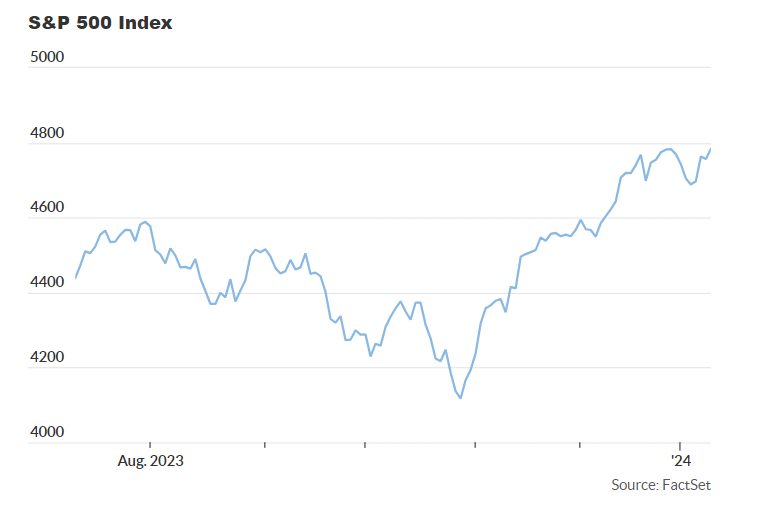

Early Thursday, futures suggested that the S&P 500 would open slightly higher, hovering just a few points away from the record close of 4796.6 observed in January 2022.

The potential to reach this milestone hinges on the release of the December CPI inflation report at 8:30 a.m. Eastern. The stock market has experienced a robust rally since October, fueled by the expectation that ongoing inflation moderation would enable the Federal Reserve to consider interest rate cuts.

The December CPI report could alter this narrative if it indicates a less benign inflation scenario than anticipated, prompting traders to scale back on optimistic bets for Fed rate cuts.

Julien Lafargue, Chief Market Strategist at Barclays Private Bank, cautioned against overly optimistic expectations, stating, “In our view, markets remain too aggressive around interest rate cut expectations.” Lafargue added that an upside surprise in the CPI report might not completely shift this perception but could be a first step in aligning markets with the Fed’s narrative of future cuts.

Ahead of the CPI report, there was already a move to buy bonds, resulting in a 4.3 basis points dip in the 10-year Treasury yield to 3.991%. Simultaneously, the price of U.S. WTI crude rose by 1.7% to approximately $78 per barrel following reports of an oil tanker seizure in the Gulf.

Cleveland Fed President Loretta Mester is scheduled to appear on Bloomberg Television at 11:30 a.m., and Richmond Fed President Tom Barkin will discuss the economic outlook at 12:40 p.m.

Additional economic data for Thursday includes the weekly initial jobless claims, also set for release at 8:30 a.m. The U.S. Treasury plans to auction $21 billion of 30-year bonds at 1 p.m., and the monthly budget statement is expected at 2 p.m., with the Congressional Budget Office estimating a deficit of $128 billion in December.