Early Wednesday, U.S. equity index futures slightly declined as traders assessed the situation after experiencing the longest consecutive period of gains in the past two years.

How are stock-index futures trading

- The ES00 S&P 500 futures dropped by 5 points or 0.1%, reaching a level of 4391.

- The Dow Jones Industrial Average futures, specifically YM00, dropped by 19 points or 0.1% to reach 34196.

- Nasdaq 100 futures, specifically NQ00, experienced a slight decrease of 30 points or 0.2%, bringing it to a total of 15344.

The Dow Jones Industrial Average climbed by 57 points on Tuesday, which accounts for a 0.17% increase and brings it to a total of 34153. The S&P 500 also experienced growth, with a 12-point increase equaling a 0.28% rise, resulting in a new figure of 4378. Additionally, the Nasdaq Composite saw a gain of 121 points, representing a 0.9% increase, and reaching a total of 13640.

What’s driving markets

There was a slight decline in equity index futures as traders took a break after a significant surge.

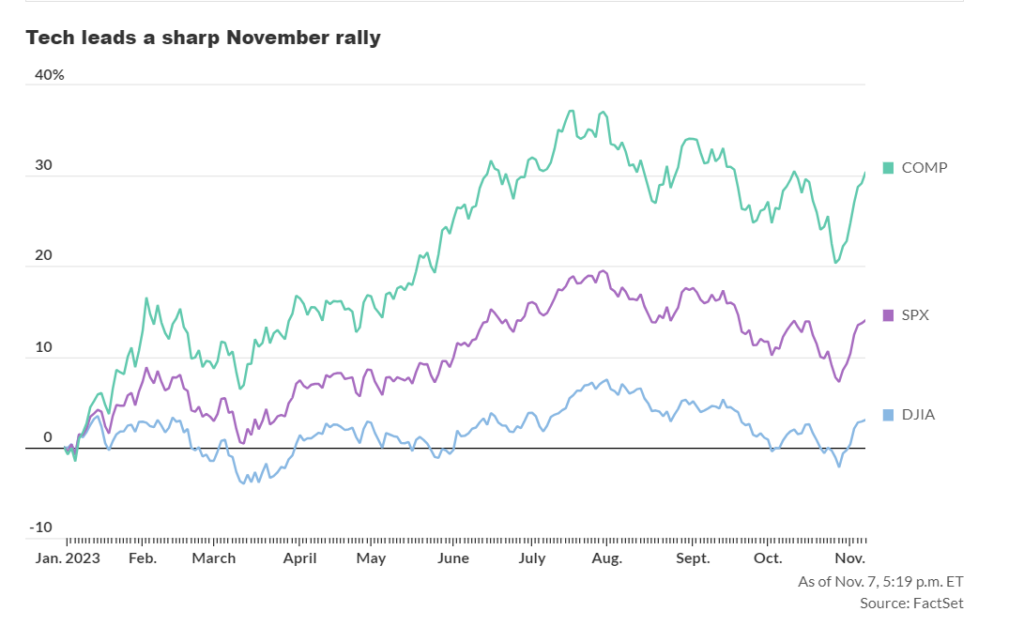

For the past seven sessions, the S&P 500 index has experienced consecutive increases, which marks its longest period of continuous gains in two years. During this period, it has gained 6.3% in value, with a significant contribution from prominent technology stocks. Similarly, the Nasdaq Composite, known for its heavy tech presence, has also seen an eight-day winning streak resulting in an 8.3% increase, which is its strongest performance in two years.

Derren Nathan, head of equity research at Hargreaves Lansdown, explains that the recent decline in implied borrowing costs and the underwhelming job data have fueled optimism for potential rate cuts in the near future. This positivity has been a driving force behind the recent progress.

However, Nathan chimed in and said: “Stocks might take a break while investors try to manage their expectations between potential rate cuts and the increasing financial pressures in the economy. This wouldn’t be the first instance where the market misjudged the timing of the Federal Reserve’s change in direction during this period of high interest rates.”

Tom Lee, the head of research at Fundstrat, explained that it made sense for stocks to go through a period of consolidation. This is due to the significant gains they have experienced recently and the absence of any significant macroeconomic news this week.

Lee added, “Due to the negative positions held by institutional and retail investors, we anticipate that stocks will likely remain steady in the absence of any significant macroeconomic news.”

Federal officials are scheduled to give comments on Wednesday. This includes Chair Jerome Powell who will make opening remarks at a research conference by the Federal Reserve at 9:15 a.m. New York Fed President John Williams will then deliver the keynote speech at the same conference at 1:40 p.m. In addition, Fed Vice Chair for Supervision Michael Barr will speak at the NAHB conference at 2 p.m. Finally, Fed Vice Chair Phillip Jefferson will conclude the research conference by making the closing remarks at 4:45 p.m.

Powell is scheduled to give a speech on Thursday that will be closely monitored.

On Wednesday, several companies, including Roblox, Warner Bros. Discovery, and Under Armour, will announce their earnings before the stock market opens. Afterwards, Walt Disney, AMC Entertainment, and Twilio will report their earnings after the market closes.

On Wednesday, there will be updates on the U.S. economy including the release of wholesale inventories for September. This release is scheduled for 10 a.m. Eastern time.

Companies in focus

- Rivian Automotive Inc. experienced a 7% increase in premarket trading, with shares of RIVN, +1.40%, after the electric vehicle (EV) manufacturer reduced its quarterly loss and announced the termination of its exclusivity agreement with Amazon.com Inc. relating to their last-mile electric delivery vans.

- Shares of Robinhood Markets Inc. declined by 7% as the popular trading app announced its quarterly earnings, which were lower than anticipated.

- The stock of Ebay Inc. decreased by 7% as the company provided a cautious prediction for its revenues in the upcoming holiday season due to increasing rivalry from Amazon.com Inc. and other competitors.