U.S. stock futures climbed on Thursday, riding a wave of positive momentum fueled by growing optimism that the U.S. rate-hike cycle might have reached its peak.

Here’s the breakdown:

- Dow Jones Industrial Average futures (YM00, +0.36%) surged by 59 points, marking a 0.2% increase to 33,410.

- S&P 500 futures (ES00, +0.57%) rose by 19 points, reflecting a 0.4% gain to reach 4,275.

- Nasdaq 100 futures (NQ00, +0.90%) showed a substantial increase of 93 points, rising by 0.6% to hit 14,838.

Wednesday’s market movement displayed significant positive shifts:

- Dow Jones Industrial Average (DJIA) surged by 222 points, a 0.67% increase to 33,275.

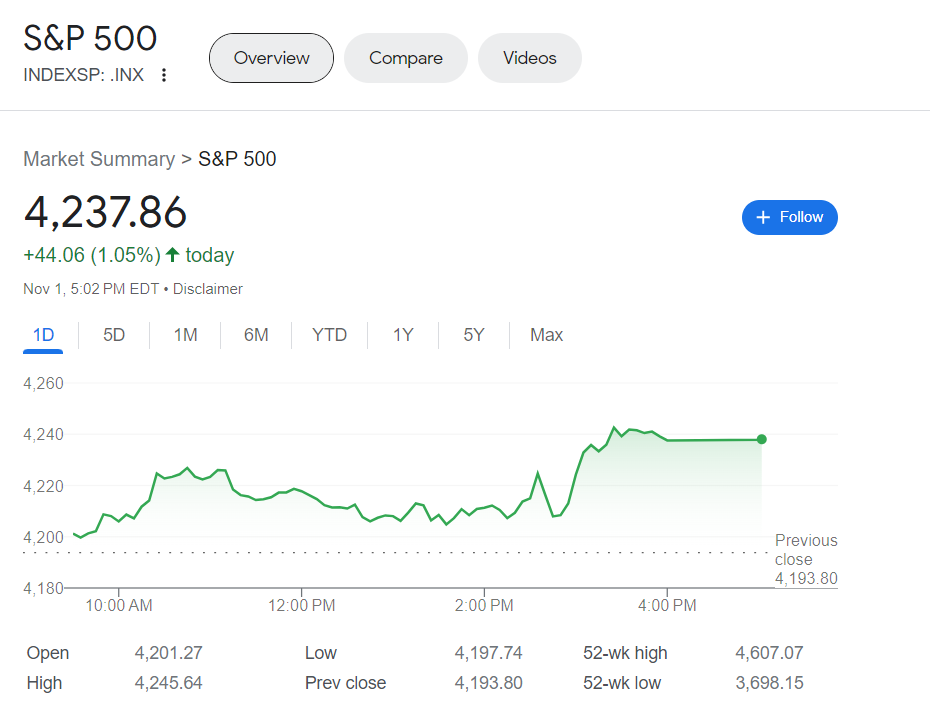

- S&P 500 (SPX) saw an upward movement of 44 points, marking a 1.05% rise to 4,238.

- Nasdaq Composite (COMP) experienced a substantial gain of 210 points, rising by 1.64% to 13,061.

Factors influencing the market:

Wednesday witnessed the introduction of crucial market elements. Federal Reserve Chair Jerome Powell didn’t explicitly confirm a peak in the rate-hike cycle, but his cautious stance was interpreted as dovish by analysts. Additionally, the Treasury refunding fell slightly short of expectations at $112 billion, with reduced issuance of 10- and 30-year notes compared to August.

Simultaneously, important indicators like the Institute for Supply Management’s manufacturing index fell well below estimations, while the ADP private-sector employment gauge revealed surprising downside trends.

“Although Powell’s approach seemed somewhat hawkish on the surface, market sentiment remained unconvinced, particularly given [Wednesday’s] economic data indicating a potential slowdown in the U.S. economy,” stated Michael Hewson, chief market analyst at CMC Markets UK.

The upcoming economic calendar, leading up to Friday’s pivotal nonfarm payrolls report, includes releases such as weekly jobless claims and third-quarter productivity.

Furthermore, Apple (AAPL, +1.87%) is scheduled to unveil its earnings after the market’s closing bell.