Early Wednesday, U.S. stock futures made gains as Treasury yields continued their descent, fueled by growing optimism that the Federal Reserve would initiate interest rate cuts in the coming year.

Current Trading of Stock-Index Futures

- S&P 500 futures experienced a 15-point increase, equivalent to 0.3%, reaching 4578.

- Dow Jones Industrial Average futures added 105 points, or 0.3%, totaling 35550.

- Nasdaq 100 futures climbed 61 points, or 0.4%, reaching 16109.

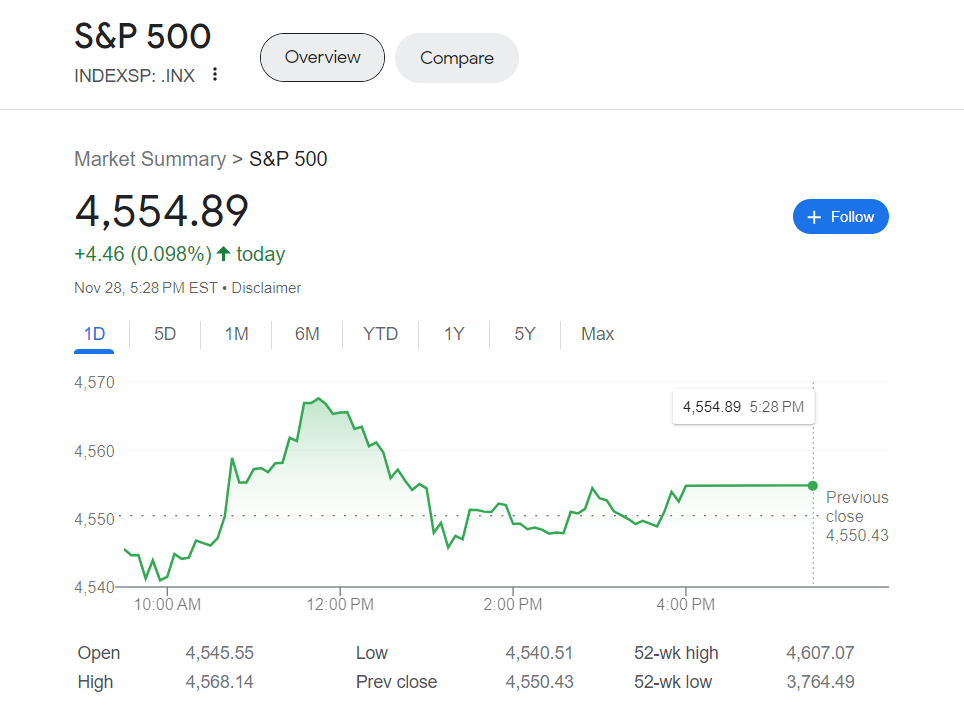

On Tuesday, the Dow Jones Industrial Average rose by 84 points (0.24%) to 35417, the S&P 500 increased by 4 points (0.1%) to 4555, and the Nasdaq Composite gained 41 points (0.29%) to 14282.

Market Drivers

Index futures indicated that the S&P 500 was poised to open Wednesday’s session challenging its highest levels since August, driven by the ongoing decline in U.S. borrowing costs.

The 10-year Treasury yield, which hit a 16-year peak above 5% in October, slid close to 4.25% in early trading. Investors are increasingly confident that easing inflation will prompt the Federal Reserve to begin reducing rates in the coming months. The probability of a rate cut in March by at least 25 basis points rose to 42%, up from 21% on Tuesday, according to the CME FedWatch tool.

Comments from Fed Governor Chris Waller on Tuesday, suggesting that current policy is well-positioned to manage the economy and curb inflation, reinforced the market’s belief that the Federal Reserve is halting interest rate hikes. This aligns with the sentiment prevailing in the market, where additional hikes had already been largely priced out earlier in the month, as noted by Stephen Innes, managing partner at SPI Asset Management.

Investors await Fed Chair Jerome Powell’s remarks on Friday to see if they echo Waller’s supposedly more dovish stance. On Wednesday, Fed officials, including Richmond Fed President Thomas Barkin and Cleveland Fed President Loretta Mester, are scheduled to speak.

U.S. economic releases on Wednesday include the first revision of third-quarter GDP and the October trade balance in goods at 8:30 a.m. Eastern. The Federal Reserve’s Beige Book of economic anecdotes will be published at 2 p.m. Additionally, important inflation data in the form of the PCE index for October will be released on Thursday.

The decline in U.S. bond yields is negatively affecting the dollar, potentially providing further support to U.S. corporations with overseas sales. The dollar index is at its lowest level since August, boosting the price of gold, which has surpassed the $2,000 an ounce mark.

However, some observers express concerns that the recent optimism in the bond market has left not only the S&P 500 but various market segments vulnerable to a pullback. Swissquote Bank’s senior analyst, Ipek Ozkardeskaya, notes that multiple asset classes, including U.S. bonds, the dollar, gold, and major currencies, are showing signs of overbought conditions, suggesting a correction may be imminent.

Companies reporting results on Wednesday include Foot Locker, Dollar Tree, and Petco Health and Wellness before the opening bell, followed by Snowflake, Salesforce, and Okta after the close.