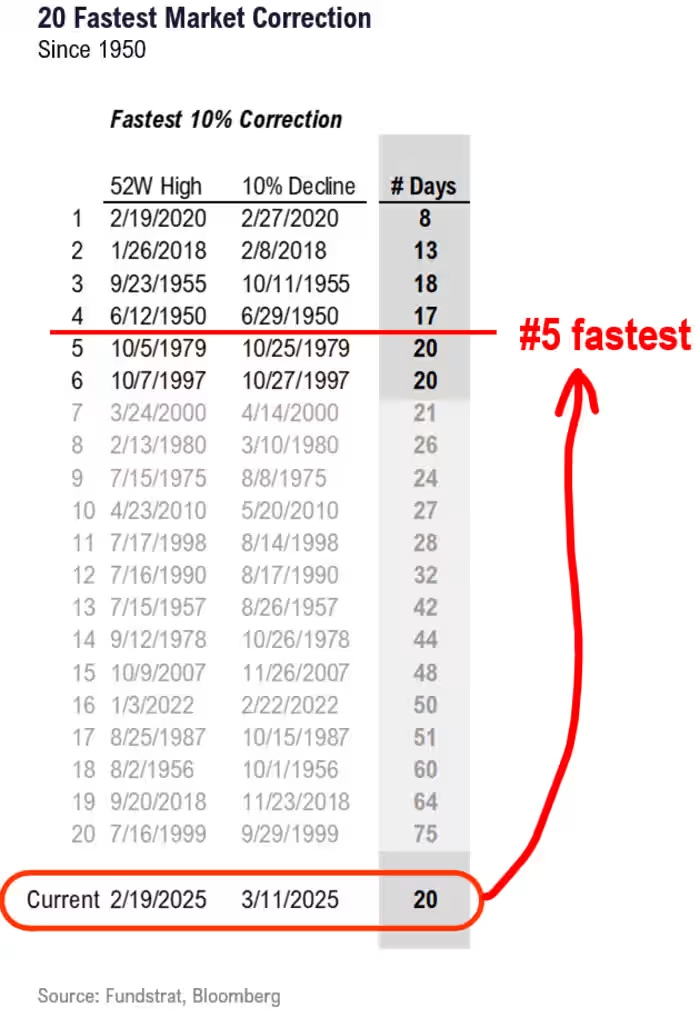

Fundstrat’s Tom Lee highlighted that the S&P 500 recent dip into correction territory occurred at the fifth-fastest pace since 1950. Historically, similar declines have been followed by market rebounds within three months.

The speed of the downturn has caught many investors off guard. Just months ago, markets were celebrating strong consecutive annual gains. However, growing concerns over President Trump’s aggressive approach to federal layoffs and escalating trade tensions have fueled fears of an impending recession. Major investment banks, including Goldman Sachs and J.P. Morgan, have raised the probability of a downturn before year-end.

Despite the turbulence, Lee argues that sharp market corrections often present buying opportunities for bold investors. His latest report, shared with MarketWatch, reinforces this perspective.

Historical Context and Market Patterns

The two fastest corrections in recent history occurred during the COVID-19 crash in early 2020 and the “volmageddon” selloff of January 2018, which took eight and 13 days, respectively, for the S&P 500 to drop 10%. Outside of the COVID-19 crash, markets historically rebounded within a month.

Lee’s data shows that in six comparable corrections, the S&P 500 posted a median gain of 9% within three months, 15% within six months, and 21% within a year. While this is a small sample size, the pattern suggests that markets tend to recover swiftly from sharp declines—unless accompanied by a recession.

Recession Fears vs. Market Resilience

Lee remains skeptical of the widespread recession concerns. He points out that corporate bond markets remain stable, and global equities—particularly in Europe and China—continue to perform well despite ongoing trade tensions. Furthermore, the Federal Reserve’s willingness to intervene, evidenced by falling Treasury yields, suggests a safety net for investors.

Comparing the current 10% market pullback to the median 24% decline seen in past recessions, Lee estimates that equities are pricing in roughly a 40% chance of recession. Whether this correction deepens into a bear market will likely hinge on economic growth and monetary policy.

Investment Strategies Moving Forward

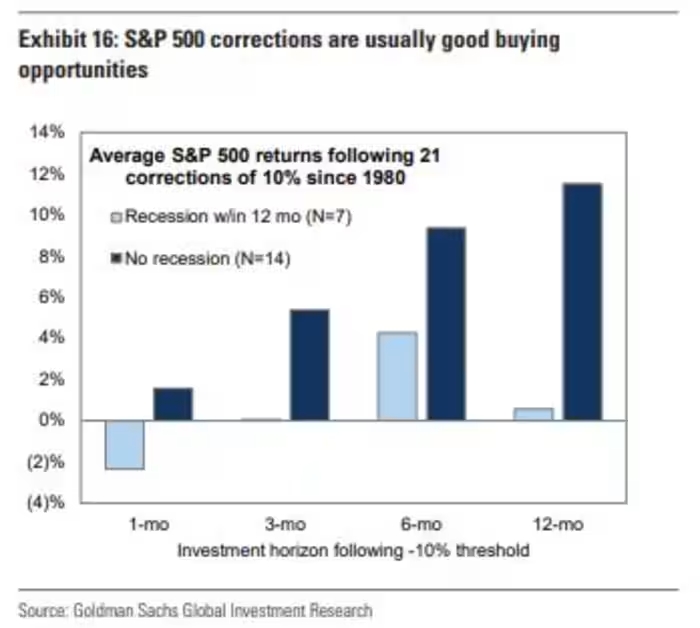

Goldman Sachs strategists noted that since 1980, there have been 21 market corrections of 10% or more. The performance over the following year largely depended on whether a recession followed. In non-recessionary periods, stocks rebounded more strongly.

For now, Goldman suggests investors focus on defensive sectors and high-growth themes like artificial intelligence, which may be more resilient to economic slowdowns.

On Wednesday, markets remained volatile, though the S&P 500 was up 0.5%, recovering some losses from its February peak. The Dow Jones remained in negative territory, while the Nasdaq Composite outperformed, gaining over 1% thanks to strong semiconductor stocks, including Nvidia’s 6.4% surge.