Key Insights for U.S. Traders:

Stocks are poised for further gains while yields are declining. Bond markets are rallying after a holiday, driven partly by safe-haven demand following Hamas’ attacks on Israel. Additionally, two Federal Reserve officials downplayed the possibility of interest rate hikes on Monday, with more Fed speakers scheduled for Tuesday.

Investors, particularly those in the oil market, will closely monitor developments in the Middle East for potential escalations. However, Wall Street tends to quickly return to business as usual, especially with upcoming inflation data and the start of earnings season on the horizon.

Goldman Sachs has an interesting take, suggesting that a group of influential momentum traders is gearing up for substantial S&P 500 purchases in the coming month.

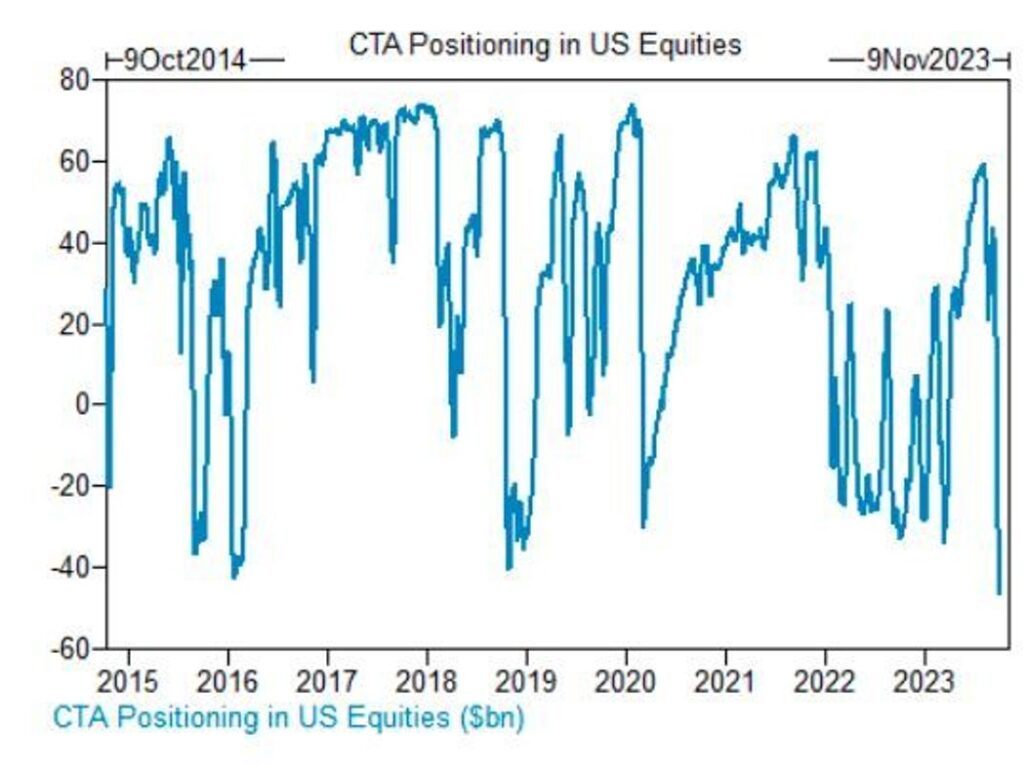

A chart from the bank illustrates historically low exposure to U.S. equities among commodity trading advisors (CTAs), who profit from futures market bets and typically follow trends. According to Goldman Sachs, CTAs currently hold a short position of approximately $90 billion in global equities, a percentile reading at zero. In the U.S. alone, they have a record-high short position of $47 billion in equities.

Goldman Sachs notes, “Per GS model, [the] CTAs are now buyers of SPX in every scenario over the next month.” This means that those CTAs who have been selling the S&P 500 may reverse their positions and start buying if Goldman’s prediction holds true. However, it’s worth mentioning that not everyone recommends blindly following trend-loving CTAs, as they can be prone to sudden shifts in sentiment.

As the Financial Times highlighted, CTAs had a stellar performance in 2022, thanks to surging inflation. However, they suffered losses earlier this year due to bets that banking industry turmoil would force the Fed to halt interest rate hikes.

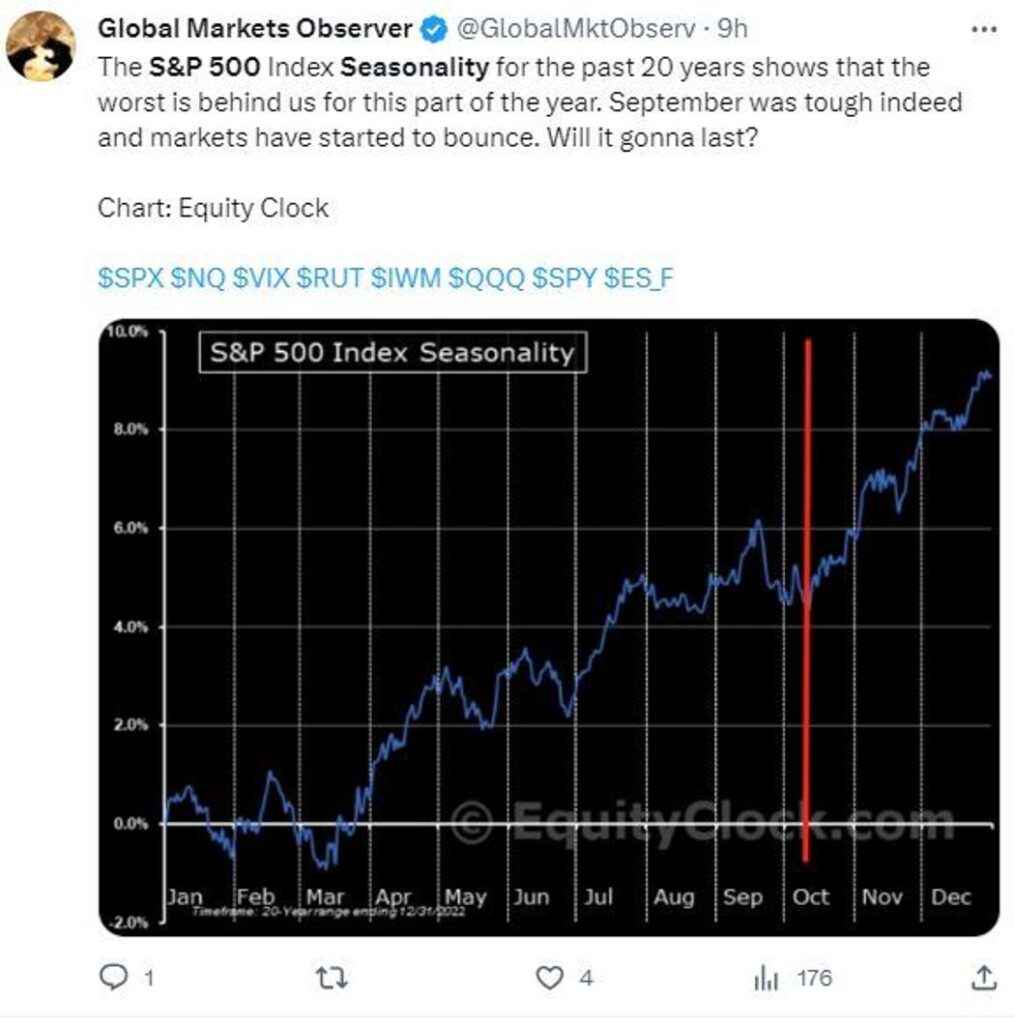

MarketWatch’s Mark Hulbert suggests that while October historically can be a volatile month, it can also mark the beginning of a seasonal stock market rebound. Jeff Hirsch, editor of the Stock Trader’s Almanac & Almanac Investor Newsletter, has referred to October as a “bear-killer, bargain month, and turnaround month,” characterized by solid, albeit occasionally volatile, trading.

An Equity Clock seasonality chart has been circulating, potentially providing additional support for stock buyers. Seth Golden, Chief Market Strategist at Finom Group, also presents a chart that may be encouraging for buyers.