The recent upward momentum in U.S. stock futures encountered a pause early Wednesday, with traders keeping a close watch on upcoming events, including inflation updates and the commencement of the corporate earnings season.

Current Stock-Index Futures Activity:

- S&P 500 futures (ES00, 0.33%) advanced by 2 points, remaining flat at 4394.

- Dow Jones Industrial Average futures (YM00, 0.31%) dipped by 2 points, holding steady at 33934.

- Nasdaq 100 futures (NQ00, 0.44%) saw a gain of 22 points, a 0.1% increase, reaching 15292.

Recent Market Performance:

On the preceding day, the Dow Jones Industrial Average (DJIA) rose by 135 points, equivalent to a 0.4% increase, closing at 33739. The S&P 500 (SPX) experienced a 23-point climb, a 0.52% gain, to reach 4358. The Nasdaq Composite (COMP) recorded a 79-point increase, reflecting a 0.58% rise, closing at 13563.

Market Drivers:

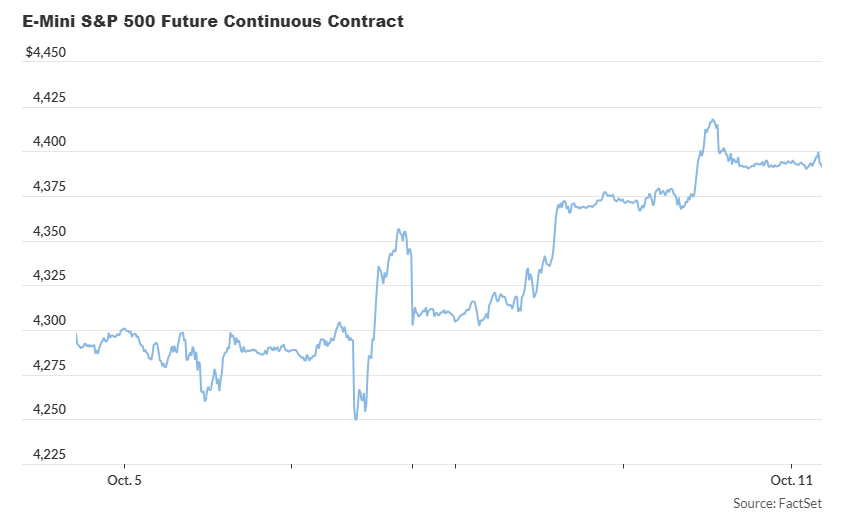

The S&P 500 has shown a 2.35% increase over the past three trading days, driven by a decline in the yield on 10-year Treasurys (BX:TMUBMUSD10Y), which dropped approximately 20 basis points from their recent 16-year high touched last Friday.

This drop in long-term implied borrowing costs follows recent comments from Federal Reserve officials, hinting that the central bank might have completed its cycle of interest rate hikes.

According to Richard Hunter, head of markets at Interactive Investor, “Markets continued to grind higher as the headwinds of the Middle Eastern conflict were neutralized by a further softening of rhetoric from the Federal Reserve.”

While bond yields decreased further on Wednesday, gains in stock-index futures were subdued as more cautious trading patterns emerged in anticipation of significant economic data and corporate earnings reports in the coming days.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, noted that “The surge of optimism, fueled by hopes the Fed will go easier with its interest rate policies…appears to have plateaued. A little more caution is returning, as investors look ahead to tomorrow’s snapshot of inflation in the United States.”

On the economic calendar, the U.S. consumer price index report for September is scheduled for release before Thursday’s market opening. In addition, investors will need to analyze the producer prices data for September, set to be published at 8:30 a.m. Eastern, as well as the minutes from the Fed’s previous policy meeting, due at 2 p.m.

Streeter added, “Investors are highly sensitive to data and if U.S. inflation shows any signs of tripping up in its downwards path, it is set to be unsettling and could upset expectations of a more dovish stance from the Fed.”

On Wednesday, there will also be a series of appearances by Fed speakers. Fed Governor Christopher Waller will deliver comments in Park City, Utah at 10:15 a.m., Atlanta Fed President Raphael Bostic is scheduled to discuss the economic outlook at 12:15 p.m., and Boston Fed President Susan Collins will give the Goldman Lecture on Economics at Wellesley College at 4:30 p.m.

Traders are also awaiting the commencement of the third-quarter company earnings season, which will be in full swing when major banks, including JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC), release their earnings reports on Friday.