even if the labor market experiences weakness in the first half of the year. Despite prevailing investor caution, Lee notes diminished skepticism as we enter 2024. While maintaining an overall positive outlook on equities, he envisions the bulk of the gains materializing in the latter half of the year, as outlined in a Thursday note to clients.

The anticipated easing of financial conditions, driven by expectations of the Federal Reserve halting interest rate hikes and potentially cutting rates in the coming year, is expected to result in increased consumer income, improved purchasing power, and real wage gains. Lee also anticipates a decline in 30-year mortgage rates and foresees “pent-up” demand from American corporations, creating a more favorable macroeconomic backdrop compared to 2023.

In terms of stocks, Lee forecasts an expansion of the price-to-earnings ratio (P/E) for the S&P 500 towards 20 times 12-month forward earnings in 2024. Currently trading at over 18 times forward earnings, according to FactSet data, Lee argues that historical trends since 1937, with 10-year Treasury yields in the 4% to 5% range, indicate that the S&P 500’s P/E exceeded 18 times forward earnings about 65% of the time.

Regarding earnings, Lee anticipates an 8.3% growth in S&P 500 earnings-per-share (EPS) to $260, driven by cyclical EPS recovery and the easing financial conditions that may stimulate a rebound in capital expenditures.

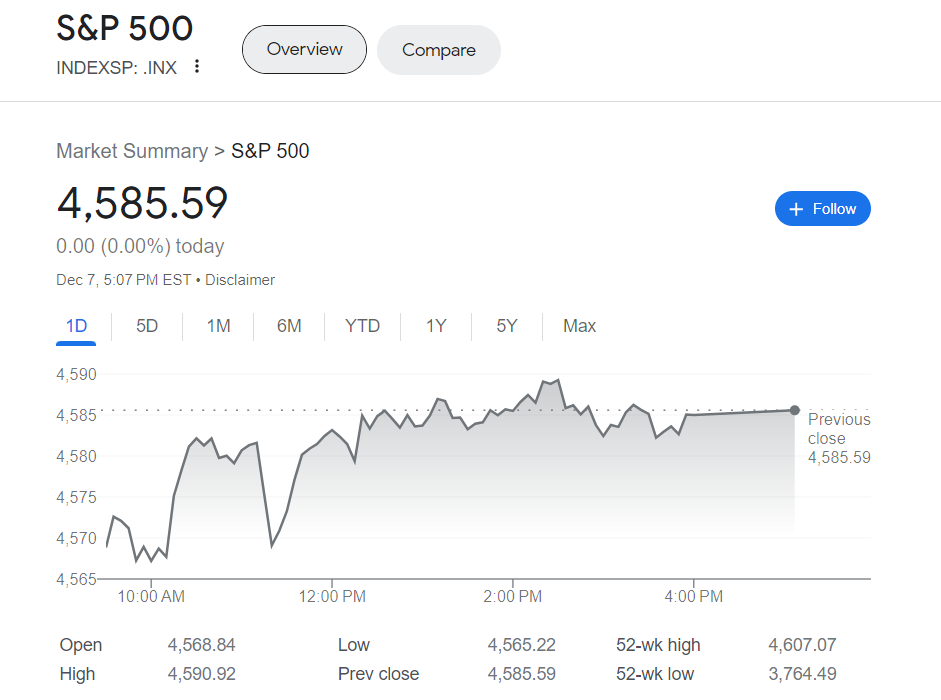

Lee’s year-end target for the S&P 500 in the next year is 8.1% higher than the 4,811 average forecast from 11 sell-side strategists polled by MarketWatch last week. Known for his bullish outlook, Lee accurately predicted the stock-market rally in 2023 and envisions the S&P 500 achieving a new all-time high of 4,825 in the final weeks of this year.

As of Thursday, the S&P 500 had risen by 0.8% to 4,587, the Dow Jones Industrial Average was 0.3% higher, and the Nasdaq Composite was on track for a 1.3% gain, according to FactSet data.