The inflation report has injected a new burst of energy into the stock market, and this rally appears to be more enduring than previous ones—there’s reason to have confidence in its sustainability.

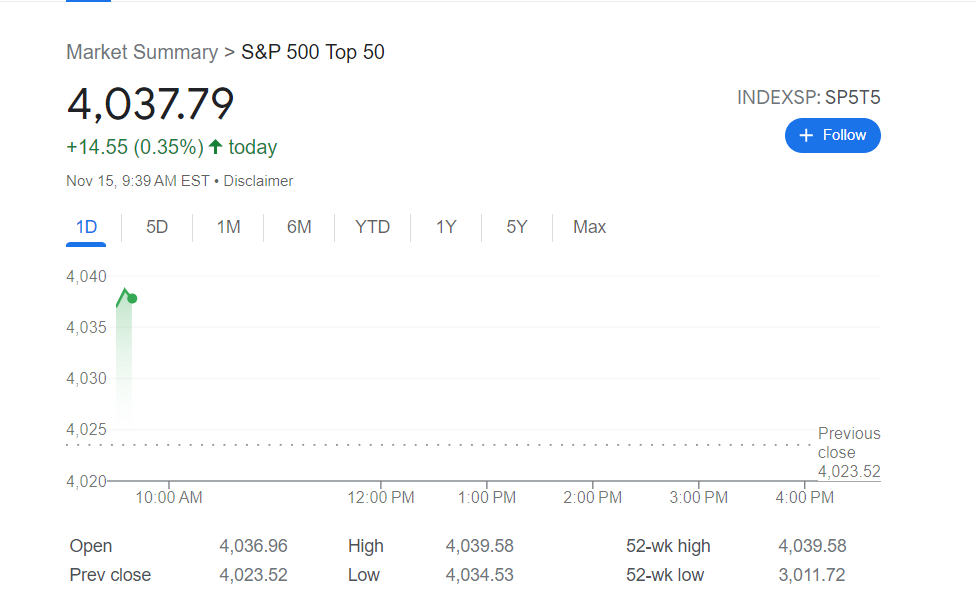

As of Tuesday morning, all three major U.S. stock indexes experienced gains exceeding 1%, with the Nasdaq Composite approaching a substantial 2% increase. This positive momentum follows the release of data indicating a 3.2% year-over-year rise in the consumer price index for October. While slightly below economists’ expectations, this figure represents a moderation from September’s 3.7% increase. With the Federal Reserve aiming for a 2% inflation rate, these numbers strengthen the belief that the central bank can maintain steady interest rates, potentially avoiding further hikes to cool the economy. In fact, there’s even speculation that the Fed might consider rate cuts within the next year, making stocks even more appealing.

Presently, the S&P 500, hovering just below 4500, is surpassing crucial levels—a positive indicator. Earlier in the year, concerns about rising interest rates and their economic impact led sellers to intervene around the “resistance level” at 4400, causing the index to retreat. However, Tuesday’s gains suggest that such apprehensions are gradually diminishing.

It’s worth noting that the next resistance level is approximately 4500. Monitoring whether the index can sustain this level or if sellers will reemerge to push it lower is crucial. As of now, the S&P 500 remains robust, just below the 4500 mark.

The sudden surge in buyers suggests the potential for further gains. If the S&P 500 can maintain its current level for a few days, momentum might propel it beyond the 2023 intraday high of 4607, recorded in July.

Frank Cappelleri of Cappthesis anticipates an upside target near 4675, which remains achievable if the SPX stays above the 4390 breakout zone. Achieving this lofty level would translate to a gain of approximately 5% from the current position.