Promising Prospects in S&P 500’s Energy Sector,” Says Oppenheimer’s Stoltzfus

Despite recent turbulence in the U.S. stock market, Wall Street’s most bullish strategist, John Stoltzfus of Oppenheimer Asset Management Inc., maintains his outlook for the S&P 500 to reach record highs this year. Stoltzfus had projected the S&P 500 to surpass 4,900 by the end of 2023, the highest target among 20 Wall Street firms surveyed by MarketWatch in August.

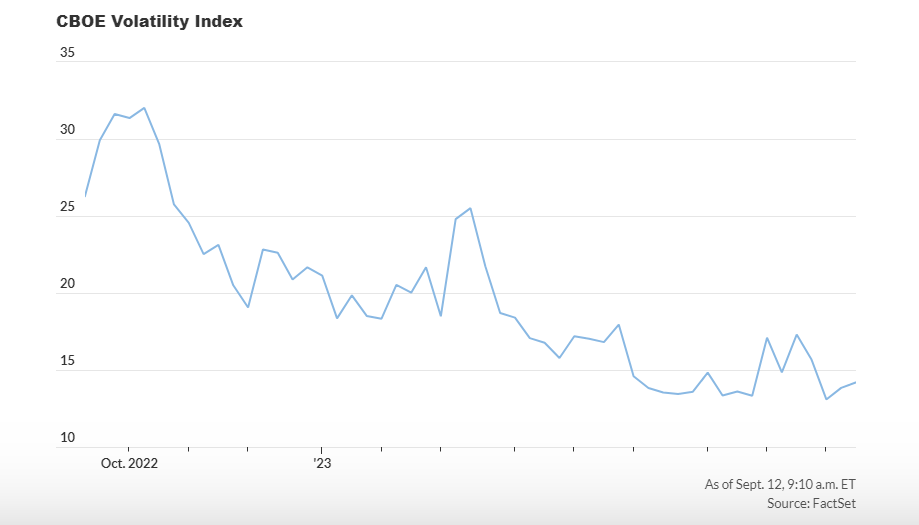

While optimism surrounding artificial intelligence and the Federal Reserve’s interest rate policy fueled gains in the stock market earlier in the year, concerns about inflation and rising oil prices led to a brief pause in the market’s rally in August. Stoltzfus and his team caution investors not to underestimate these pressures, even as the Fed approaches the end of its rate-hike cycle. They believe that inflation remains a concern and anticipate one more rate hike this year and possibly another next year.

Despite these challenges, Stoltzfus remains confident in his team’s peak target for the S&P 500. He suggests that market weakness presents opportunities for investors to identify undervalued assets during periods of volatility. Specifically, the S&P 500 Energy Sector has caught Stoltzfus’s attention as policymakers globally work to combat inflation and manage economic growth.

The team at Oppenheimer sees potential for the Fed’s success in curbing inflation to lead to a rate pause next year, reducing pressure on economic growth. This, coupled with fiscal stimulus from infrastructure projects and domestic chip manufacturing efforts, could drive profitability in the energy sector well into 2024.

As of year-to-date data, the Energy Select Sector SPDR Fund (XLE), a proxy for the energy sector in the S&P 500, has advanced 3.9%. Meanwhile, the price of West Texas Intermediate crude oil has risen by 8.5%. Oil futures traded at their highest levels of the year in response to output cut extension announcements from Russia and Saudi Arabia, though they settled slightly lower later on.

Stoltzfus’s forecast in late July anticipated the S&P 500 reaching its record high by the end of 2023, with a year-end price target of 4,900. This represents a 9.2% increase from the S&P 500’s current level.

On Monday, U.S. stocks closed higher, driven by gains in the technology sector, with the Nasdaq Composite rising by 1.1%. The S&P 500 gained 0.7%, and the Dow Jones Industrial Average ended 0.3% higher.

Please note that this summary is not financial advice; it is a simplified overview of a complex financial news article. Consult with a financial advisor for investing decisions.