The stock market on Wall Street experienced a strong recovery towards the end of the day, resulting in a significant rally in November. This surge was driven by the belief that the Federal Reserve will stop raising interest rates aggressively.

After experiencing a significant increase of $3 trillion this month, the S&P 500 is now only 5% shy of reaching its highest point ever. In the month of November, the leading US stock market index rose by more than 8%, a rare occurrence that has only happened fewer than 10 times in the same month since 1928, as per Bloomberg’s data. This also marks the largest monthly gain for the index since July 2022. However, Treasuries experienced a decline after a remarkable rally, while the dollar ended on a higher note but recorded its poorest performance in a year.

In the past few weeks, consumer spending, inflation, and job market activity in the United States have all decreased, which suggests that the pace of economic growth is gradually slowing down. The core personal consumption expenditures price index, which is a key indicator of underlying inflation for the Federal Reserve, matched the predictions made by economists.

Sonu Varghese, global macro strategist at Carson Group, predicts that the recent developments are likely to solidify expectations that the turning point in the monetary policy is imminent. It is anticipated that the Federal Reserve will reduce interest rates at least once in the first half of 2024. The acknowledgement from Fed officials regarding the easing of inflation, despite a robust economy and low unemployment, has essentially set the foundation for the implementation of rate cuts.

According to Callie Cox from eToro, at the moment, the market is bullish unless there is evidence to suggest otherwise.

Inflation progress and potential rate cuts are being openly discussed by Powell and Fed presidents. If the Fed’s perspective remains consistent, there may be ongoing demand for rate cuts, particularly in industries impacted by interest rates. However, it is important to proceed cautiously since the economy is slowing down and there is still a possibility of a recession.

According to a Bloomberg Intelligence model called the Economic Regime Index, there is promising news for those who are optimistic about the equity market. It suggests that the most difficult macroeconomic challenges faced by the United States seem to be over.

In English language, the paraphrased version of the paragraph could be: Last month, the index returned to a state of recession after a substantial recovery earlier this year from its lowest point in late 2022. Although the model indicates possible economic fragility in the future, as long as it remains above its previous lows, the outlook is positive for the S&P 500, according to Gina Martin Adams, the chief equity strategist at BI.

Chris Verrone at Strategas stated that although November was exceptional, one of the common questions from clients this week was whether the strong performance of November would negatively impact the typical December Santa Claus rally. However, Verrone noted that this was not the case.

He pointed out that there is a noticeable favoritism towards a significant increase in performance in December after a poor showing in November. However, there is hardly any variation in the remaining 90% of the data. Verrone stated that the performance in December is roughly equal to the average November, even after experiencing substantial gains in November.

Traders remained vigilant in monitoring the recent statements made by American officials. John Williams, the President of the Federal Reserve Bank of New York, emphasized that the benchmark lending rate is currently at or close to its highest level and referred to the policy as “quite stringent.” Mary Daly, the President of the San Francisco Federal Reserve Bank, expressed confidence in the current interest rates as an effective measure to regulate inflation. However, she stated that she is not considering any reductions and it is premature to determine if there will be further increases.

Brian Rose, senior US economist at UBS Global Wealth Management, stated that it is currently too soon to abandon the inclination towards tightening in the Federal Reserve’s forward guidance. Rose anticipates that Fed Chair Jerome Powell, who is scheduled to speak publicly on Friday, will exercise caution to prevent coming across as excessively accommodating.

Yellen expresses optimism about a smooth economic transition and suggests that unemployment rates may stabilize.

If Powell gives more dovish comments, the soft economic data could lead to a rally in the markets for Jose Torres at Interactive Brokers. However, only a moderate level of optimism can be derived from recent progress, as Powell has already highlighted that the Federal Reserve will only begin cutting rates once there is evidence of a sustained decrease in inflation.

“If he continues to hold a strong position and disappoints expectations of interest rate reductions in the beginning of next year, then today’s data may be similar to a deceptive warm day in February,” explained Torres. “Though it may seem like a sign of Spring’s arrival, it is typically just a break from the burdensome task of clearing snow and wearing thick winter attire that resembles the Michelin tire man.”

Similarly, Torres mentioned that if Powell continues to adopt a cautious approach, the prevailing negativity surrounding the possibility of interest rate reductions in the near future could lead to unpredictable market fluctuations.

Oil prices dropped after the output reduction from OPEC+ did not persuade traders.

Corporate Highlights:

- Tesla Inc. has finally delivered the first Blade Runner-like Cybertrucks to customers after facing delays and production issues for two years. The starting price of these vehicles is $60,990, excluding potential savings that Tesla believes might bring the purchase price to $49,890.

- Dell Technologies Inc. announced lower than anticipated revenue due to persistently weak interest from businesses for personal computers.

- Walt Disney Co. has announced that it will be distributing a dividend of 30 cents per share for the latter half of its fiscal year in accordance with their commitment to reinstate the payment that was temporarily stopped due to the pandemic.

- According to individuals familiar with the matter, OpenAI is maintaining its intention to allow employees to sell their shares in the company through a tender offer. They are also extending the deadline by an additional month, giving potential participants more time to make their decision.

- Canada has made a decision to purchase up to 16 military surveillance planes from Boeing Co., in a deal worth $7.7 billion. This decision means that they have chosen to not go with a competing option from Canadian private-jet manufacturer, Bombardier Inc.

- Ford Motor Company has revised its financial forecast, indicating that its profits will be lower than previously expected. This adjustment is due to the increased labor expenses resulting from the recently negotiated agreement with the United Auto Workers union.

- After being denied the request for seats, Nelson Peltz’s Trian Fund Management LP, a billionaire, intends to pursue board representation at Walt Disney Co., a entertainment company.

- Meta Platforms Inc. has filed a lawsuit against the US Federal Trade Commission, alleging that the agency’s internal trials go against the Constitution. The company is seeking a court order to promptly stop the commission’s attempt to modify a privacy settlement from 2020.

- AbbVie Inc. has reached an agreement to purchase ImmunoGen Inc. for $10.1 billion, with the intention of obtaining access to highly sought-after cancer treatments in the expanding market.

Key events this week:

- China Caixin Manufacturing PMI, Friday

- On Friday, the manufacturing Purchasing Managers’ Index (PMI) data for the Eurozone, compiled by S&P Global, was released.

- On Friday, there will be reports on US construction spending and the ISM Manufacturing index.

- Federal Reserve Chair Jerome Powell will take part in a informal discussion in Atlanta on Friday.

- On Friday, Austan Goolsbee, the President of the Chicago Federal Reserve, delivered a speech.

Some of the main moves in markets:

Stocks

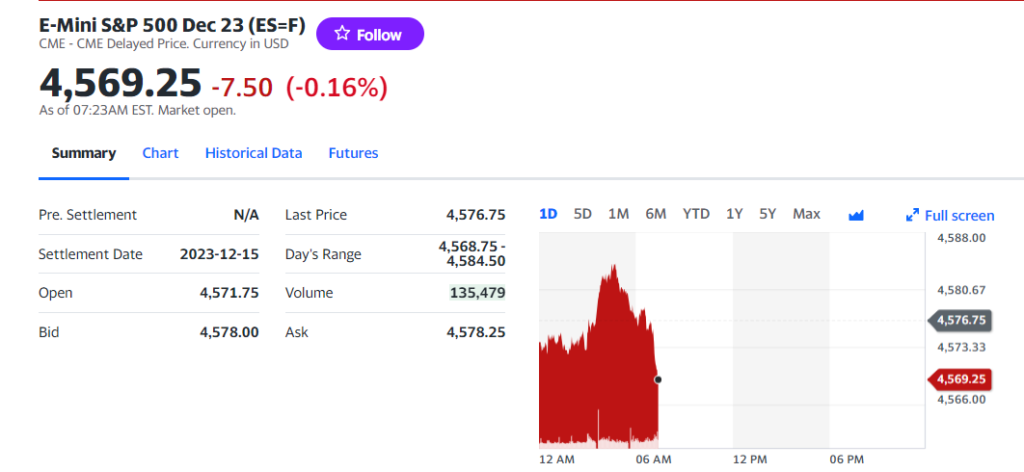

- As of 4 p.m. New York time, there was a 0.4% increase in the S&P 500.

- The Nasdaq 100 fell 0.2%

- The Dow Jones Industrial Average increased by 1.5%.

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index increased by 0.4%.

- The euro fell 0.7% to $1.0887

- The British pound fell 0.5% to $1.2626

- The value of the Japanese yen decreased by 0.7%, reaching a rate of 148.22 per dollar.

- Cryptocurrencies

- Bitcoin was little changed at $37,757.5

- Ether rose 0.8% to $2,044.88

Bonds

- The interest rate on 10-year Treasuries increased by eight basis points to 4.34%.

- The 10-year yield of Germany increased by two basis points to reach 2.45%.

- The 10-year interest rate in Britain increased by eight basis points to reach 4.18%.

Commodities

- The price of West Texas Intermediate crude oil dropped by 3.1% and is now $75.44 per barrel.

- The price of gold dropped by 0.4% to $2,035.57 per ounce.