U.S. stock futures faced challenges in gaining momentum on Monday as investors anticipated a bustling week on the economic front, marked by crucial events such as consumer prices and the final Federal Reserve meeting of the year.

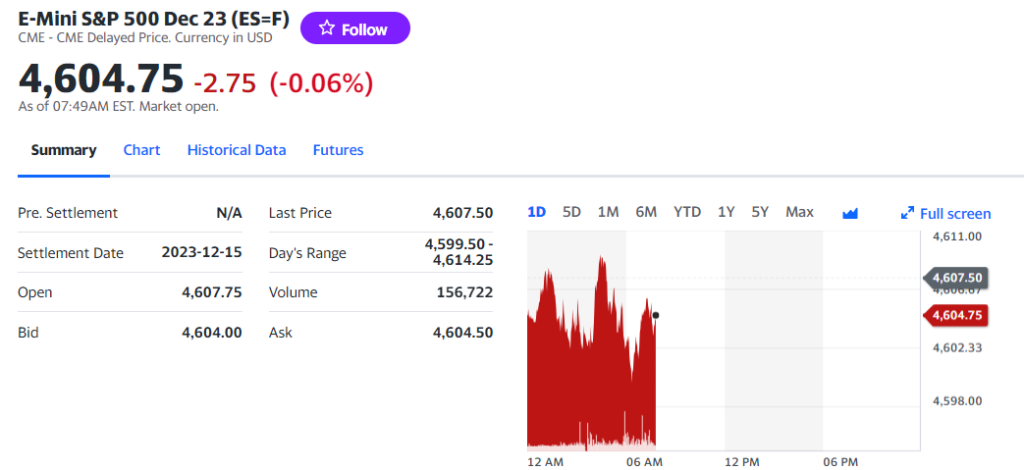

Here’s a snapshot of stock-index futures activity:

- S&P 500 futures (ES00, -0.04%) dipped 0.7 points to 4606.75.

- Dow Jones Industrial Average futures (YM00, +0.01%) remained unchanged at 36645.

- Nasdaq 100 futures (NQ00, -0.11%) declined by 17 points, or 0.1%, settling at 16292.

In Friday’s trading, the Dow industrials (DJIA) increased by 130.49 points, or 0.4%, reaching a closing high of 36,247.87, the highest since Jan. 12, 2022. The S&P 500 (SPX) rose by 0.4% to end at 4,604.37, achieving its best close since March 29, 2022, while the Nasdaq Composite (COMP) climbed 0.4% to 14,403.97, marking the highest close since April 4, 2022.

All three major indexes extended their gains for a sixth consecutive week.

Factors influencing the markets

Following a robust jobs report that propelled stocks upward on Friday, investors are now directing their focus towards the final Fed meeting of the year and crucial inflation data scheduled for release.

Economists anticipate that November consumer prices, set to be revealed on Tuesday, will display subdued headline inflation but a solid core reading, excluding food and energy prices. Producer prices are slated for Wednesday, and retail sales data is expected on Thursday.

On Wednesday, Fed Chair Jerome Powell and his colleagues will disclose the outcomes of the two-day meeting, with expectations that the central bank will maintain its key benchmark interest rate within the range of 5.25% to 5.5%.

Peter Iosif, senior research analyst at Noteris, noted that Friday’s robust jobs data might influence Powell’s statements this week, potentially reinforcing the Fed’s hawkish stance and challenging market expectations for an early rate cut.

Additionally, the European Central Bank and the Bank of England are set to announce policy decisions on Thursday, while a Bank of Japan decision is anticipated for the following week.

The yen faced a decline against the dollar on Monday, following reports that central bank officials were not in a rush to end a decades-long negative interest rate policy. The yen had rallied the previous week amid growing expectations that officials were leaning in that direction.

Gold prices dipped 0.2% to $2,009.30 an ounce, and crude futures were modestly lower.