Analysts, including Savita Subramanian from Bank of America, are diligently working on their predictions like Santa’s elves. Subramanian, an equity and quantitative strategist, forecasts that the S&P 500 will reach an all-time high of 5,000 by 2024, creating an ideal environment for selective stock picking.

Subramanian and her team provide numerous explanations for what appears to be one of the most optimistic predictions for the upcoming year up until now. On Wednesday, Lori Calvasina from RBC Capital also introduced a year-end target price for the S&P 500 of 5,000.

According to Bank of America, investors have surpassed the point of maximum uncertainty regarding the overall economy and major geopolitical events. Additionally, the bank states that the positive aspect is that they are now discussing negative news.

The Bank of America team explains that their positive outlook is not based on the expectation of the Federal Reserve cutting, but rather on the successful achievements of the Fed. They believe that companies have adjusted to the increased interest rates and inflation as they typically do.

Subramanian and Co. appear to be more optimistic compared to their colleague, strategist Michael Hartnett. Hartnett cautioned about investors flocking into stocks with the belief of Federal Reserve easing and a smooth economic transition.

Why should you pay attention to Subramanian? Her prediction for the S&P 500 in 2023, which is 4,600, seems to be accurate, unlike many other cautious predictions made by her peers on Wall Street. However, the round number of 5,000 is appealing, but even if there is a 10% increase from the current level next year, it may not compare to the index’s significant gain of over 18% in 2024, so far.

So, are there more factors that could contribute to a significant increase in stock prices from this point onwards? One such reason is the presence of numerous individuals with negative intentions, as she points out. Despite the optimistic market sentiment, the data suggests that many investors lack confidence in stocks, except for those who are enthusiastic about artificial intelligence.

“In the English language, she states that pension equity weights are currently at their lowest point in 25 years, sell-side market targets from banks and brokerages are mostly unsuccessful, the consensus long-term earnings growth for the S&P 500 is at a low point (excluding the impact of COVID), and active funds are closely following their benchmarks. She adds that bull markets usually conclude with strong belief and enthusiasm, and we are currently far from experiencing that.”

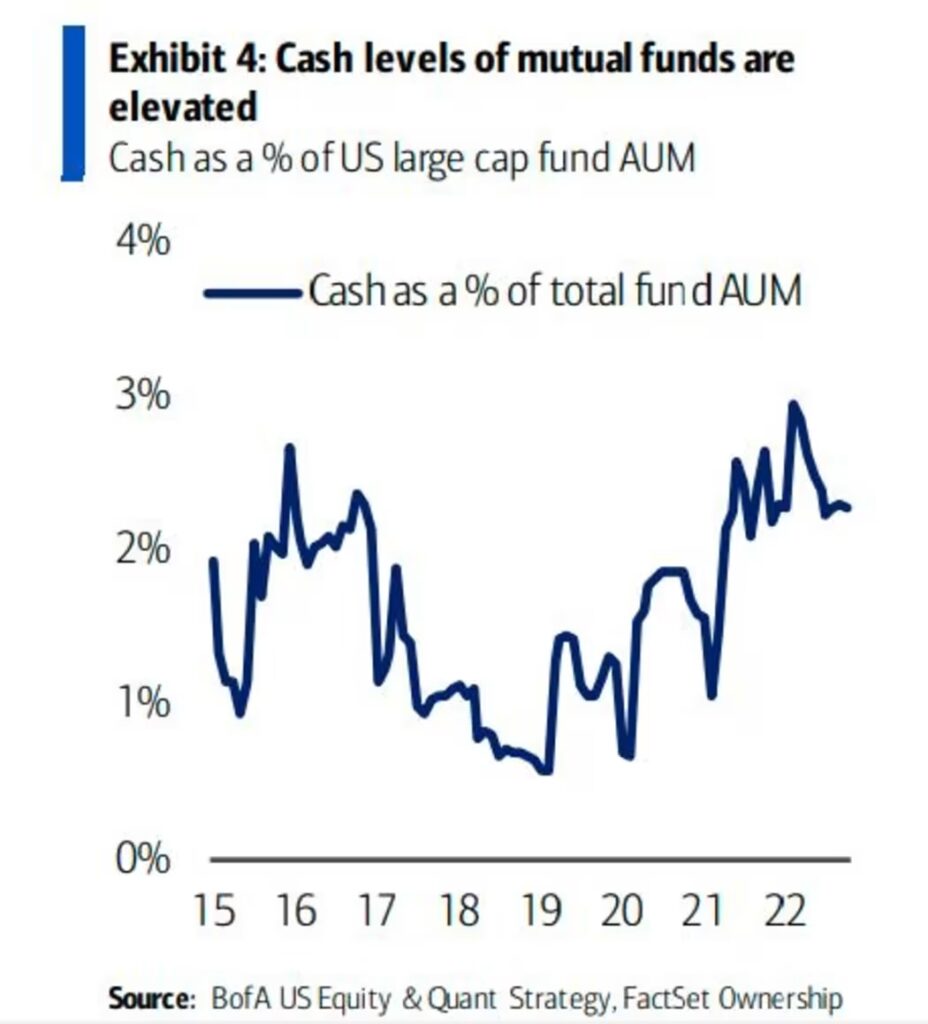

Earlier this month, BlackRock expressed concern about clients holding onto $4 trillion in cash, partly due to anxiety about interest rates.

There are additional reasons mentioned by the strategist. She refers to a survey conducted by Bank of America analysts, who have positive predictions for 2024. These predictions include improved profit margins, reduced expenses, gradual decreases in prices without a significant decline, and more. The strategist also takes into account historical data, mentioning that profits tend to increase even when economic growth slows down. This was observed in the 1950s when earnings per share decreased for six consecutive quarters before the recession but then grew during that economic downturn.

The fourth reason is that 2024 is a year of elections, which have historically had a positive impact on the stock market. Additionally, there may be bipartisan agreement on continuing defense spending and promoting domestic manufacturing, both of which tend to benefit the economy. However, the possibility of fiscal austerity measures could negatively affect healthcare stocks.

Another factor is that the United States has been actively pursuing deglobalization since 2018, which has been advantageous for companies. Additionally, the increase in oil prices has positively impacted earnings per share (EPS), and the United States is in a favorable position as it produces a significant portion of its own energy.

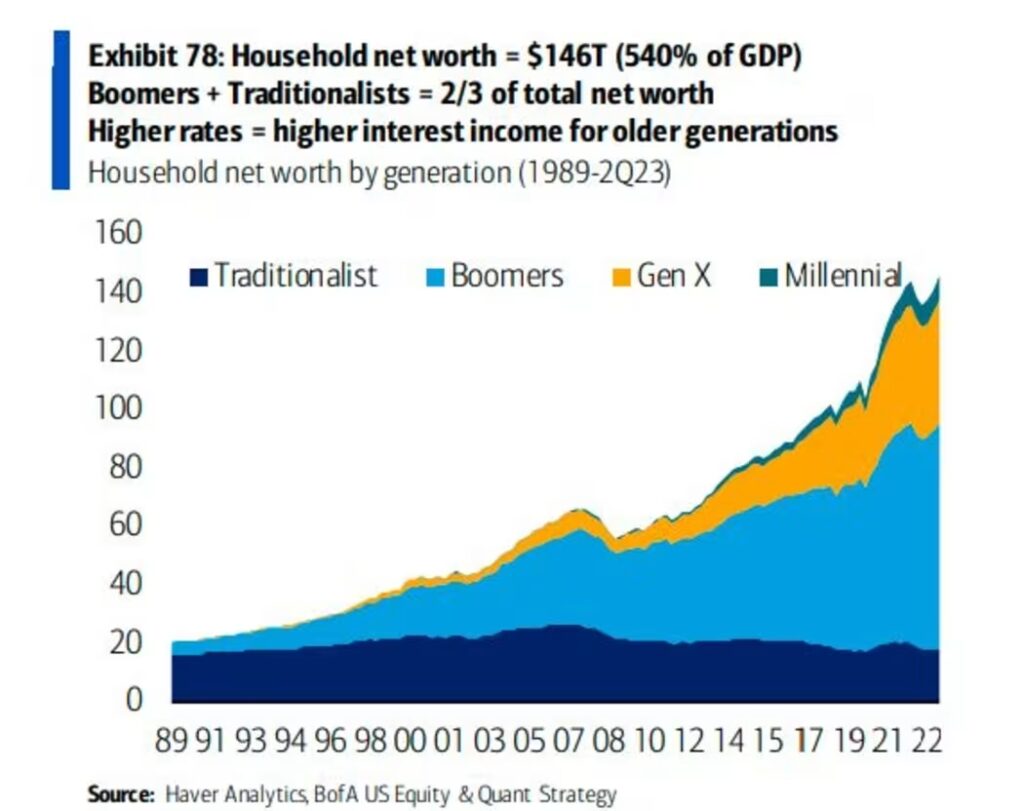

Subramanian believes that it is important for everyone to express their gratitude towards individuals born between 1946 and 1964, as they are willing to share their wealth. According to her, the baby boomers, with a collective net worth of approximately $80 trillion, are currently benefiting from increased rates and the process of passing on their fortunes to millennials has already commenced.

According to her, this specific generation possesses around 50% of the overall value of households in the United States, and they have secured very low mortgage rates. As a result, their actual mortgage rate is even lower than the rates before the COVID pandemic.

Therefore, the question is how to utilize this enthusiastic outlook effectively. She suggests that clients should maintain a preference for cyclical stocks because they contribute to the growth of communications services equities. However, Bank of America still views U.S. tech and technology, media, and telecommunications as successful in the long run.