Stocks have surged to new heights, prompting Wall Street to revise its S&P 500 targets upwards. However, it’s wise to exercise caution and not get swept up in the hype.

The beginning of the week saw several strategists adjust their S&P 500 forecasts. Citigroup raised its mid-2024 projection from 4400 to 5000, while Piper Sandler increased theirs to 4825 from 4625.

Even Mike Wilson from Morgan Stanley, who had previously predicted a significant 18% decline, acknowledged the possibility of a sustained market rally in a recent note.

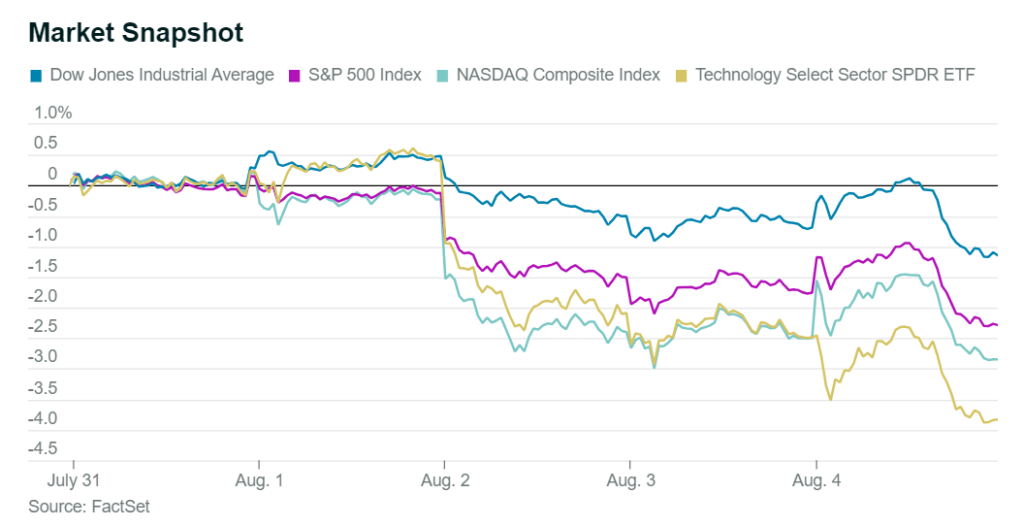

Interestingly, this week proved challenging for the stock market. The S&P 500 dipped by 2.3%, the Dow Jones Industrial Average fell 1.1%, and the Nasdaq Composite declined by 2.8%. Notably, the S&P 500 had already surged by 28% from its bear-market low in October. Strategists, taken aback by this massive rally, are now adjusting their forecasts to reflect the current market situation.

This response is not unwarranted. Recent events underscore the resilience of the economy, although not to the extent of compelling unexpected actions from the Federal Reserve. The latest payrolls report indicated the addition of only 187,000 jobs in July, with downward revisions for previous months. This suggests that a controlled slowdown remains a possibility.

Earnings have also outperformed expectations, with Amazon.com (AMZN) standing out by gaining 8.3% after its report. This is especially significant given the S&P 500’s premium valuation.

Nevertheless, rushing to invest after the S&P 500 achieved its strongest performance in the first seven months of a year since 1997 may be premature. The index is still relatively expensive, trading at over 19 times forward earnings for the next 12 months, up from about 15 times at the beginning of the rally. Additionally, stocks like Apple (AAPL), which played a pivotal role in the rally, show signs of potential stagnation. This eagerness to invest appears driven by a sense of urgency and the fear of missing out.

Michael Arone, Chief Investment Strategist at State Street Global Advisors, notes that “FOMO” (fear of missing out) is becoming evident as bears seem to be giving in. This sentiment makes him increasingly apprehensive, as it could lead to a potential market pullback.

History supports Arone’s caution, and not just due to the typical summer weakness. Comparing the average S&P 500 target against the index itself reveals that Wall Street’s predictions are, at best, coincidental indicators and, at worst, lagging ones. For instance, in 2022, these forecasts peaked shortly after the market did in January of that year.

This past week, surging Treasury yields triggered the market’s decline. While the exact cause is unclear, it could be attributed to a combination of increased debt issuance by the Treasury, along with robust economic data prompting a reevaluation of growth projections. Higher yields reduce stock valuations, assuming other factors remain constant. Yet, if the increase remains moderate, it could present a buying opportunity.

This perspective gains significance as the market looks towards 2024. A notable 61 S&P 500 companies that reported second-quarter earnings raised profit guidance, while 23 lowered outlooks, according to Wells Fargo. This contributes to analysts’ expectations of sales and earnings growth in the upcoming year.

In essence, the market is focused on 2024, as explained by Doug Bycoff, Chief Investment Officer of the Bycoff Group. He suggests that a 5% pullback could be seen as a chance to enter the market at a better position.

In conclusion, the key takeaway is not to invest during periods of excitement but rather to seize opportunities during market dips.