In August, the U.S. stock market saw a slowdown in its robust AI-driven rally, with the S&P 500 index potentially facing its worst month in six months, and the Nasdaq Composite poised for its most significant monthly decline of the year. As we approach September, historical trends suggest that the coming month may bring even more volatility.

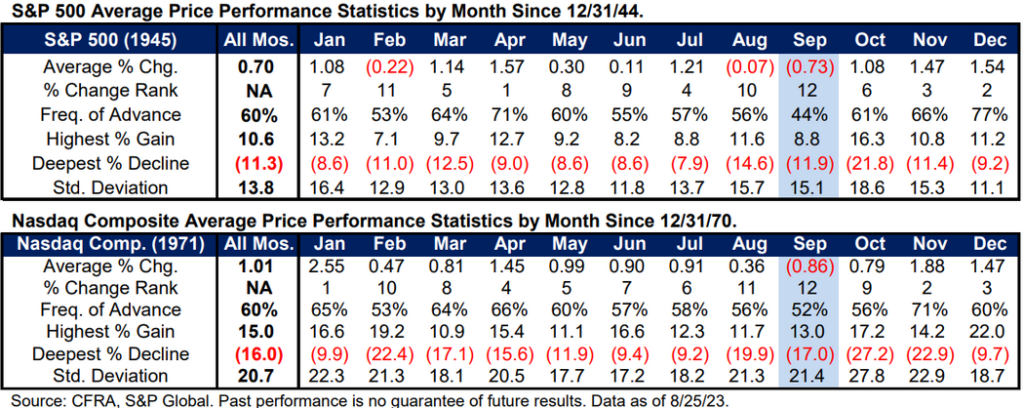

According to Sam Stovall, Chief Investment Strategist at CFRA Research, since 1945, September has been the worst-performing month for the large-cap S&P 500 index, with an average monthly return of -0.73%. It’s the only month where the S&P 500 has seen more monthly declines than gains, boasting a “win rate” of just 44%. The technology-heavy Nasdaq Composite has also historically struggled in September, recording its only negative average return since 1971, with an average return of -0.86%.

Given this historical track record, Stovall advises investors to prepare for the possibility of disappointing results for both the S&P 500 and Nasdaq in the month ahead.

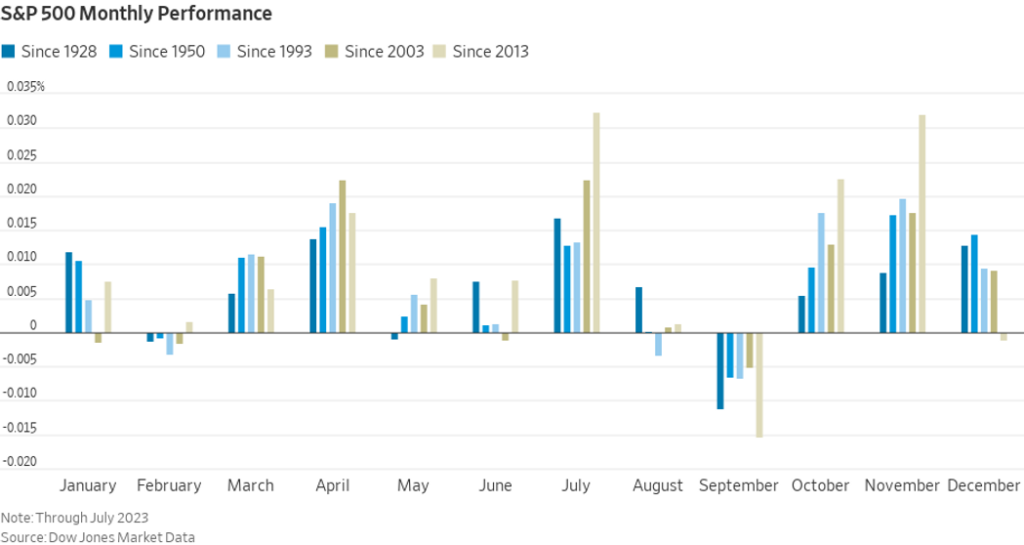

The U.S. stock market’s impressive ascent this year hit a roadblock in August as strong economic data raised concerns that the Federal Reserve might maintain higher interest rates for an extended period, leading to a surge in longer-dated Treasury yields. The S&P 500 has already lost nearly 2% this month, potentially marking its most substantial monthly decline since February. Notably, when the S&P 500 falls 2% or more in August, historical data from Dow Jones Market Data suggests that September returns tend to be even worse.

Despite these historical trends, some factors are suggesting a different outcome this year. Market sentiment has shifted from bullish levels in late July, which could provide some support for equities heading into early September. Additionally, technical indicators are hinting at the possibility of a stock market rally.

While historical data can provide valuable insights, the dynamics of the market are subject to change. As we enter September, investors should keep a close eye on evolving trends and market sentiment to make informed decisions in these uncertain times.

As of now, U.S. stock indexes have shown modest gains, with the S&P 500 up 0.4%, the Dow industrials up 0.2%, and the Nasdaq Composite advancing 0.6%. These figures reflect the current market conditions and may change as the month progresses. Stay tuned for updates and stay vigilant in your investment strategies.