U.S. stock index futures hovered close to record highs early Tuesday in anticipation of an impending earnings report from the highly regarded Microsoft.

Current Stock-Index Futures Trading:

- S&P 500 futures (ES00, -0.13%) experienced a minor dip of 5 points, or 0.1%, settling at 4949.

- Dow Jones Industrial Average futures (YM00, -0.18%) fell by 48 points, or 0.1%, reaching 38440.

- Nasdaq 100 futures (NQ00, -0.05%) eased by 12 points, or 0.1%, reaching 17694.

On Monday, the Dow Jones Industrial Average (DJIA) exhibited a gain of 224 points, or 0.59%, closing at 38333. The S&P 500 (SPX) saw an increase of 37 points, or 0.76%, reaching 4928, and the Nasdaq Composite (COMP) gained 173 points, or 1.12%, closing at 15628.

Driving Factors in the Market:

The U.S. fourth quarter 2023 corporate earnings reporting season enters a significant phase on Tuesday, with investors acknowledging that the recent surge in stocks to new highs leaves little room for disappointment.

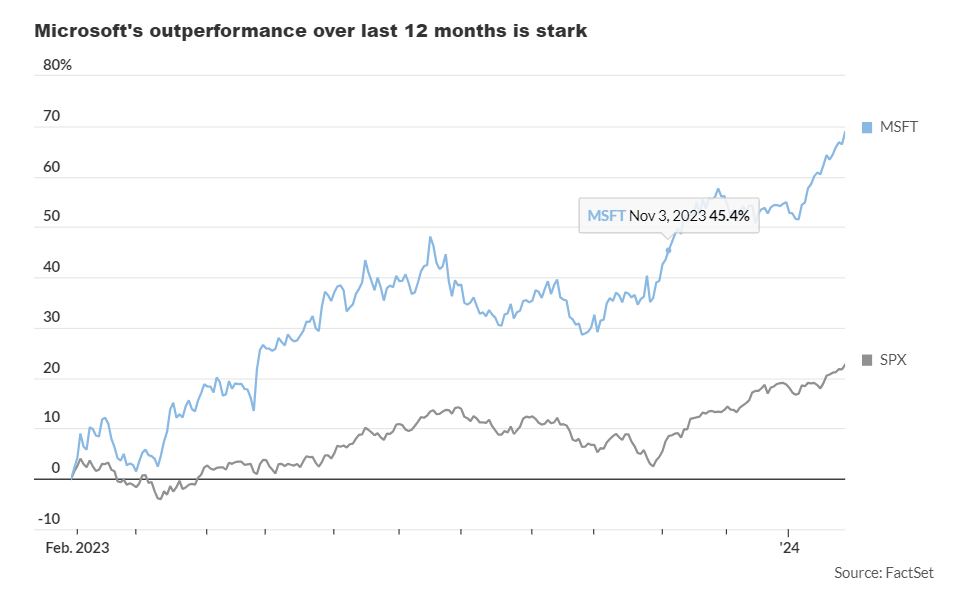

On Monday, the S&P 500 marked its sixth record of 2024, achieving a rally of 17.5% over the past three months. This upswing has been propelled by substantial gains in large technology stocks, especially those companies expected to benefit from the sales of AI-related technology. This includes hardware like chip-maker Nvidia (NVDA, +2.35%) and software like Microsoft (MSFT, +1.43%).

This narrative has propelled Microsoft’s market value beyond $3 trillion, following a remarkable 65% surge in the past 12 months. It has also elevated its next-12-month price/earnings ratio to 33.4, a multiple notably higher than in recent years.

Investors keenly await Microsoft’s results and forecasts, scheduled for after Tuesday’s closing bell, seeking justification for the prevailing market optimism, particularly given its substantial 7.3% weighting in the S&P 500. Option pricing suggests Microsoft shares may experience a movement of approximately ±2.5% by the end of the week, as per MarketWatch calculations.

In the coming days, earnings reports from four other influential stocks, known as the ‘Magnificent 7,’ are expected, including Alphabet (GOOG, +0.68%) on Tuesday, followed by Apple (AAPL, -0.36%), Amazon (AMZN, +1.34%), and Meta (META, +1.75%) on Thursday.

“The price reaction to 5 of the ‘Mag 7’ reports…[is] critical for overall market direction,” emphasized Julian Emanuel, a strategist at Evercore ISI.

Additional companies reporting results on Tuesday include Pfizer (PFE, +0.04%), General Motors (GM, +0.60%), UPS (UPS, -0.80%), and HCA Healthcare (HCA, +1.16%) before the opening bell on Wall Street, followed after the close by Advanced Micro Devices (AMD, +0.33%), Starbucks (SBUX, +1.08%), Electronic Arts (EA, -0.60%), and Juniper Networks (JNPR, +0.08%).

Supporting market sentiment on Tuesday are softer Treasury yields. The benchmark 10-year yield (BX:TMUBMUSD10Y) has retraced toward the 4% mark after the Treasury announced reduced borrowing needs for the first quarter on Monday.

The Federal Reserve initiates its two-day policy meeting on Tuesday, with no expected changes in interest rates this month.

Scheduled U.S. economic updates on Tuesday include the S&P Case-Shiller home price index for November at 9 a.m. Eastern, followed by the December job openings report and January consumer confidence at 10 a.m.